The global Automotive Brake Components Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Mechanical Brakes, Hydraulic Brakes, Power Brakes), By Application (Passenger Vehicles, Commercial Vehicles), By Brake Fluids (Glycol Based, Silicon-Based), By Brake Lining Material (Fully Metallic (Sintered Iron), Semi-Metallic (Iron Fibres), Non-Asbestos Lining Material (Synthetic Substance)), By Material (Organic, Metallic, Ceramic, Carbon), By Brake Components (Drum Brakes, Emergency brake, Pedal, Booster, Master Cylinder, Combo Valve, Disc Brakes, Lines), By Technology (Anti-Lock Braking System (ABS), Electronic Stability Control (ESC), Traction Control System (TCS), Electronic Brake-Force Distribution (EBD)).

The Automotive Brake Components market is integral to the performance and safety of braking systems in vehicles, encompassing a wide range of parts such as brake pads, rotors, calipers, and lines. Brake components work together to convert kinetic energy into heat energy through friction, thereby slowing or stopping the vehicle. With the automotive industry's focus on braking efficiency, durability, and noise reduction, the demand for high-quality brake components continues to grow. Manufacturers in this market focus on developing components with advanced materials, precise machining, and innovative designs to optimize braking performance and longevity. Moreover, advancements in brake component technology, including ceramic friction materials, lightweight rotor designs, and electronic brake force distribution systems, drive innovation, allowing for improved stopping power and fade resistance. Additionally, as vehicle designs evolve to incorporate electrification and autonomous driving features, the automotive brake components market is poised for sustained growth and innovation, with opportunities for product development, customization, and market expansion across vehicle segments and regions.

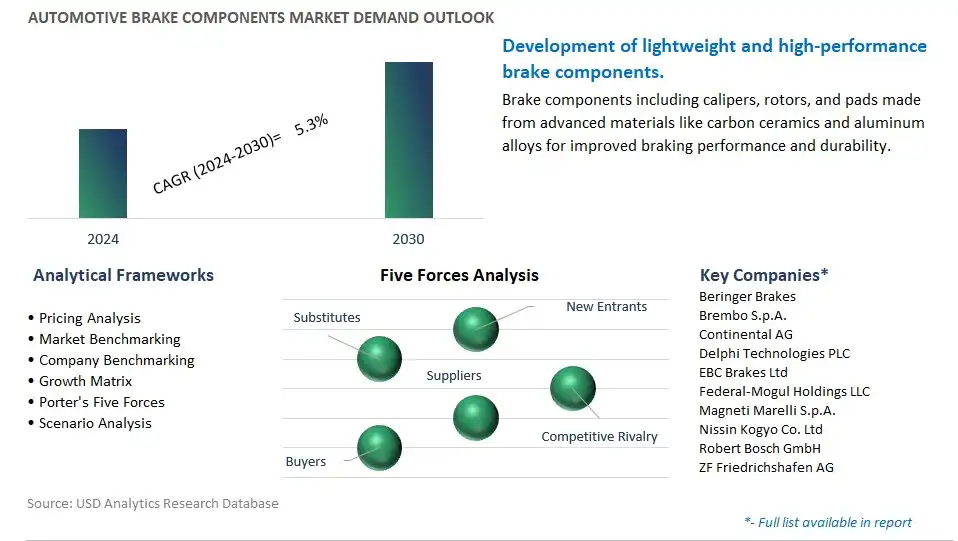

The global Automotive Brake Components market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Automotive Brake Components Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Automotive Brake Components Market Industry include- Beringer Brakes, Brembo S.p.A., Continental AG, Delphi Technologies PLC, EBC Brakes Ltd, Federal-Mogul Holdings LLC, Magneti Marelli S.p.A., Nissin Kogyo Co. Ltd, Robert Bosch GmbH, ZF Friedrichshafen AG.

The most prominent trend in the Automotive Brake Components Market is the increasing emphasis on lightweight brake components. As automotive manufacturers strive to improve fuel efficiency and reduce emissions, there is a growing demand for brake components that are lightweight yet durable. Lightweight brake components, such as aluminum calipers, carbon ceramic brake discs, and composite brake pads, offer several benefits including improved handling, reduced unsprung weight, and enhanced performance. Additionally, lighter brake components contribute to overall vehicle weight reduction, leading to improved fuel economy and lower carbon footprint. This trend reflects the industry's focus on adopting innovative materials and manufacturing techniques to achieve weight savings without compromising braking performance.

A major driver propelling the growth of the Automotive Brake Components Market is the increasing vehicle production and sales worldwide. With rising consumer demand for automobiles, especially in emerging markets, there is a significant uptick in vehicle manufacturing activities across the globe. As more vehicles are produced and sold, there is a corresponding increase in the demand for brake components such as brake pads, brake calipers, brake rotors, and brake drums. Additionally, stringent safety regulations and standards mandating the use of high-quality brake components further drive the demand for reliable braking systems in vehicles. The growing vehicle production and sales worldwide serve as a key driver for the expansion of the Automotive Brake Components Market.

An opportunity for significant expansion in the Automotive Brake Components Market lies in the integration of advanced sensor technologies for predictive maintenance. With the advent of Industry 4.0 and the Internet of Things (IoT), there is a growing trend towards incorporating sensors into automotive brake components to monitor performance, wear, and temperature in real time. By integrating sensors into brake pads, rotors, and calipers, manufacturers can enable predictive maintenance capabilities that alert drivers and service technicians to potential issues before they escalate into costly repairs or safety hazards. Moreover, data collected from these sensors can be utilized to optimize brake system performance, extend component lifespan, and enhance overall vehicle safety. By offering brake components with integrated sensor technologies, manufacturers can provide added value to customers and differentiate their products in the Automotive Brake Components Market.

By Type

Mechanical Brakes

-Drum Brakes

-Disc Brakes

Hydraulic Brakes

Power Brakes

-Air Brakes

-Vacuum brakes

-Others

By Application

Passenger Vehicles

Commercial Vehicles

By Brake Fluids

Glycol Based (Absorb Water)

Silicon Based (Doesn’t Absorb Water)

By Distribution Channel

Original Equipment Manufacturers (OEM)

Aftermarket

By Brake Lining Material

Fully Metallic (Sintered Iron)

Semi-Metallic (Iron Fibers)

Non-Asbestos Lining Material (Synthetic Substance)

By Material

Organic

Metallic

Ceramic

Carbon

By Brake Components

Drum Brakes

Emergency brake

Pedal

Booster

Master Cylinder

Combo Valve

Disc Brakes

Lines

By Technology

Anti-Lock Braking System (ABS)

Electronic Stability Control (ESC)

Traction Control System (TCS)

Electronic Brake-Force Distribution (EBD)Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Beringer Brakes

Brembo S.p.A.

Continental AG

Delphi Technologies PLC

EBC Brakes Ltd

Federal-Mogul Holdings LLC

Magneti Marelli S.p.A.

Nissin Kogyo Co. Ltd

Robert Bosch GmbH

ZF Friedrichshafen AG

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive Brake Components Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive Brake Components Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive Brake Components Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive Brake Components Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive Brake Components Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive Brake Components Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive Brake Components Industry

4.2 Key Market Trends in Automotive Brake Components Industry

4.3 Potential Opportunities in Automotive Brake Components Industry

4.4 Key Challenges in Automotive Brake Components Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive Brake Components Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive Brake Components Market Outlook by Segments

7.1 Automotive Brake Components Market Outlook by Segments, $ Million, 2021- 2030

By Type

Mechanical Brakes

-Drum Brakes

-Disc Brakes

Hydraulic Brakes

Power Brakes

-Air Brakes

-Vacuum brakes

-Others

By Application

Passenger Vehicles

Commercial Vehicles

By Brake Fluids

Glycol Based (Absorb Water)

Silicon Based (Doesn’t Absorb Water)

By Distribution Channel

Original Equipment Manufacturers (OEM)

Aftermarket

By Brake Lining Material

Fully Metallic (Sintered Iron)

Semi-Metallic (Iron Fibers)

Non-Asbestos Lining Material (Synthetic Substance)

By Material

Organic

Metallic

Ceramic

Carbon

By Brake Components

Drum Brakes

Emergency brake

Pedal

Booster

Master Cylinder

Combo Valve

Disc Brakes

Lines

By Technology

Anti-Lock Braking System (ABS)

Electronic Stability Control (ESC)

Traction Control System (TCS)

Electronic Brake-Force Distribution (EBD)

8 North America Automotive Brake Components Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive Brake Components Markets in 2024

8.2 North America Automotive Brake Components Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive Brake Components Market size Outlook by Segments, 2021-2030

By Type

Mechanical Brakes

-Drum Brakes

-Disc Brakes

Hydraulic Brakes

Power Brakes

-Air Brakes

-Vacuum brakes

-Others

By Application

Passenger Vehicles

Commercial Vehicles

By Brake Fluids

Glycol Based (Absorb Water)

Silicon Based (Doesn’t Absorb Water)

By Distribution Channel

Original Equipment Manufacturers (OEM)

Aftermarket

By Brake Lining Material

Fully Metallic (Sintered Iron)

Semi-Metallic (Iron Fibers)

Non-Asbestos Lining Material (Synthetic Substance)

By Material

Organic

Metallic

Ceramic

Carbon

By Brake Components

Drum Brakes

Emergency brake

Pedal

Booster

Master Cylinder

Combo Valve

Disc Brakes

Lines

By Technology

Anti-Lock Braking System (ABS)

Electronic Stability Control (ESC)

Traction Control System (TCS)

Electronic Brake-Force Distribution (EBD)

9 Europe Automotive Brake Components Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive Brake Components Markets in 2024

9.2 Europe Automotive Brake Components Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive Brake Components Market Size Outlook by Segments, 2021-2030

By Type

Mechanical Brakes

-Drum Brakes

-Disc Brakes

Hydraulic Brakes

Power Brakes

-Air Brakes

-Vacuum brakes

-Others

By Application

Passenger Vehicles

Commercial Vehicles

By Brake Fluids

Glycol Based (Absorb Water)

Silicon Based (Doesn’t Absorb Water)

By Distribution Channel

Original Equipment Manufacturers (OEM)

Aftermarket

By Brake Lining Material

Fully Metallic (Sintered Iron)

Semi-Metallic (Iron Fibers)

Non-Asbestos Lining Material (Synthetic Substance)

By Material

Organic

Metallic

Ceramic

Carbon

By Brake Components

Drum Brakes

Emergency brake

Pedal

Booster

Master Cylinder

Combo Valve

Disc Brakes

Lines

By Technology

Anti-Lock Braking System (ABS)

Electronic Stability Control (ESC)

Traction Control System (TCS)

Electronic Brake-Force Distribution (EBD)

10 Asia Pacific Automotive Brake Components Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive Brake Components Markets in 2024

10.2 Asia Pacific Automotive Brake Components Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive Brake Components Market size Outlook by Segments, 2021-2030

By Type

Mechanical Brakes

-Drum Brakes

-Disc Brakes

Hydraulic Brakes

Power Brakes

-Air Brakes

-Vacuum brakes

-Others

By Application

Passenger Vehicles

Commercial Vehicles

By Brake Fluids

Glycol Based (Absorb Water)

Silicon Based (Doesn’t Absorb Water)

By Distribution Channel

Original Equipment Manufacturers (OEM)

Aftermarket

By Brake Lining Material

Fully Metallic (Sintered Iron)

Semi-Metallic (Iron Fibers)

Non-Asbestos Lining Material (Synthetic Substance)

By Material

Organic

Metallic

Ceramic

Carbon

By Brake Components

Drum Brakes

Emergency brake

Pedal

Booster

Master Cylinder

Combo Valve

Disc Brakes

Lines

By Technology

Anti-Lock Braking System (ABS)

Electronic Stability Control (ESC)

Traction Control System (TCS)

Electronic Brake-Force Distribution (EBD)

11 South America Automotive Brake Components Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive Brake Components Markets in 2024

11.2 South America Automotive Brake Components Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive Brake Components Market size Outlook by Segments, 2021-2030

By Type

Mechanical Brakes

-Drum Brakes

-Disc Brakes

Hydraulic Brakes

Power Brakes

-Air Brakes

-Vacuum brakes

-Others

By Application

Passenger Vehicles

Commercial Vehicles

By Brake Fluids

Glycol Based (Absorb Water)

Silicon Based (Doesn’t Absorb Water)

By Distribution Channel

Original Equipment Manufacturers (OEM)

Aftermarket

By Brake Lining Material

Fully Metallic (Sintered Iron)

Semi-Metallic (Iron Fibers)

Non-Asbestos Lining Material (Synthetic Substance)

By Material

Organic

Metallic

Ceramic

Carbon

By Brake Components

Drum Brakes

Emergency brake

Pedal

Booster

Master Cylinder

Combo Valve

Disc Brakes

Lines

By Technology

Anti-Lock Braking System (ABS)

Electronic Stability Control (ESC)

Traction Control System (TCS)

Electronic Brake-Force Distribution (EBD)

12 Middle East and Africa Automotive Brake Components Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive Brake Components Markets in 2024

12.2 Middle East and Africa Automotive Brake Components Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive Brake Components Market size Outlook by Segments, 2021-2030

By Type

Mechanical Brakes

-Drum Brakes

-Disc Brakes

Hydraulic Brakes

Power Brakes

-Air Brakes

-Vacuum brakes

-Others

By Application

Passenger Vehicles

Commercial Vehicles

By Brake Fluids

Glycol Based (Absorb Water)

Silicon Based (Doesn’t Absorb Water)

By Distribution Channel

Original Equipment Manufacturers (OEM)

Aftermarket

By Brake Lining Material

Fully Metallic (Sintered Iron)

Semi-Metallic (Iron Fibers)

Non-Asbestos Lining Material (Synthetic Substance)

By Material

Organic

Metallic

Ceramic

Carbon

By Brake Components

Drum Brakes

Emergency brake

Pedal

Booster

Master Cylinder

Combo Valve

Disc Brakes

Lines

By Technology

Anti-Lock Braking System (ABS)

Electronic Stability Control (ESC)

Traction Control System (TCS)

Electronic Brake-Force Distribution (EBD)

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Beringer Brakes

Brembo S.p.A.

Continental AG

Delphi Technologies PLC

EBC Brakes Ltd

Federal-Mogul Holdings LLC

Magneti Marelli S.p.A.

Nissin Kogyo Co. Ltd

Robert Bosch GmbH

ZF Friedrichshafen AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Mechanical Brakes

-Drum Brakes

-Disc Brakes

Hydraulic Brakes

Power Brakes

-Air Brakes

-Vacuum brakes

-Others

By Application

Passenger Vehicles

Commercial Vehicles

By Brake Fluids

Glycol Based (Absorb Water)

Silicon Based (Doesn’t Absorb Water)

By Distribution Channel

Original Equipment Manufacturers (OEM)

Aftermarket

By Brake Lining Material

Fully Metallic (Sintered Iron)

Semi-Metallic (Iron Fibers)

Non-Asbestos Lining Material (Synthetic Substance)

By Material

Organic

Metallic

Ceramic

Carbon

By Brake Components

Drum Brakes

Emergency brake

Pedal

Booster

Master Cylinder

Combo Valve

Disc Brakes

Lines

By Technology

Anti-Lock Braking System (ABS)

Electronic Stability Control (ESC)

Traction Control System (TCS)

Electronic Brake-Force Distribution (EBD)

The global Automotive Brake Components Market is one of the lucrative growth markets, poised to register a 5.3% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Beringer Brakes, Brembo S.p.A., Continental AG, Delphi Technologies PLC, EBC Brakes Ltd, Federal-Mogul Holdings LLC, Magneti Marelli S.p.A., Nissin Kogyo Co. Ltd, Robert Bosch GmbH, ZF Friedrichshafen AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume