The global Automotive Plastic Fasteners Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Non-Threaded Industrial Fasteners, Threaded Industrial Fasteners), By Material (Acetal, Nylon, Polycarbonate, Polyethylene, Polypropylene, Polyvinyl Chloride), By Function (Bonding, Noise, Vibration & Harshness (NVH)), By Vehicle (Heavy Commercial Vehicles, Light Commercial Vehicles, Passenger Vehicles), By Application (Chassis, Electronics, Exterior, Interior, Powertrain, Wire harnessing).

The market for automotive plastic fasteners is witnessing growth as automakers increasingly adopt lightweight materials and streamline assembly processes to improve vehicle efficiency and performance. Key trends shaping the future of this industry include the development of engineered plastic fasteners with high strength-to-weight ratios, chemical resistance, and vibration damping properties, which offer advantages over traditional metal fasteners in weight-sensitive applications. Additionally, advancements in injection molding technology and material science enable the production of complex-shaped fasteners with tight tolerances and precise functionality, supporting design flexibility and cost-effective manufacturing. Moreover, the integration of smart fastening solutions such as self-locking mechanisms, snap-fit designs, and RFID tagging enhances assembly efficiency, quality control, and traceability in automotive production lines. As automakers seek to reduce vehicle mass, improve fuel efficiency, and optimize manufacturing processes, the demand for lightweight and high-performance plastic fasteners is expected to continue growing, driving innovation and market expansion in this sector.

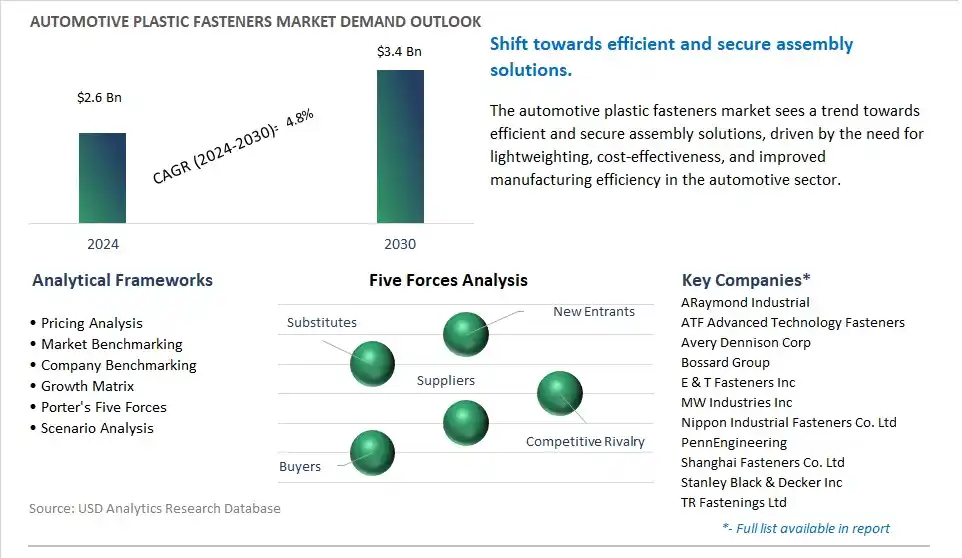

The market report analyses the leading companies in the industry including ARaymond Industrial, ATF Advanced Technology Fasteners, Avery Dennison Corp, Bossard Group, E & T Fasteners Inc, MW Industries Inc, Nippon Industrial Fasteners Co. Ltd, PennEngineering, Shanghai Fasteners Co. Ltd, Stanley Black & Decker Inc, TR Fastenings Ltd.

A prominent trend in the automotive industry is the shift towards lightweighting and cost reduction, driving the demand for automotive plastic fasteners. As automakers seek to improve fuel efficiency and reduce vehicle weight, there is a growing preference for lightweight materials over traditional metal fasteners. Plastic fasteners offer significant weight savings while maintaining adequate strength and durability, making them an attractive alternative for automotive assembly applications. Additionally, plastic fasteners are often more cost-effective to produce than their metal counterparts, contributing to overall cost reduction in vehicle manufacturing. The trend towards lightweighting and cost optimization is expected to fuel the adoption of automotive plastic fasteners across the industry.

A key driver behind the increasing demand for automotive plastic fasteners is the need for design flexibility and meeting performance requirements. Modern vehicle designs are becoming more complex, requiring fasteners that can accommodate intricate shapes and assembly configurations. Plastic fasteners offer greater design flexibility compared to metal fasteners, allowing for innovative and streamlined assembly processes. Moreover, advancements in plastic materials engineering have resulted in fasteners with enhanced mechanical properties, such as high tensile strength, corrosion resistance, and thermal stability, meeting the rigorous performance standards of automotive applications. As automakers continue to innovate and optimize vehicle designs, the demand for plastic fasteners that can meet evolving performance requirements is expected to rise, driving market growth.

An emerging opportunity for the automotive plastic fasteners market lies in the expansion of the electric vehicle (EV) market. With the global shift towards electrification to reduce carbon emissions and dependence on fossil fuels, the demand for electric vehicles is expected to surge in the coming years. Electric vehicles present unique challenges and opportunities for fastener suppliers, particularly in terms of weight reduction, electrical insulation, and thermal management. Plastic fasteners are well-suited for EV applications due to their lightweight nature and compatibility with electrical systems. Furthermore, as electric vehicle technology evolves, there will be a growing need for specialized fasteners designed to withstand the unique operating conditions of electric drivetrains and battery systems. By catering to the specific requirements of the expanding electric vehicle market, suppliers of automotive plastic fasteners aim to capitalize on this opportunity to drive growth and innovation in the industry.

The automotive plastic fasteners market begins with raw material acquisition, where chemical companies including BASF SE and Dow Inc. provide plastic resins suitable for fastener production, including Polyamide (PA), Polypropylene (PP), and Polyacetal (POM). Mold design and manufacturing follow, with specialized mold makers designing and producing molds for various types of plastic fasteners.

Fastener manufacturing then occurs through injection molding by Tier 2 or Tier 3 automotive suppliers including PennEngineering® and Waldemar Kawalec Group, ensuring precise control over molding parameters for high-volume production to meet industry demands.

Logistics and distribution ensure timely delivery of plastic fasteners, facilitated by logistics companies and fastener manufacturers with established distribution networks. Assembly and integration into vehicles are conducted by automakers including Toyota, Volkswagen, and General Motors during the vehicle assembly process.

Threaded industrial fasteners have emerged as the largest segment in the automotive plastic fasteners market due to their widespread use and versatility in automotive applications. Threaded fasteners, such as bolts, screws, and nuts, are essential components used in various automotive assemblies, including interior trim, exterior panels, engine components, and structural elements. Plastic threaded fasteners offer diverse advantages over traditional metal fasteners, including lightweight construction, corrosion resistance, and the ability to reduce assembly time and cost. Additionally, plastic fasteners can be tailored to specific performance requirements, such as vibration resistance, thermal stability, and electrical insulation, making them suitable for a wide range of automotive applications. The dominance of threaded industrial fasteners in the automotive plastic fasteners market is further driven by advancements in plastic materials and manufacturing technologies, enabling the production of high-quality, durable fasteners that meet stringent automotive industry standards. In addition, the shift toward electric vehicles and lightweighting initiatives in the automotive industry accelerates the adoption of plastic fasteners due to their contribution to overall vehicle weight reduction and improved efficiency. As automotive manufacturers continue to prioritize lightweight materials, cost-effectiveness, and performance, the demand for threaded industrial plastic fasteners is expected to remain robust, solidifying their position as the largest segment in the market.

Nylon is the fastest-growing segment in the automotive plastic fasteners market due to its versatile properties and suitability for a wide range of automotive applications. Nylon fasteners offer excellent strength, durability, and resistance to wear, making them ideal for use in demanding automotive environments. Additionally, nylon exhibits high tensile strength, impact resistance, and dimensional stability, ensuring reliable performance in critical automotive assemblies. The adoption of nylon fasteners is further accelerated by their compatibility with various manufacturing processes, including injection molding, extrusion, and machining, enabling cost-effective production and customization to meet specific application requirements. In addition, the lightweight nature of nylon contributes to overall vehicle weight reduction, supporting automotive lightweighting initiatives aimed at improving fuel efficiency and reducing emissions. As automotive manufacturers increasingly prioritize the use of lightweight and durable materials in vehicle construction, the demand for nylon fasteners is expected to continue its rapid growth trajectory, consolidating its position as a key segment in the automotive plastic fasteners market.

The segment of Noise, Vibration and Harshness (NVH) is the fastest-growing segment in the automotive plastic fasteners market due to its critical role in enhancing vehicle comfort, performance, and durability. NVH fasteners are specifically designed to mitigate noise, vibration, and harshness levels within the vehicle cabin, ensuring a smooth and quiet driving experience for passengers. As automotive manufacturers strive to meet customer expectations for quieter and more refined vehicles, the demand for NVH fasteners is on the rise. Plastic NVH fasteners offer diverse advantages over traditional metal fasteners, including lightweight construction, vibration damping properties, and corrosion resistance, making them well-suited for NVH applications. Additionally, the use of plastic fasteners contributes to overall vehicle weight reduction, supporting automotive lightweighting initiatives aimed at improving fuel efficiency and reducing emissions. In addition, advancements in material science and engineering enable the development of innovative plastic NVH fasteners with tailored properties to address specific noise and vibration challenges in modern vehicles. As automotive manufacturers continue to prioritize NVH performance to enhance vehicle comfort and competitiveness, the demand for plastic NVH fasteners is expected to experience rapid growth, consolidating their position as a key segment in the automotive plastic fasteners market.

By Type

Non-Threaded Industrial Fasteners

Threaded Industrial Fasteners

By Material

Acetal

Nylon

Polycarbonate

Polyethylene

Polypropylene

Polyvinyl Chloride

By Function

Bonding

Noise, Vibration & Harshness (NVH)

By Vehicle

Heavy Commercial Vehicles

Light Commercial Vehicles

Passenger Vehicles

By Application

Chassis

Electronics

Exterior

Interior

Powertrain

Wire harnessing

ARaymond Industrial

ATF Advanced Technology Fasteners

Avery Dennison Corp

Bossard Group

E & T Fasteners Inc

MW Industries Inc

Nippon Industrial Fasteners Co. Ltd

PennEngineering

Shanghai Fasteners Co. Ltd

Stanley Black & Decker Inc

TR Fastenings Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive Plastic Fasteners Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive Plastic Fasteners Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive Plastic Fasteners Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive Plastic Fasteners Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive Plastic Fasteners Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive Plastic Fasteners Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive Plastic Fasteners Industry

4.2 Key Market Trends in Automotive Plastic Fasteners Industry

4.3 Potential Opportunities in Automotive Plastic Fasteners Industry

4.4 Key Challenges in Automotive Plastic Fasteners Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive Plastic Fasteners Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive Plastic Fasteners Market Outlook by Segments

7.1 Automotive Plastic Fasteners Market Outlook by Segments, $ Million, 2021- 2030

By Type

Non-Threaded Industrial Fasteners

Threaded Industrial Fasteners

By Material

Acetal

Nylon

Polycarbonate

Polyethylene

Polypropylene

Polyvinyl Chloride

By Function

Bonding

Noise, Vibration & Harshness (NVH)

By Vehicle

Heavy Commercial Vehicles

Light Commercial Vehicles

Passenger Vehicles

By Application

Chassis

Electronics

Exterior

Interior

Powertrain

Wire harnessing

8 North America Automotive Plastic Fasteners Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive Plastic Fasteners Markets in 2024

8.2 North America Automotive Plastic Fasteners Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive Plastic Fasteners Market size Outlook by Segments, 2021-2030

By Type

Non-Threaded Industrial Fasteners

Threaded Industrial Fasteners

By Material

Acetal

Nylon

Polycarbonate

Polyethylene

Polypropylene

Polyvinyl Chloride

By Function

Bonding

Noise, Vibration & Harshness (NVH)

By Vehicle

Heavy Commercial Vehicles

Light Commercial Vehicles

Passenger Vehicles

By Application

Chassis

Electronics

Exterior

Interior

Powertrain

Wire harnessing

9 Europe Automotive Plastic Fasteners Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive Plastic Fasteners Markets in 2024

9.2 Europe Automotive Plastic Fasteners Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive Plastic Fasteners Market Size Outlook by Segments, 2021-2030

By Type

Non-Threaded Industrial Fasteners

Threaded Industrial Fasteners

By Material

Acetal

Nylon

Polycarbonate

Polyethylene

Polypropylene

Polyvinyl Chloride

By Function

Bonding

Noise, Vibration & Harshness (NVH)

By Vehicle

Heavy Commercial Vehicles

Light Commercial Vehicles

Passenger Vehicles

By Application

Chassis

Electronics

Exterior

Interior

Powertrain

Wire harnessing

10 Asia Pacific Automotive Plastic Fasteners Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive Plastic Fasteners Markets in 2024

10.2 Asia Pacific Automotive Plastic Fasteners Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive Plastic Fasteners Market size Outlook by Segments, 2021-2030

By Type

Non-Threaded Industrial Fasteners

Threaded Industrial Fasteners

By Material

Acetal

Nylon

Polycarbonate

Polyethylene

Polypropylene

Polyvinyl Chloride

By Function

Bonding

Noise, Vibration & Harshness (NVH)

By Vehicle

Heavy Commercial Vehicles

Light Commercial Vehicles

Passenger Vehicles

By Application

Chassis

Electronics

Exterior

Interior

Powertrain

Wire harnessing

11 South America Automotive Plastic Fasteners Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive Plastic Fasteners Markets in 2024

11.2 South America Automotive Plastic Fasteners Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive Plastic Fasteners Market size Outlook by Segments, 2021-2030

By Type

Non-Threaded Industrial Fasteners

Threaded Industrial Fasteners

By Material

Acetal

Nylon

Polycarbonate

Polyethylene

Polypropylene

Polyvinyl Chloride

By Function

Bonding

Noise, Vibration & Harshness (NVH)

By Vehicle

Heavy Commercial Vehicles

Light Commercial Vehicles

Passenger Vehicles

By Application

Chassis

Electronics

Exterior

Interior

Powertrain

Wire harnessing

12 Middle East and Africa Automotive Plastic Fasteners Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive Plastic Fasteners Markets in 2024

12.2 Middle East and Africa Automotive Plastic Fasteners Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive Plastic Fasteners Market size Outlook by Segments, 2021-2030

By Type

Non-Threaded Industrial Fasteners

Threaded Industrial Fasteners

By Material

Acetal

Nylon

Polycarbonate

Polyethylene

Polypropylene

Polyvinyl Chloride

By Function

Bonding

Noise, Vibration & Harshness (NVH)

By Vehicle

Heavy Commercial Vehicles

Light Commercial Vehicles

Passenger Vehicles

By Application

Chassis

Electronics

Exterior

Interior

Powertrain

Wire harnessing

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ARaymond Industrial

ATF Advanced Technology Fasteners

Avery Dennison Corp

Bossard Group

E & T Fasteners Inc

MW Industries Inc

Nippon Industrial Fasteners Co. Ltd

PennEngineering

Shanghai Fasteners Co. Ltd

Stanley Black & Decker Inc

TR Fastenings Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Non-Threaded Industrial Fasteners

Threaded Industrial Fasteners

By Material

Acetal

Nylon

Polycarbonate

Polyethylene

Polypropylene

Polyvinyl Chloride

By Function

Bonding

Noise, Vibration & Harshness (NVH)

By Vehicle

Heavy Commercial Vehicles

Light Commercial Vehicles

Passenger Vehicles

By Application

Chassis

Electronics

Exterior

Interior

Powertrain

Wire harnessing

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Automotive Plastic Fasteners is forecast to reach $3.4 Billion in 2030 from $2.6 Billion in 2024, registering a CAGR of 4.8% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ARaymond Industrial, ATF Advanced Technology Fasteners, Avery Dennison Corp, Bossard Group, E & T Fasteners Inc, MW Industries Inc, Nippon Industrial Fasteners Co. Ltd, PennEngineering, Shanghai Fasteners Co. Ltd, Stanley Black & Decker Inc, TR Fastenings Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume