The global Automotive Smart Antenna Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Component (Transceiver, Electronic Control Unit (ECU), Others), By Frequency (High, Very High, Ultra-High), By Sales Channel (OEM, Aftermarket), By Vehicle (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles), By Electric Vehicle (Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-in Hybrid Vehicle (PHEV)).

The automotive smart antenna market is witnessing rapid growth in 2024, driven by the increasing adoption of connected car technologies, vehicle-to-everything (V2X) communication, and advanced driver assistance systems (ADAS). Smart antennas, also known as multiple-input multiple-output (MIMO) antennas, enable vehicles to transmit and receive wireless signals for various applications such as GPS navigation, cellular connectivity, Wi-Fi hotspot access, and vehicle-to-vehicle (V2V) communication. With the proliferation of electric vehicles (EVs), autonomous driving features, and in-car entertainment services, automakers are integrating smart antennas into vehicle designs to enhance connectivity, safety, and user experience. Furthermore, the rollout of 5G networks and the Internet of Things (IoT) ecosystem are driving innovation in automotive smart antenna technologies, paving the way for seamless connectivity and intelligent transportation systems.

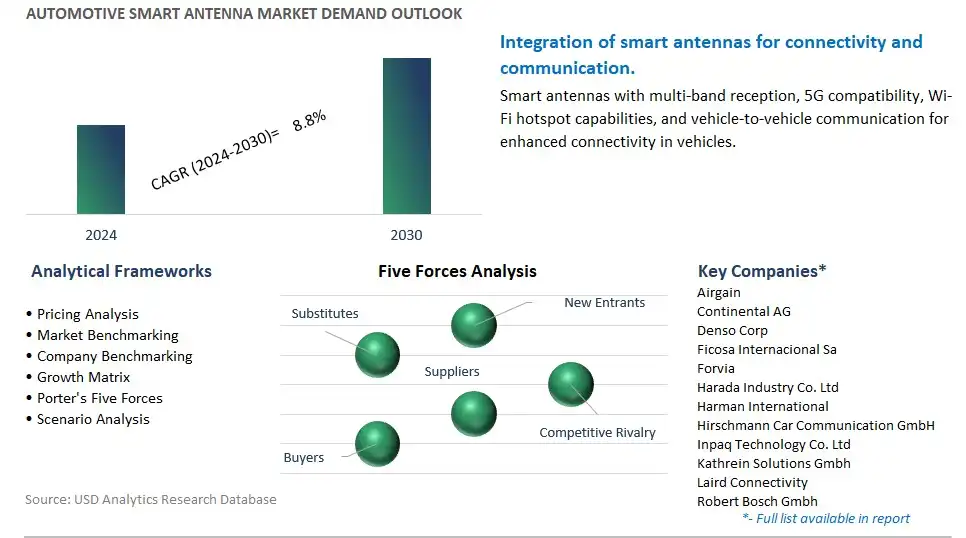

The global Automotive Smart Antenna market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Automotive Smart Antenna Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Automotive Smart Antenna Market Industry include- Airgain, Continental AG, Denso Corp, Ficosa Internacional Sa, Forvia, Harada Industry Co. Ltd, Harman International, Hirschmann Car Communication GmbH, Inpaq Technology Co. Ltd, Kathrein Solutions Gmbh, Laird Connectivity, Robert Bosch Gmbh, Schaffner Holding AG, Taoglas Ltd, TE Connectivity, Yokowo Co. Ltd.

A significant trend in the automotive smart antenna market is the integration of advanced connectivity and communication technologies. As vehicles become increasingly connected and autonomous, there's a growing demand for smart antennas capable of supporting a wide range of wireless communication standards, including 5G, Wi-Fi, Bluetooth, and satellite navigation. Smart antennas serve as central hubs for transmitting and receiving signals from various communication systems, enabling seamless connectivity between vehicles, infrastructure, and external devices. Additionally, the integration of beamforming and multiple-input multiple-output (MIMO) technologies in smart antennas enhances signal reception, reliability, and data throughput, providing drivers and passengers with access to high-speed internet, real-time navigation, and entertainment services while on the road. This trend reflects the industry's response to the growing demand for connected and intelligent vehicles that offer enhanced communication capabilities and personalized experiences.

The primary driver in the automotive smart antenna market is the demand for advanced driver assistance systems (ADAS) and autonomous driving technology. As vehicle manufacturers race to develop self-driving cars and improve safety features, there's an increasing need for smart antennas that can support the complex communication requirements of these systems. Smart antennas play a crucial role in enabling vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-everything (V2X) communication, allowing vehicles to exchange real-time data, sensor information, and situational awareness to enhance safety and efficiency on the road. Moreover, smart antennas facilitate the integration of sensors, cameras, and radar systems, providing essential inputs for autonomous driving functions such as adaptive cruise control, lane-keeping assistance, and collision avoidance. The rapid advancement of ADAS and autonomous driving technologies drives the demand for smart antennas and stimulates market growth in the automotive industry.

An emerging opportunity in the automotive smart antenna market lies in the expansion into connected car services and data analytics. With the proliferation of connected vehicles and digital ecosystems, there's a growing demand for smart antennas that can support advanced connected car services and data-driven insights. Smart antennas equipped with sensors and telematics capabilities can collect and transmit valuable vehicle data, including diagnostics, performance metrics, and usage patterns, to cloud-based platforms for analysis and interpretation. Additionally, smart antennas enable over-the-air (OTA) updates and software upgrades, allowing automakers to remotely deploy new features, improve system functionality, and enhance experiences throughout the vehicle's lifecycle. By offering integrated solutions for connected car services and data analytics, smart antenna manufacturers can capitalize on the growing demand for intelligent transportation solutions and position themselves as key enablers of the connected vehicle ecosystem.

By Component

Transceiver

Electronic Control Unit (ECU)

Others

By Frequency

High

Very High

Ultra-High

By Sales Channel

OEM

Aftermarket

By Vehicle

Passenger Car

Light Commercial Vehicles

Heavy Commercial Vehicles

By Electric Vehicle

Battery Electric Vehicle (BEV)

Fuel Cell Electric Vehicle (FCEV)

Plug-in Hybrid Vehicle (PHEV)Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Airgain

Continental AG

Denso Corp

Ficosa Internacional Sa

Forvia

Harada Industry Co. Ltd

Harman International

Hirschmann Car Communication GmbH

Inpaq Technology Co. Ltd

Kathrein Solutions Gmbh

Laird Connectivity

Robert Bosch Gmbh

Schaffner Holding AG

Taoglas Ltd

TE Connectivity

Yokowo Co. Ltd

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive Smart Antenna Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive Smart Antenna Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive Smart Antenna Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive Smart Antenna Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive Smart Antenna Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive Smart Antenna Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive Smart Antenna Industry

4.2 Key Market Trends in Automotive Smart Antenna Industry

4.3 Potential Opportunities in Automotive Smart Antenna Industry

4.4 Key Challenges in Automotive Smart Antenna Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive Smart Antenna Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive Smart Antenna Market Outlook by Segments

7.1 Automotive Smart Antenna Market Outlook by Segments, $ Million, 2021- 2030

By Component

Transceiver

Electronic Control Unit (ECU)

Others

By Frequency

High

Very High

Ultra-High

By Sales Channel

OEM

Aftermarket

By Vehicle

Passenger Car

Light Commercial Vehicles

Heavy Commercial Vehicles

By Electric Vehicle

Battery Electric Vehicle (BEV)

Fuel Cell Electric Vehicle (FCEV)

Plug-in Hybrid Vehicle (PHEV)

8 North America Automotive Smart Antenna Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive Smart Antenna Markets in 2024

8.2 North America Automotive Smart Antenna Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive Smart Antenna Market size Outlook by Segments, 2021-2030

By Component

Transceiver

Electronic Control Unit (ECU)

Others

By Frequency

High

Very High

Ultra-High

By Sales Channel

OEM

Aftermarket

By Vehicle

Passenger Car

Light Commercial Vehicles

Heavy Commercial Vehicles

By Electric Vehicle

Battery Electric Vehicle (BEV)

Fuel Cell Electric Vehicle (FCEV)

Plug-in Hybrid Vehicle (PHEV)

9 Europe Automotive Smart Antenna Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive Smart Antenna Markets in 2024

9.2 Europe Automotive Smart Antenna Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive Smart Antenna Market Size Outlook by Segments, 2021-2030

By Component

Transceiver

Electronic Control Unit (ECU)

Others

By Frequency

High

Very High

Ultra-High

By Sales Channel

OEM

Aftermarket

By Vehicle

Passenger Car

Light Commercial Vehicles

Heavy Commercial Vehicles

By Electric Vehicle

Battery Electric Vehicle (BEV)

Fuel Cell Electric Vehicle (FCEV)

Plug-in Hybrid Vehicle (PHEV)

10 Asia Pacific Automotive Smart Antenna Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive Smart Antenna Markets in 2024

10.2 Asia Pacific Automotive Smart Antenna Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive Smart Antenna Market size Outlook by Segments, 2021-2030

By Component

Transceiver

Electronic Control Unit (ECU)

Others

By Frequency

High

Very High

Ultra-High

By Sales Channel

OEM

Aftermarket

By Vehicle

Passenger Car

Light Commercial Vehicles

Heavy Commercial Vehicles

By Electric Vehicle

Battery Electric Vehicle (BEV)

Fuel Cell Electric Vehicle (FCEV)

Plug-in Hybrid Vehicle (PHEV)

11 South America Automotive Smart Antenna Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive Smart Antenna Markets in 2024

11.2 South America Automotive Smart Antenna Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive Smart Antenna Market size Outlook by Segments, 2021-2030

By Component

Transceiver

Electronic Control Unit (ECU)

Others

By Frequency

High

Very High

Ultra-High

By Sales Channel

OEM

Aftermarket

By Vehicle

Passenger Car

Light Commercial Vehicles

Heavy Commercial Vehicles

By Electric Vehicle

Battery Electric Vehicle (BEV)

Fuel Cell Electric Vehicle (FCEV)

Plug-in Hybrid Vehicle (PHEV)

12 Middle East and Africa Automotive Smart Antenna Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive Smart Antenna Markets in 2024

12.2 Middle East and Africa Automotive Smart Antenna Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive Smart Antenna Market size Outlook by Segments, 2021-2030

By Component

Transceiver

Electronic Control Unit (ECU)

Others

By Frequency

High

Very High

Ultra-High

By Sales Channel

OEM

Aftermarket

By Vehicle

Passenger Car

Light Commercial Vehicles

Heavy Commercial Vehicles

By Electric Vehicle

Battery Electric Vehicle (BEV)

Fuel Cell Electric Vehicle (FCEV)

Plug-in Hybrid Vehicle (PHEV)

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Airgain

Continental AG

Denso Corp

Ficosa Internacional Sa

Forvia

Harada Industry Co. Ltd

Harman International

Hirschmann Car Communication GmbH

Inpaq Technology Co. Ltd

Kathrein Solutions Gmbh

Laird Connectivity

Robert Bosch Gmbh

Schaffner Holding AG

Taoglas Ltd

TE Connectivity

Yokowo Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Component

Transceiver

Electronic Control Unit (ECU)

Others

By Frequency

High

Very High

Ultra-High

By Sales Channel

OEM

Aftermarket

By Vehicle

Passenger Car

Light Commercial Vehicles

Heavy Commercial Vehicles

By Electric Vehicle

Battery Electric Vehicle (BEV)

Fuel Cell Electric Vehicle (FCEV)

Plug-in Hybrid Vehicle (PHEV)

The global Automotive Smart Antenna Market is one of the lucrative growth markets, poised to register a 8.8% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Airgain, Continental AG, Denso Corp, Ficosa Internacional Sa, Forvia, Harada Industry Co. Ltd, Harman International, Hirschmann Car Communication GmbH, Inpaq Technology Co. Ltd, Kathrein Solutions Gmbh, Laird Connectivity, Robert Bosch Gmbh, Schaffner Holding AG, Taoglas Ltd, TE Connectivity, Yokowo Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume