The global Automotive Digital Cockpit Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Equipment (Digital Instrument Cluster, Driving Monitoring System, Head-Up Display (HUD)), By Display Technology (LCD, TFT-LCD, OLED), By Vehicle (Passenger Cars, Commercial Vehicles).

In 2024, the automotive digital cockpit market is experiencing rapid growth driven by the integration of digital displays, infotainment systems, and connectivity features in modern vehicles. Digital cockpits reimagine the traditional dashboard layout, replacing analog gauges and buttons with customizable high-resolution screens that provide drivers with real-time information, entertainment options, and advanced driver assistance features. With the rise of connected and autonomous vehicles, digital cockpits play a crucial role in enhancing the in-vehicle experience, enabling seamless interaction between drivers, passengers, and vehicle systems. Moreover, advancements in augmented reality, gesture recognition, and voice control technologies further enhance the functionality and user experience of automotive digital cockpits. As automotive OEMs prioritize digital transformation and user-centric design, the automotive digital cockpit market is poised for sustained growth, offering innovative solutions to enhance comfort, convenience, and safety for occupants.

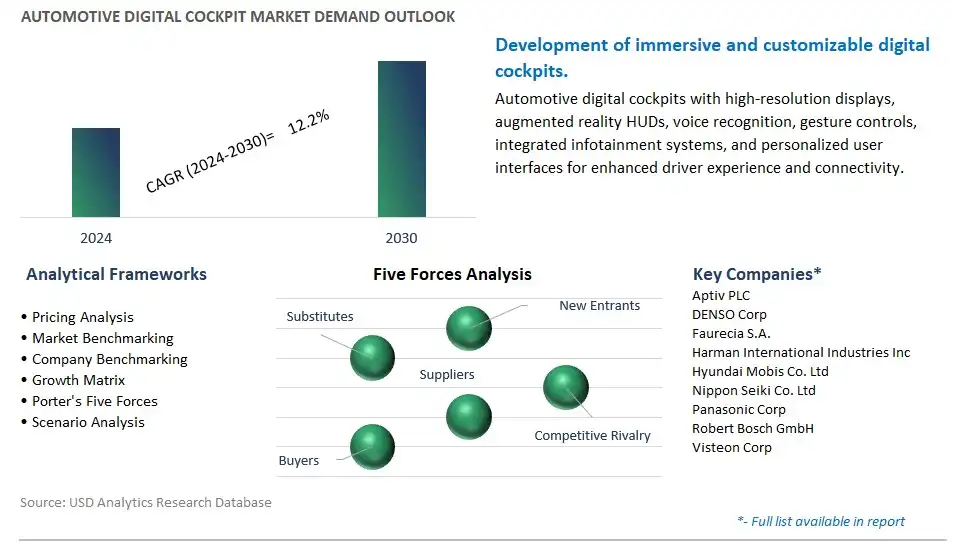

The global Automotive Digital Cockpit market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Automotive Digital Cockpit Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Automotive Digital Cockpit Market Industry include- Aptiv PLC, DENSO Corp, Faurecia S.A., Harman International Industries Inc, Hyundai Mobis Co. Ltd, Nippon Seiki Co. Ltd, Panasonic Corp, Robert Bosch GmbH, Visteon Corp.

The automotive digital cockpit market is witnessing a prominent trend driven by the rising demand for connected and autonomous vehicles. As consumers seek more integrated and intuitive driving experiences, automakers are focusing on developing advanced digital cockpits that seamlessly integrate infotainment, navigation, connectivity, and vehicle control systems. This trend is fueled by the growing adoption of electric vehicles, which require sophisticated digital interfaces for monitoring battery status and optimizing energy efficiency. Additionally, the proliferation of in-car connectivity technologies, such as 5G and vehicle-to-everything (V2X) communication, is further driving the demand for digital cockpits that can support a wide range of applications and services, including real-time traffic updates, remote diagnostics, and over-the-air software updates.

A key driver shaping the automotive digital cockpit market is the continuous advancement in human-machine interface (HMI) systems. As automotive manufacturers strive to differentiate their offerings and enhance experience, they are increasingly investing in innovative HMI technologies that enable intuitive interaction between drivers, passengers, and vehicle systems. This includes the integration of voice recognition, gesture control, augmented reality displays, and natural language processing capabilities, allowing s to seamlessly interact with digital cockpits without being distracted from the driving task. Moreover, the emergence of artificial intelligence and machine learning algorithms is enabling personalized interfaces that adapt to individual preferences and driving habits, further enhancing the overall driving experience and safety.

An emerging Market Opportunity in the automotive digital cockpit market lies in the integration of health and wellness monitoring features. With the growing emphasis on occupant safety and well-being, there is a rising demand for digital cockpits that can monitor and analyze various physiological parameters, such as heart rate, stress levels, and fatigue, in real time. By incorporating biometric sensors and health monitoring algorithms into the cockpit design, automakers can provide drivers with valuable insights into their physical condition and alert them to potential health risks or fatigue-related impairments during long journeys. Furthermore, the integration of wellness-focused features, such as personalized relaxation programs or posture correction reminders, can contribute to a more comfortable and enjoyable driving experience, particularly in the context of autonomous vehicles where occupants have more leisure time to engage in wellness activities. This represents a significant Market Opportunity for automotive OEMs and technology suppliers to differentiate their products and cater to the evolving needs and preferences of health-conscious consumers.

By Equipment

Digital Instrument Cluster

Driving Monitoring System

Head-Up Display (HUD)

By Display Technology

LCD

TFT-LCD

OLED

By Vehicle

Passenger Cars

Commercial VehiclesGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Aptiv PLC

DENSO Corp

Faurecia S.A.

Harman International Industries Inc

Hyundai Mobis Co. Ltd

Nippon Seiki Co. Ltd

Panasonic Corp

Robert Bosch GmbH

Visteon Corp

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive Digital Cockpit Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive Digital Cockpit Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive Digital Cockpit Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive Digital Cockpit Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive Digital Cockpit Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive Digital Cockpit Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive Digital Cockpit Industry

4.2 Key Market Trends in Automotive Digital Cockpit Industry

4.3 Potential Opportunities in Automotive Digital Cockpit Industry

4.4 Key Challenges in Automotive Digital Cockpit Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive Digital Cockpit Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive Digital Cockpit Market Outlook by Segments

7.1 Automotive Digital Cockpit Market Outlook by Segments, $ Million, 2021- 2030

By Equipment

Digital Instrument Cluster

Driving Monitoring System

Head-Up Display (HUD)

By Display Technology

LCD

TFT-LCD

OLED

By Vehicle

Passenger Cars

Commercial Vehicles

8 North America Automotive Digital Cockpit Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive Digital Cockpit Markets in 2024

8.2 North America Automotive Digital Cockpit Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive Digital Cockpit Market size Outlook by Segments, 2021-2030

By Equipment

Digital Instrument Cluster

Driving Monitoring System

Head-Up Display (HUD)

By Display Technology

LCD

TFT-LCD

OLED

By Vehicle

Passenger Cars

Commercial Vehicles

9 Europe Automotive Digital Cockpit Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive Digital Cockpit Markets in 2024

9.2 Europe Automotive Digital Cockpit Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive Digital Cockpit Market Size Outlook by Segments, 2021-2030

By Equipment

Digital Instrument Cluster

Driving Monitoring System

Head-Up Display (HUD)

By Display Technology

LCD

TFT-LCD

OLED

By Vehicle

Passenger Cars

Commercial Vehicles

10 Asia Pacific Automotive Digital Cockpit Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive Digital Cockpit Markets in 2024

10.2 Asia Pacific Automotive Digital Cockpit Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive Digital Cockpit Market size Outlook by Segments, 2021-2030

By Equipment

Digital Instrument Cluster

Driving Monitoring System

Head-Up Display (HUD)

By Display Technology

LCD

TFT-LCD

OLED

By Vehicle

Passenger Cars

Commercial Vehicles

11 South America Automotive Digital Cockpit Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive Digital Cockpit Markets in 2024

11.2 South America Automotive Digital Cockpit Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive Digital Cockpit Market size Outlook by Segments, 2021-2030

By Equipment

Digital Instrument Cluster

Driving Monitoring System

Head-Up Display (HUD)

By Display Technology

LCD

TFT-LCD

OLED

By Vehicle

Passenger Cars

Commercial Vehicles

12 Middle East and Africa Automotive Digital Cockpit Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive Digital Cockpit Markets in 2024

12.2 Middle East and Africa Automotive Digital Cockpit Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive Digital Cockpit Market size Outlook by Segments, 2021-2030

By Equipment

Digital Instrument Cluster

Driving Monitoring System

Head-Up Display (HUD)

By Display Technology

LCD

TFT-LCD

OLED

By Vehicle

Passenger Cars

Commercial Vehicles

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Aptiv PLC

DENSO Corp

Faurecia S.A.

Harman International Industries Inc

Hyundai Mobis Co. Ltd

Nippon Seiki Co. Ltd

Panasonic Corp

Robert Bosch GmbH

Visteon Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Equipment

Digital Instrument Cluster

Driving Monitoring System

Head-Up Display (HUD)

By Display Technology

LCD

TFT-LCD

OLED

By Vehicle

Passenger Cars

Commercial Vehicles

The global Automotive Digital Cockpit Market is one of the lucrative growth markets, poised to register a 12.2% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aptiv PLC, DENSO Corp, Faurecia S.A., Harman International Industries Inc, Hyundai Mobis Co. Ltd, Nippon Seiki Co. Ltd, Panasonic Corp, Robert Bosch GmbH, Visteon Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume