The global Automotive E-Compressor Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Compressor (Scroll Compressors, Rotary Compressors, Centrifugal Compressors, Reciprocating Compressors, Axial Compressors), By Vehicle (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Capacity (Small, Medium, Large), By Technology (VFD, Fixed Speed), By Propulsion (Battery Electric Vehicle (BEV), Plug-in Hybrid Vehicle (PHEV), Fuel-cell Electric Vehicle (FCEV), Hybrid Electric Vehicle (HEV))

Automotive E-Compressor refers to an electrically-driven compressor system used in electric vehicles (EVs), hybrid vehicles, and fuel cell vehicles to manage air conditioning, heating, and thermal management systems. E-Compressors operate independently from the vehicle's internal combustion engine, drawing power from the battery or electrical system to provide efficient climate control and cabin comfort while reducing emissions and energy consumption. The Automotive E-Compressor market is growing rapidly with the increasing adoption of electric mobility, stricter emission regulations, and the focus on enhancing EV performance, range, and energy efficiency. With advancements in electric drivetrain technology, thermal management solutions, and automotive HVAC systems, E-Compressor technologies play a crucial role in optimizing EVs' environmental impact, driving range, and passenger comfort, supporting the transition towards sustainable transportation solutions globally.

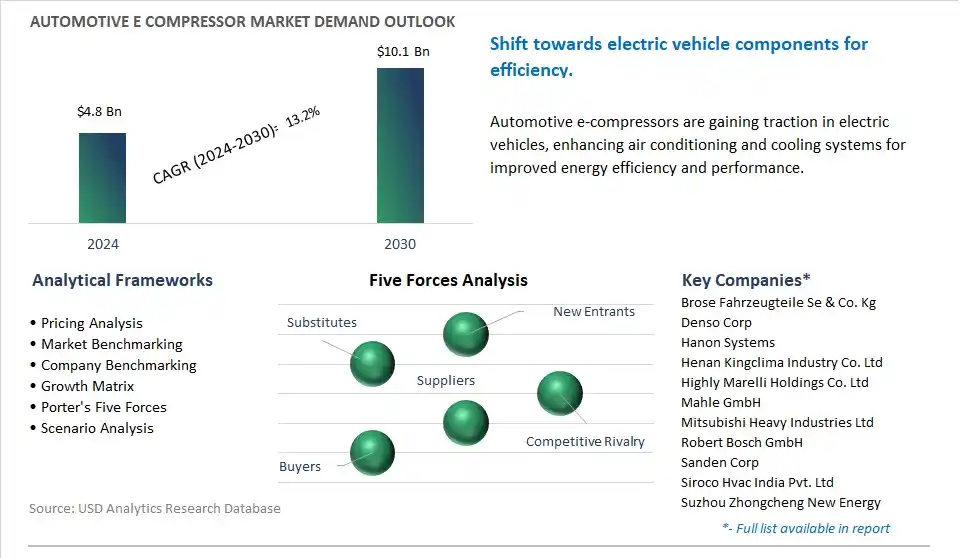

The market report analyses the leading companies in the industry including Brose Fahrzeugteile Se & Co. Kg, Denso Corp, Hanon Systems, Henan Kingclima Industry Co. Ltd, Highly Marelli Holdings Co. Ltd, Mahle GmbH, Mitsubishi Heavy Industries Ltd, Robert Bosch GmbH, Sanden Corp, Siroco Hvac India Pvt. Ltd, Suzhou Zhongcheng New Energy Technology Co. Ltd, Toyota Industries Corp, Valeo, Yute Motor Mechanical Parts Co. Ltd, Zhejiang Boyang Compressor Co. Ltd.

The most prominent trend in the automotive e-compressor market is the shift towards electric and hybrid vehicles equipped with advanced climate control systems. As automotive manufacturers prioritize sustainability and energy efficiency, there is an increasing adoption of e-compressors for electric and hybrid vehicles to provide efficient and environmentally friendly air conditioning and heating solutions. This trend includes the development of compact, high-performance e-compressors that enhance cabin comfort while minimizing energy consumption, driving market growth in the automotive sector.

A significant driver for the automotive e-compressor market is the implementation of stringent emission regulations and fuel economy standards globally. Governments and regulatory bodies are imposing stricter emission norms and fuel efficiency targets on automakers, leading to the adoption of technologies such as e-compressors to reduce vehicle emissions, improve energy efficiency, and enhance overall vehicle performance. Factors such as the Paris Agreement commitments, CO2 reduction targets, and consumer demand for eco-friendly vehicles drive the demand for e-compressors, supporting market expansion and technological advancements.

One Market Opportunity in the automotive e-compressor market lies in the integration of e-compressors with HVAC (heating, ventilation, and air conditioning) automation and smart controls. Advancements in automotive electronics and connectivity enable the integration of e-compressors with intelligent HVAC systems that can optimize climate control based on real-time data, occupant preferences, weather conditions, and driving patterns. Collaborating with HVAC technology providers, automotive OEMs, and software developers presents opportunities to develop smart HVAC solutions, enhance user experience, reduce energy consumption, and differentiate e-compressor offerings in the automotive market. Capitalizing on this opportunity involves R&D investment, software development, compatibility testing, and marketing strategies highlighting the benefits of integrated e-compressor and smart HVAC systems for next-generation vehicles.

The high market share of Scroll compressors is primarily due to the scroll compressor's widespread adoption in automotive applications, driven by its compact design, high efficiency, low noise levels, and reliability. Scroll compressors are well-suited for automotive air conditioning systems, hybrid and electric vehicle cooling systems, and other HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) applications in vehicles. Their efficient operation and ability to maintain consistent performance under varying conditions make them the preferred choice for automotive e-compressor solutions, contributing to their status as the largest segment in this market.

The fastest-growing segment among "Automotive E-Compressor by Capacity" is "Medium." This rapid growth is propelled by the increasing adoption of electric and hybrid vehicles, which require efficient and powerful e-compressors to manage cooling and air conditioning systems. Medium-capacity e-compressors strike a balance between performance and energy efficiency, making them ideal for a wide range of automotive applications across different vehicle sizes and types. Additionally, advancements in automotive technologies and the push towards sustainability drive the demand for medium-capacity e-compressors as automakers prioritize eco-friendly solutions without compromising performance.

The dominant market share of the Fixed Speed segment in Automotive E-Compressor industry is due to the widespread use of fixed-speed compressors in automotive applications, driven by their simplicity, cost-effectiveness, and reliability. Fixed-speed e-compressors operate at a constant speed, providing consistent cooling and air conditioning performance in vehicles. While Variable Frequency Drive (VFD) technology offers energy-saving benefits by adjusting compressor speed based on demand, fixed-speed compressors remain the preferred choice for automotive e-compressors due to their proven track record, ease of integration, and suitability for a wide range of vehicle models and production volumes.

In the US Automotive E-Compressor market, there's a rising trend toward electrification and energy-efficient technologies in vehicles. E-compressors play a crucial role in electric and hybrid vehicles by managing the air conditioning and cooling systems, enhancing vehicle performance, range, and overall efficiency. With increasing adoption of electric vehicles (EVs) and stringent emissions regulations, automotive manufacturers are investing in e-compressor technologies to deliver optimal thermal management solutions, driving the growth of this market in the United States.

By Compressor

Scroll Compressors

Rotary Compressors

Centrifugal Compressors

Reciprocating Compressors

Axial Compressors

By Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

By Capacity

Small

Medium

Large

By Technology

VFD

Fixed Speed

By Propulsion

Battery Electric Vehicle (BEV)

Plug-in Hybrid Vehicle (PHEV)

Fuel-cell Electric Vehicle (FCEV)

Hybrid Electric Vehicle (HEV)

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Brose Fahrzeugteile Se & Co. Kg

Denso Corp

Hanon Systems

Henan Kingclima Industry Co. Ltd

Highly Marelli Holdings Co. Ltd

Mahle GmbH

Mitsubishi Heavy Industries Ltd

Robert Bosch GmbH

Sanden Corp

Siroco Hvac India Pvt. Ltd

Suzhou Zhongcheng New Energy Technology Co. Ltd

Toyota Industries Corp

Valeo

Yute Motor Mechanical Parts Co. Ltd

Zhejiang Boyang Compressor Co. Ltd

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive E-Compressor Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive E-Compressor Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive E-Compressor Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive E-Compressor Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive E-Compressor Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive E-Compressor Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive E-Compressor Industry

4.2 Key Market Trends in Automotive E-Compressor Industry

4.3 Potential Opportunities in Automotive E-Compressor Industry

4.4 Key Challenges in Automotive E-Compressor Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive E-Compressor Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive E-Compressor Market Outlook by Segments

7.1 Automotive E-Compressor Market Outlook by Segments, $ Million, 2021- 2030

By Compressor

Scroll Compressors

Rotary Compressors

Centrifugal Compressors

Reciprocating Compressors

Axial Compressors

By Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

By Capacity

Small

Medium

Large

By Technology

VFD

Fixed Speed

By Propulsion

Battery Electric Vehicle (BEV)

Plug-in Hybrid Vehicle (PHEV)

Fuel-cell Electric Vehicle (FCEV)

Hybrid Electric Vehicle (HEV)

8 North America Automotive E-Compressor Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive E-Compressor Markets in 2024

8.2 North America Automotive E-Compressor Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive E-Compressor Market size Outlook by Segments, 2021-2030

By Compressor

Scroll Compressors

Rotary Compressors

Centrifugal Compressors

Reciprocating Compressors

Axial Compressors

By Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

By Capacity

Small

Medium

Large

By Technology

VFD

Fixed Speed

By Propulsion

Battery Electric Vehicle (BEV)

Plug-in Hybrid Vehicle (PHEV)

Fuel-cell Electric Vehicle (FCEV)

Hybrid Electric Vehicle (HEV)

9 Europe Automotive E-Compressor Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive E-Compressor Markets in 2024

9.2 Europe Automotive E-Compressor Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive E-Compressor Market Size Outlook by Segments, 2021-2030

By Compressor

Scroll Compressors

Rotary Compressors

Centrifugal Compressors

Reciprocating Compressors

Axial Compressors

By Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

By Capacity

Small

Medium

Large

By Technology

VFD

Fixed Speed

By Propulsion

Battery Electric Vehicle (BEV)

Plug-in Hybrid Vehicle (PHEV)

Fuel-cell Electric Vehicle (FCEV)

Hybrid Electric Vehicle (HEV)

10 Asia Pacific Automotive E-Compressor Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive E-Compressor Markets in 2024

10.2 Asia Pacific Automotive E-Compressor Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive E-Compressor Market size Outlook by Segments, 2021-2030

By Compressor

Scroll Compressors

Rotary Compressors

Centrifugal Compressors

Reciprocating Compressors

Axial Compressors

By Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

By Capacity

Small

Medium

Large

By Technology

VFD

Fixed Speed

By Propulsion

Battery Electric Vehicle (BEV)

Plug-in Hybrid Vehicle (PHEV)

Fuel-cell Electric Vehicle (FCEV)

Hybrid Electric Vehicle (HEV)

11 South America Automotive E-Compressor Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive E-Compressor Markets in 2024

11.2 South America Automotive E-Compressor Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive E-Compressor Market size Outlook by Segments, 2021-2030

By Compressor

Scroll Compressors

Rotary Compressors

Centrifugal Compressors

Reciprocating Compressors

Axial Compressors

By Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

By Capacity

Small

Medium

Large

By Technology

VFD

Fixed Speed

By Propulsion

Battery Electric Vehicle (BEV)

Plug-in Hybrid Vehicle (PHEV)

Fuel-cell Electric Vehicle (FCEV)

Hybrid Electric Vehicle (HEV)

12 Middle East and Africa Automotive E-Compressor Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive E-Compressor Markets in 2024

12.2 Middle East and Africa Automotive E-Compressor Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive E-Compressor Market size Outlook by Segments, 2021-2030

By Compressor

Scroll Compressors

Rotary Compressors

Centrifugal Compressors

Reciprocating Compressors

Axial Compressors

By Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

By Capacity

Small

Medium

Large

By Technology

VFD

Fixed Speed

By Propulsion

Battery Electric Vehicle (BEV)

Plug-in Hybrid Vehicle (PHEV)

Fuel-cell Electric Vehicle (FCEV)

Hybrid Electric Vehicle (HEV)

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Brose Fahrzeugteile Se & Co. Kg

Denso Corp

Hanon Systems

Henan Kingclima Industry Co. Ltd

Highly Marelli Holdings Co. Ltd

Mahle GmbH

Mitsubishi Heavy Industries Ltd

Robert Bosch GmbH

Sanden Corp

Siroco Hvac India Pvt. Ltd

Suzhou Zhongcheng New Energy Technology Co. Ltd

Toyota Industries Corp

Valeo

Yute Motor Mechanical Parts Co. Ltd

Zhejiang Boyang Compressor Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Compressor

Scroll Compressors

Rotary Compressors

Centrifugal Compressors

Reciprocating Compressors

Axial Compressors

By Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

By Capacity

Small

Medium

Large

By Technology

VFD

Fixed Speed

By Propulsion

Battery Electric Vehicle (BEV)

Plug-in Hybrid Vehicle (PHEV)

Fuel-cell Electric Vehicle (FCEV)

Hybrid Electric Vehicle (HEV)

Global Automotive E Compressor Market is forecast to reach $10.1 Billion in 2030 from $4.8 Billion in 2024, registering a CAGR of 13.2%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Brose Fahrzeugteile Se & Co. Kg, Denso Corp, Hanon Systems, Henan Kingclima Industry Co. Ltd, Highly Marelli Holdings Co. Ltd, Mahle GmbH, Mitsubishi Heavy Industries Ltd, Robert Bosch GmbH, Sanden Corp, Siroco Hvac India Pvt. Ltd, Suzhou Zhongcheng New Energy Technology Co. Ltd, Toyota Industries Corp, Valeo, Yute Motor Mechanical Parts Co. Ltd, Zhejiang Boyang Compressor Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume