The Automated Suturing Devices Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Product (Disposable, Reusable), By Application (Cardiac, Orthopedic, Ophthalmic, Gastrointestinal, Dental, Gynecological, Others).

The Automated Suturing Devices market in 2024 introduces advanced technological solutions to enhance surgical procedures, offering automated devices designed to streamline suturing processes, improve efficiency, and enhance surgical outcomes. These devices utilize innovative mechanisms such as robotics, advanced suturing techniques, and intelligent feedback systems to facilitate precise tissue approximation and closure during surgical procedures. By automating repetitive suturing tasks, reducing surgical time, and minimizing tissue trauma, automated suturing devices aim to enhance wound healing, reduce postoperative complications, and improve patient recovery outcomes. As surgical techniques continue to evolve and minimally invasive procedures become more prevalent, the automated suturing devices market is poised for significant growth and innovation, driven by the demand for advanced surgical technologies that optimize patient care and surgical efficiency.

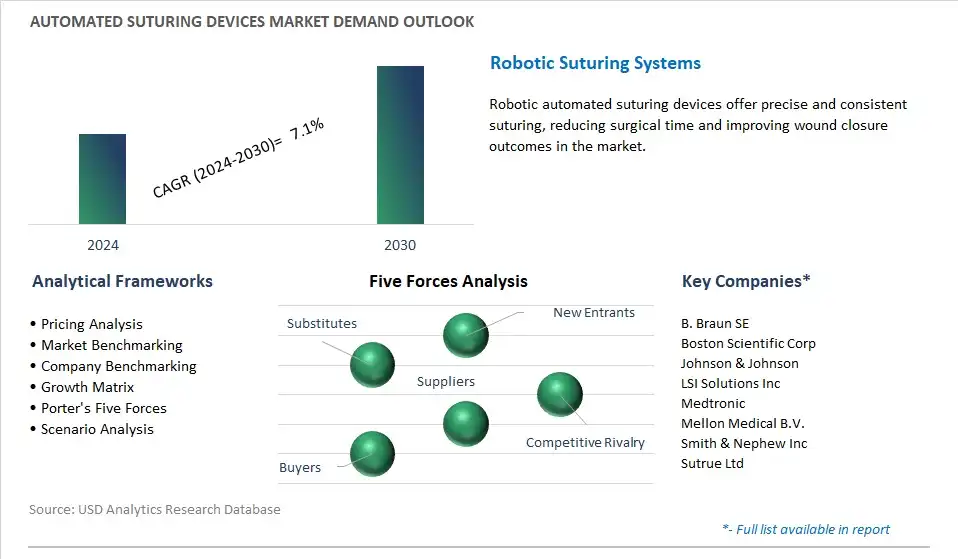

A prominent trend in the Automated Suturing Devices market is the continuous advancements in robotic suturing technology. Robotic-assisted suturing systems are incorporating innovative features such as artificial intelligence, machine learning, and haptic feedback to enhance precision, dexterity, and surgical outcomes. These advancements enable surgeons to perform complex suturing procedures with greater accuracy and efficiency, reducing the risk of complications and improving patient recovery times. As robotic technology evolves, automated suturing devices are becoming increasingly sophisticated, offering surgeons greater control and flexibility during minimally invasive surgeries.

A key driver for the Automated Suturing Devices market is the growing demand for minimally invasive surgical procedures. Minimally invasive techniques offer numerous benefits over traditional open surgeries, including smaller incisions, reduced trauma to surrounding tissues, faster recovery times, and shorter hospital stays. Automated suturing devices play a crucial role in minimally invasive surgeries by enabling precise and efficient suturing within confined spaces, such as the abdomen or thoracic cavity. Surgeons are increasingly adopting automated suturing devices to perform laparoscopic, endoscopic, and robotic-assisted procedures across various medical specialties, driving the market growth for these advanced surgical instruments.

One potential opportunity in the Automated Suturing Devices market is the expansion into ambulatory surgery centers (ASCs). ASCs are outpatient facilities that offer surgical procedures in a more cost-effective and convenient setting compared to traditional hospitals. As the demand for outpatient surgeries continues to rise, there is a growing need for advanced surgical technologies, including automated suturing devices, in ASCs. By targeting ASCs with specialized automated suturing systems designed for outpatient procedures, manufacturers can capitalize on the expanding market for minimally invasive surgeries outside of hospital settings. Expanding into ASCs presents an opportunity to reach a broader customer base and address the evolving needs of surgeons and patients in the ambulatory care sector.

By Product

Disposable

Reusable

By Application

Cardiac

Orthopedic

Ophthalmic

Gastrointestinal

Dental

Gynecological

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

B. Braun SE

Boston Scientific Corp

Johnson & Johnson

LSI Solutions Inc

Medtronic

Mellon Medical B.V.

Smith & Nephew Inc

Sutrue Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automated Suturing Devices Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automated Suturing Devices Market Size Outlook, $ Million, 2021 to 2030

3.2 Automated Suturing Devices Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automated Suturing Devices Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automated Suturing Devices Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automated Suturing Devices Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automated Suturing Devices Market Industry

4.2 Key Market Trends in Automated Suturing Devices Market Industry

4.3 Potential Opportunities in Automated Suturing Devices Market Industry

4.4 Key Challenges in Automated Suturing Devices Market Industry

5 Market Factor Analysis

5.1 Competitive Landscape

5.1.1 Global Automated Suturing Devices Market Share by Company (%), 2023

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automated Suturing Devices Market Outlook By Segments

7.1 Automated Suturing Devices Market Outlook by Segments

By Product

Disposable

Reusable

By Application

Cardiac

Orthopedic

Ophthalmic

Gastrointestinal

Dental

Gynecological

Others

8 North America Automated Suturing Devices Market Analysis And Outlook To 2030

8.1 Introduction to North America Automated Suturing Devices Markets in 2024

8.2 North America Automated Suturing Devices Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automated Suturing Devices Market size Outlook by Segments, 2021-2030

By Product

Disposable

Reusable

By Application

Cardiac

Orthopedic

Ophthalmic

Gastrointestinal

Dental

Gynecological

Others

9 Europe Automated Suturing Devices Market Analysis And Outlook To 2030

9.1 Introduction to Europe Automated Suturing Devices Markets in 2024

9.2 Europe Automated Suturing Devices Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automated Suturing Devices Market Size Outlook By Segments, 2021-2030

By Product

Disposable

Reusable

By Application

Cardiac

Orthopedic

Ophthalmic

Gastrointestinal

Dental

Gynecological

Others

10 Asia Pacific Automated Suturing Devices Market Analysis And Outlook To 2030

10.1 Introduction to Asia Pacific Automated Suturing Devices Markets in 2024

10.2 Asia Pacific Automated Suturing Devices Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automated Suturing Devices Market size Outlook by Segments, 2021-2030

By Product

Disposable

Reusable

By Application

Cardiac

Orthopedic

Ophthalmic

Gastrointestinal

Dental

Gynecological

Others

11 South America Automated Suturing Devices Market Analysis And Outlook To 2030

11.1 Introduction to South America Automated Suturing Devices Markets in 2024

11.2 South America Automated Suturing Devices Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automated Suturing Devices Market size Outlook by Segments, 2021-2030

By Product

Disposable

Reusable

By Application

Cardiac

Orthopedic

Ophthalmic

Gastrointestinal

Dental

Gynecological

Others

12 Middle East And Africa Automated Suturing Devices Market Analysis And Outlook To 2030

12.1 Introduction to Middle East and Africa Automated Suturing Devices Markets in 2024

12.2 Middle East and Africa Automated Suturing Devices Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automated Suturing Devices Market size Outlook by Segments, 2021-2030

By Product

Disposable

Reusable

By Application

Cardiac

Orthopedic

Ophthalmic

Gastrointestinal

Dental

Gynecological

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

B. Braun SE

Boston Scientific Corp

Johnson & Johnson

LSI Solutions Inc

Medtronic

Mellon Medical B.V.

Smith & Nephew Inc

Sutrue Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Disposable

Reusable

By Application

Cardiac

Orthopedic

Ophthalmic

Gastrointestinal

Dental

Gynecological

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Automated Suturing Devices Market is one of the lucrative growth markets, poised to register a 7.1% growth (CAGR) between 2024 and 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

B. Braun SE, Boston Scientific Corp, Johnson & Johnson, LSI Solutions Inc, Medtronic, Mellon Medical B.V., Smith & Nephew Inc, Sutrue Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume