The Aseptic Sampling Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Manual Aseptic Sampling (Valves, Bags, Bottles, Others), Aseptic Sampling Technique), By Technique (Off-line Sampling Technique, On-line Sampling Technique, In-line Sampling Technique), By Application (Downstream Processing, Upstream Processing), By End-user (Pharmaceutical & Biotechnology Companies, CMOs & CROs, Others).

The Aseptic Sampling Market is witnessing notable growth, driven by the increasing emphasis on maintaining sterile conditions in pharmaceutical and biotechnology manufacturing processes. Aseptic sampling involves the collection of samples without introducing contaminants, ensuring the integrity of products and processes. This market includes a variety of aseptic sampling devices and systems designed for sterile sample collection in critical manufacturing environments. Manufacturers are innovating with single-use sampling systems and closed-loop technologies to enhance aseptic practices. With the growing focus on product quality, regulatory compliance, and the expansion of biopharmaceutical production, the Aseptic Sampling Market is poised for continuous expansion, playing a critical role in ensuring the safety and efficacy of pharmaceutical products.

The market report analyses the leading companies in the industry including Danaher Corporation, Thermo Fisher Scientific, Merck KGaA, Sartorius AG, Eppendroff, Lonza Group, GEA Group, KEOFITT A/S, Qualitru Sampling Systems, W. L. Gore & Associates, and Others.

The most prominent trend in the Aseptic Sampling Market is the increasing adoption of single-use aseptic sampling systems. As industries such as biopharmaceuticals and food and beverage prioritize efficiency, flexibility, and contamination prevention, there is a notable trend towards replacing traditional reusable sampling systems with disposable, single-use alternatives. Single-use aseptic sampling systems offer advantages such as reduced risk of cross-contamination, simplified validation processes, and enhanced operational flexibility. This trend aligns with the broader industry shift towards more streamlined and aseptic manufacturing practices, contributing to the growth of the Aseptic Sampling Market.

A major driver propelling the Aseptic Sampling Market is the stringent regulatory requirements for aseptic processing in industries such as pharmaceuticals and biotechnology. To ensure product safety and compliance with regulatory standards, companies are compelled to implement robust aseptic sampling practices throughout their manufacturing processes. Stringent guidelines from health authorities necessitate the use of validated and aseptic sampling techniques to maintain product integrity and prevent microbial contamination. The market is driven by the imperative to adhere to these regulatory standards, creating a demand for advanced aseptic sampling solutions that meet the stringent requirements of the pharmaceutical and biopharmaceutical industries.

An emerging opportunity in the Aseptic Sampling Market lies in the integration of advanced technologies for real-time monitoring of aseptic processes. Market players have the potential to leverage innovations such as real-time microbial detection systems, process analytical technologies (PAT), and smart sensors to enhance the efficiency and reliability of aseptic sampling. This opportunity involves developing solutions that enable continuous monitoring, instant detection of deviations, and proactive intervention in aseptic processes. Integrating advanced technologies offers the potential to elevate the quality and safety of aseptic sampling practices, presenting a valuable opportunity for companies to contribute to the evolution of aseptic manufacturing and meet the increasing demand for precision and automation in the industry. Seizing this opportunity allows companies to provide cutting-edge solutions that align with the future needs of aseptic processing.

Off-line sampling technique is the largest segment in the aseptic sampling market by technique. This approach allows for samples to be collected and analyzed separately, making it a versatile option for various processes and industries. It is widely adopted in pharmaceutical and biotechnology applications where sterility and precision are critical. The popularity of off-line techniques is also attributed to their ease of implementation, cost-effectiveness, and ability to maintain sample integrity without the need for complex equipment or real-time monitoring, making them a reliable choice for quality control and testing.

Downstream processing is the largest segment in the aseptic sampling market by application. This is due to its critical role in the purification and formulation of biopharmaceutical products. Aseptic sampling is essential in downstream processes to ensure product quality and safety, particularly during filtration, chromatography, and storage stages. With the rising production of biologics and biosimilars, the demand for aseptic sampling in downstream processing has increased significantly. This segment’s importance in meeting regulatory standards and maintaining the integrity of final products makes it the largest market share holder.

Pharmaceutical and biotechnology companies are the fastest-growing segment in the aseptic sampling market by end-user. These companies are heavily investing in advanced bioprocessing technologies to meet the growing demand for biopharmaceuticals and personalized medicine. Aseptic sampling is crucial for ensuring compliance with stringent regulatory requirements and maintaining product safety and efficacy. The increasing number of drug development pipelines, coupled with the rising focus on biologics and vaccines, is driving the adoption of aseptic sampling solutions among these organizations, making them the fastest-growing end-user segment.

|

Parameter |

Details |

|

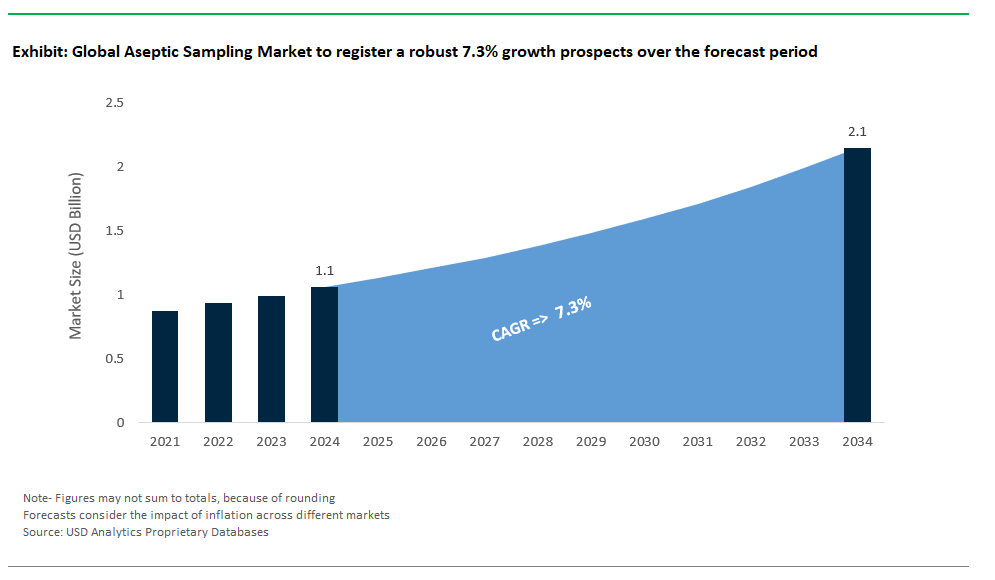

Market Size (2024) |

$1.06 Billion |

|

Market Size (2034) |

$2.1 Billion |

|

Market Growth Rate |

7.3% |

|

Segments |

By Type (Manual, Aseptic), By Technique (Off-line Sampling Technique, On-line Sampling Technique, In-line Sampling Technique), By Application (Downstream Processing, Upstream Processing), By End-user (Pharmaceutical & Biotechnology Companies, CMOs & CROs, Others) |

|

Study Period |

2019- 2024 and 2025-2034 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Danaher Corp, Thermo Fisher Scientific, Merck KGaA, Sartorius AG, Eppendroff, Lonza Group, GEA Group, KEOFITT A/S, Qualitru Sampling Systems, W. L. Gore & Associates, and Others. |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

By Type

By Technique

By Application

By End-user

Geographical Analysis

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Aseptic Sampling Market, encompassing current market size, growth trends, and forecasts till 2034.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Aseptic Sampling Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 INTRODUCTION TO 2024 Aseptic Sampling Markets

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 RESEARCH METHODOLOGY

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 EXECUTIVE SUMMARY

3.1 Global Aseptic Sampling Market Size Outlook, $ Million, 2021 to 2030

3.2 Aseptic Sampling Market Outlook by Type, $ Million, 2021 to 2030

3.3 Aseptic Sampling Market Outlook by Product, $ Million, 2021 to 2030

3.4 Aseptic Sampling Market Outlook by Application, $ Million, 2021 to 2030

3.5 Aseptic Sampling Market Outlook by Key Countries, $ Million, 2021 to 2030

4 MARKET DYNAMICS

4.1 Key Driving Forces of Aseptic Sampling Market Industry

4.2 Key Market Trends in Aseptic Sampling Market Industry

4.3 Potential Opportunities in Aseptic Sampling Market Industry

4.4 Key Challenges in Aseptic Sampling Market Industry

5 MARKET FACTOR ANALYSIS

5.1 Competitive Landscape

5.1.1 Global Aseptic Sampling Market Share by Company

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 GROWTH OUTLOOK ACROSS SCENARIOS

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 GLOBAL Aseptic Sampling Market OUTLOOK BY SEGMENTS

7.1 Aseptic Sampling Market Outlook by Segments

By Type

Manual Aseptic Sampling

-Valves

-Bags

-Bottles

-Others

Aseptic Sampling Technique

By Technique

Off-line Sampling Technique

On-line Sampling Technique

In-line Sampling Technique

By Application

Downstream Processing

Upstream Processing

By End-user

Pharmaceutical & Biotechnology Companies

CMOs & CROs

Others

8 NORTH AMERICA Aseptic Sampling Market ANALYSIS AND OUTLOOK TO 2030

8.1 Introduction to North America Aseptic Sampling Markets in 2024

8.2 North America Aseptic Sampling Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Aseptic Sampling Market size Outlook by Segments, 2021-2030

By Type

Manual Aseptic Sampling

-Valves

-Bags

-Bottles

-Others

Aseptic Sampling Technique

By Technique

Off-line Sampling Technique

On-line Sampling Technique

In-line Sampling Technique

By Application

Downstream Processing

Upstream Processing

By End-user

Pharmaceutical & Biotechnology Companies

CMOs & CROs

Others

9 EUROPE Aseptic Sampling Market ANALYSIS AND OUTLOOK TO 2030

9.1 Introduction to Europe Aseptic Sampling Markets in 2024

9.2 Europe Aseptic Sampling Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Aseptic Sampling Market size Outlook by Segments, 2021-2030

By Type

Manual Aseptic Sampling

-Valves

-Bags

-Bottles

-Others

Aseptic Sampling Technique

By Technique

Off-line Sampling Technique

On-line Sampling Technique

In-line Sampling Technique

By Application

Downstream Processing

Upstream Processing

By End-user

Pharmaceutical & Biotechnology Companies

CMOs & CROs

Others

10 ASIA PACIFIC Aseptic Sampling Market ANALYSIS AND OUTLOOK TO 2030

10.1 Introduction to Asia Pacific Aseptic Sampling Markets in 2024

10.2 Asia Pacific Aseptic Sampling Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Aseptic Sampling Market size Outlook by Segments, 2021-2030

By Type

Manual Aseptic Sampling

-Valves

-Bags

-Bottles

-Others

Aseptic Sampling Technique

By Technique

Off-line Sampling Technique

On-line Sampling Technique

In-line Sampling Technique

By Application

Downstream Processing

Upstream Processing

By End-user

Pharmaceutical & Biotechnology Companies

CMOs & CROs

Others

11 SOUTH AMERICA Aseptic Sampling Market ANALYSIS AND OUTLOOK TO 2030

11.1 Introduction to South America Aseptic Sampling Markets in 2024

11.2 South America Aseptic Sampling Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Aseptic Sampling Market size Outlook by Segments, 2021-2030

By Type

Manual Aseptic Sampling

-Valves

-Bags

-Bottles

-Others

Aseptic Sampling Technique

By Technique

Off-line Sampling Technique

On-line Sampling Technique

In-line Sampling Technique

By Application

Downstream Processing

Upstream Processing

By End-user

Pharmaceutical & Biotechnology Companies

CMOs & CROs

Others

12 MIDDLE EAST AND AFRICA Aseptic Sampling Market ANALYSIS AND OUTLOOK TO 2030

12.1 Introduction to Middle East and Africa Aseptic Sampling Markets in 2024

12.2 Middle East and Africa Aseptic Sampling Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Aseptic Sampling Market size Outlook by Segments, 2021-2030

By Type

Manual Aseptic Sampling

-Valves

-Bags

-Bottles

-Others

Aseptic Sampling Technique

By Technique

Off-line Sampling Technique

On-line Sampling Technique

In-line Sampling Technique

By Application

Downstream Processing

Upstream Processing

By End-user

Pharmaceutical & Biotechnology Companies

CMOs & CROs

Others

13 COMPANY PROFILES

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Danaher Corporation

Thermo Fisher Scientific

Merck KGaA

Sartorius AG

Eppendroff

Lonza Group

GEA Group

KEOFITT A/S

Qualitru Sampling Systems

W. L. Gore & Associates

14 APPENDIX

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

By Technique

By Application

By End-user

Geographical Analysis

Aseptic Sampling Market Size is valued at $1.06 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.3% to reach $2.1 Billion by 2034.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Danaher Corporation, Thermo Fisher Scientific, Merck KGaA, Sartorius AG, Eppendroff, Lonza Group, GEA Group, KEOFITT A/S, Qualitru Sampling Systems, W. L. Gore & Associates

Base Year- 2024; Estimated Year- 2025; Historic Period- 2019-2024; Forecast period- 2025 to 2034; Currency: Revenue (USD); Volume