The global Automotive Sheet Metal Components Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Steel, Aluminum), By Component (Interior, Drivetrain, Engine, Exterior, Chassis, Others).

The automotive sheet metal components market is evolving in 2024, driven by the automotive industry's emphasis on lightweighting, design flexibility, and cost efficiency. Sheet metal components, including body panels, chassis reinforcements, and structural assemblies, are integral parts of vehicle construction, contributing to both aesthetics and functionality. With the growing adoption of electric vehicles (EVs) and stringent fuel efficiency standards, automakers are leveraging advanced materials, forming techniques, and joining technologies to optimize component weight while maintaining structural integrity and safety performance. Moreover, the shift towards electric vehicle platforms and modular architectures is reshaping the automotive sheet metal components market, driving innovation and collaboration across the supply chain.

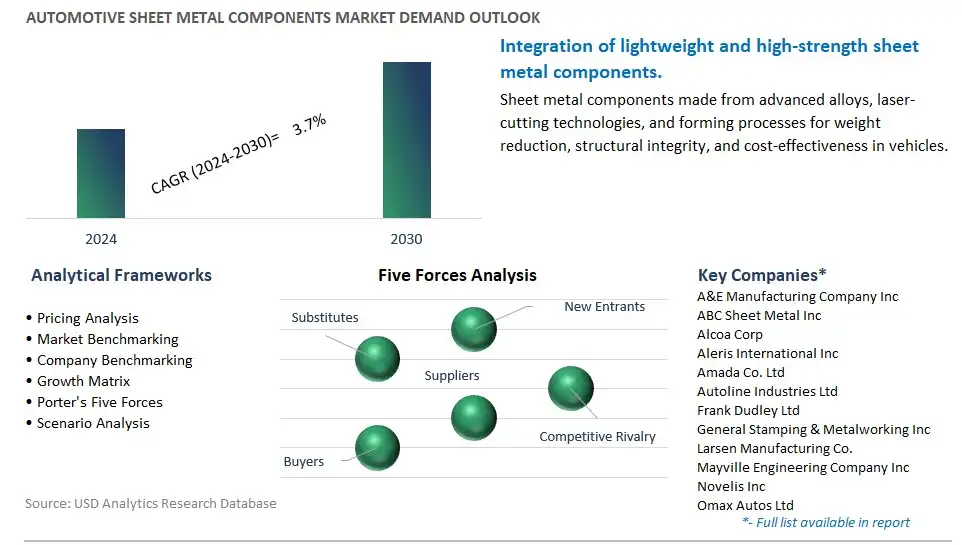

The global Automotive Sheet Metal Components market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Automotive Sheet Metal Components Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Automotive Sheet Metal Components Market Industry include- A&E Manufacturing Company Inc, ABC Sheet Metal Inc, Alcoa Corp, Aleris International Inc, Amada Co. Ltd, Autoline Industries Ltd, Frank Dudley Ltd, General Stamping & Metalworking Inc, Larsen Manufacturing Co., Mayville Engineering Company Inc, Novelis Inc, Omax Autos Ltd, O'Neal Manufacturing Services, Paul Craemer GmbH, Prototek Sheetmetal Fabrication Llc.

In the automotive sheet metal components market, a prominent trend is the increasing adoption of advanced manufacturing technologies such as automation, robotics, and additive manufacturing. This trend is driven by the need for faster production cycles, improved quality control, and greater flexibility in manufacturing processes, leading to the development of innovative sheet metal components that meet the evolving needs of the automotive industry.

One of the primary drivers of the automotive sheet metal components market is the growing demand for light weighting solutions to improve fuel efficiency and reduce emissions in vehicles. As automotive manufacturers strive to meet stringent regulatory standards and consumer preferences for more fuel-efficient vehicles, there is a significant emphasis on using lightweight materials such as aluminum and advanced high-strength steel in sheet metal components to achieve weight reduction without compromising on structural integrity and safety.

An opportunity lies in the expansion of electric vehicle (EV) production, which requires specialized sheet metal components to accommodate the unique design and assembly requirements of EVs. As the automotive industry transitions towards electrification to address environmental concerns and regulatory mandates, there is a growing demand for sheet metal components tailored for EV platforms, including battery enclosures, chassis components, and structural reinforcements. Manufacturers can capitalize on this opportunity by offering customized solutions for the burgeoning electric vehicle market segment.

By Type

Steel

Aluminum

By Component

Interior

Drivetrain

Engine

Exterior

Chassis

OthersGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

A&E Manufacturing Company Inc

ABC Sheet Metal Inc

Alcoa Corp

Aleris International Inc

Amada Co. Ltd

Autoline Industries Ltd

Frank Dudley Ltd

General Stamping & Metalworking Inc

Larsen Manufacturing Co.

Mayville Engineering Company Inc

Novelis Inc

Omax Autos Ltd

O'Neal Manufacturing Services

Paul Craemer GmbH

Prototek Sheetmetal Fabrication Llc

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive Sheet Metal Components Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive Sheet Metal Components Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive Sheet Metal Components Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive Sheet Metal Components Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive Sheet Metal Components Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive Sheet Metal Components Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive Sheet Metal Components Industry

4.2 Key Market Trends in Automotive Sheet Metal Components Industry

4.3 Potential Opportunities in Automotive Sheet Metal Components Industry

4.4 Key Challenges in Automotive Sheet Metal Components Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive Sheet Metal Components Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive Sheet Metal Components Market Outlook by Segments

7.1 Automotive Sheet Metal Components Market Outlook by Segments, $ Million, 2021- 2030

By Type

Steel

Aluminum

By Component

Interior

Drivetrain

Engine

Exterior

Chassis

Others

8 North America Automotive Sheet Metal Components Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive Sheet Metal Components Markets in 2024

8.2 North America Automotive Sheet Metal Components Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive Sheet Metal Components Market size Outlook by Segments, 2021-2030

By Type

Steel

Aluminum

By Component

Interior

Drivetrain

Engine

Exterior

Chassis

Others

9 Europe Automotive Sheet Metal Components Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive Sheet Metal Components Markets in 2024

9.2 Europe Automotive Sheet Metal Components Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive Sheet Metal Components Market Size Outlook by Segments, 2021-2030

By Type

Steel

Aluminum

By Component

Interior

Drivetrain

Engine

Exterior

Chassis

Others

10 Asia Pacific Automotive Sheet Metal Components Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive Sheet Metal Components Markets in 2024

10.2 Asia Pacific Automotive Sheet Metal Components Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive Sheet Metal Components Market size Outlook by Segments, 2021-2030

By Type

Steel

Aluminum

By Component

Interior

Drivetrain

Engine

Exterior

Chassis

Others

11 South America Automotive Sheet Metal Components Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive Sheet Metal Components Markets in 2024

11.2 South America Automotive Sheet Metal Components Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive Sheet Metal Components Market size Outlook by Segments, 2021-2030

By Type

Steel

Aluminum

By Component

Interior

Drivetrain

Engine

Exterior

Chassis

Others

12 Middle East and Africa Automotive Sheet Metal Components Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive Sheet Metal Components Markets in 2024

12.2 Middle East and Africa Automotive Sheet Metal Components Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive Sheet Metal Components Market size Outlook by Segments, 2021-2030

By Type

Steel

Aluminum

By Component

Interior

Drivetrain

Engine

Exterior

Chassis

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

A&E Manufacturing Company Inc

ABC Sheet Metal Inc

Alcoa Corp

Aleris International Inc

Amada Co. Ltd

Autoline Industries Ltd

Frank Dudley Ltd

General Stamping & Metalworking Inc

Larsen Manufacturing Co.

Mayville Engineering Company Inc

Novelis Inc

Omax Autos Ltd

O'Neal Manufacturing Services

Paul Craemer GmbH

Prototek Sheetmetal Fabrication Llc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Steel

Aluminum

By Component

Interior

Drivetrain

Engine

Exterior

Chassis

Others

The global Automotive Sheet Metal Components Market is one of the lucrative growth markets, poised to register a 3.7% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

A&E Manufacturing Company Inc, ABC Sheet Metal Inc, Alcoa Corp, Aleris International Inc, Amada Co. Ltd, Autoline Industries Ltd, Frank Dudley Ltd, General Stamping & Metalworking Inc, Larsen Manufacturing Co., Mayville Engineering Company Inc, Novelis Inc, Omax Autos Ltd, O'Neal Manufacturing Services, Paul Craemer GmbH, Prototek Sheetmetal Fabrication Llc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume