The global Artificial Bone Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Material (Ceramics, Hydroxyapatite, Composite, Polymer, Others), By End-User (Hospitals, Specialty clinics, Research organization).

The Artificial Bone Market in 2024 focuses on biomaterials, bone grafts, and orthobiologics used in orthopedic and reconstructive surgeries for bone repair, bone regeneration, and skeletal reconstruction. These artificial bone products include synthetic bone grafts, ceramic implants, demineralized bone matrix (DBM), and bone morphogenetic proteins (BMPs), providing structural support, osteoconductive scaffolds, and osteogenic factors for bone healing and tissue regeneration. With a focus on biocompatibility, graft integration, and bone remodeling stimulation, artificial bone technologies support orthopedic interventions, bone defect repair, and musculoskeletal health restoration.

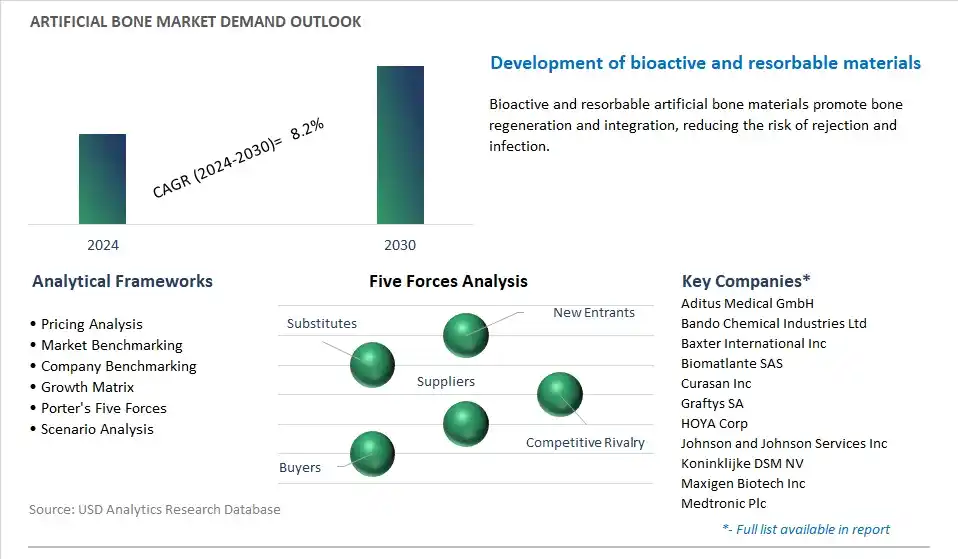

The global Artificial Bone Industry is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Artificial Bone Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Artificial Bone Industry include- Aditus Medical GmbH, Bando Chemical Industries Ltd, Baxter International Inc, Biomatlante SAS, Curasan Inc, Graftys SA, HOYA Corp, Johnson and Johnson Services Inc, Koninklijke DSM NV, Maxigen Biotech Inc, Medtronic Plc, Mindray Bio Medical Electronics Co. Ltd, Nuvasive Inc, Orthofix Medical Inc, Smith and Nephew plc, Stryker Corp, Xtant Medical Holdings Inc, Ziacom Medical S.L., Zimmer Biomet Holdings Inc.

In the Artificial Bone market, a significant trend is the continuous advancements in biomaterials and tissue engineering techniques for the development of synthetic bone substitutes. Researchers and manufacturers are leveraging innovative materials such as bioceramics, bioactive glasses, and synthetic polymers to create biocompatible and osteoconductive scaffolds that promote bone regeneration and integration. This trend drives market growth by offering alternatives to traditional bone grafts, reducing donor site morbidity, and enabling customized implants tailored to patient-specific needs for orthopedic and dental applications.

A key driver for the Artificial Bone market is the rising incidence of bone disorders, degenerative diseases, and traumatic injuries necessitating bone grafting procedures. With an aging population and lifestyle factors contributing to osteoporosis, osteoarthritis, and fractures, there's an increasing demand for bone augmentation and reconstruction therapies to restore skeletal integrity and function. Artificial bone substitutes address this demand by providing synthetic alternatives to autografts and allografts, offering biocompatible scaffolds that support bone healing, fusion, and regeneration in orthopedic, spinal, and dental surgeries.

An opportunity exists in personalized implant solutions and 3D printing technologies for artificial bone fabrication. By integrating patient-specific imaging data with computer-aided design (CAD) software and additive manufacturing techniques, there's potential to create customized bone implants with precise anatomical fit, structural integrity, and biological functionality. This opportunity enables orthopedic surgeons and dentists to optimize surgical outcomes, minimize implant rejection rates, and improve patient satisfaction through tailored treatment approaches. Moreover, partnerships with medical device companies, research institutions, and regulatory agencies can accelerate the development and commercialization of personalized bone implants, driving innovation and market expansion in the Artificial Bone segment.

The fastest growing segment in the Artificial Bone Market is the Hydroxyapatite material category. This growth is primarily fueled by the increasing adoption of hydroxyapatite due to its biocompatibility, osteoconductive properties, and ability to promote bone regeneration. Moreover, the rising prevalence of bone-related disorders and injuries, coupled with advancements in surgical techniques and implant technologies, is driving the demand for hydroxyapatite-based artificial bones across various end-user segments including hospitals, specialty clinics, and research organizations. Additionally, ongoing research and development activities aimed at enhancing the properties and applications of hydroxyapatite further contribute to its rapid growth within the market.

By Material

Ceramics

Hydroxyapatite

Composite

Polymer

Others

By End-User

Hospitals

Specialty clinics

Research organization

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Aditus Medical GmbH

Bando Chemical Industries Ltd

Baxter International Inc

Biomatlante SAS

Curasan Inc

Graftys SA

HOYA Corp

Johnson and Johnson Services Inc

Koninklijke DSM NV

Maxigen Biotech Inc

Medtronic Plc

Mindray Bio Medical Electronics Co. Ltd

Nuvasive Inc

Orthofix Medical Inc

Smith and Nephew plc

Stryker Corp

Xtant Medical Holdings Inc

Ziacom Medical S.L.

Zimmer Biomet Holdings Inc

* List not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Artificial Bone Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Artificial Bone Industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Artificial Bone Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Artificial Bone Market Size Outlook, $ Million, 2021 to 2030

3.2 Artificial Bone Market Outlook by Type, $ Million, 2021 to 2030

3.3 Artificial Bone Market Outlook by Product, $ Million, 2021 to 2030

3.4 Artificial Bone Market Outlook by Application, $ Million, 2021 to 2030

3.5 Artificial Bone Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Artificial Bone Industry

4.2 Key Market Trends in Artificial Bone Industry

4.3 Potential Opportunities in Artificial Bone Industry

4.4 Key Challenges in Artificial Bone Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Artificial Bone Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Artificial Bone Market Outlook by Segments

7.1 Artificial Bone Market Outlook by Segments, $ Million, 2021- 2030

By Material

Ceramics

Hydroxyapatite

Composite

Polymer

Others

By End-User

Hospitals

Specialty clinics

Research organization

8 North America Artificial Bone Market Analysis and Outlook To 2030

8.1 Introduction to North America Artificial Bone Markets in 2024

8.2 North America Artificial Bone Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Artificial Bone Market size Outlook by Segments, 2021-2030

By Material

Ceramics

Hydroxyapatite

Composite

Polymer

Others

By End-User

Hospitals

Specialty clinics

Research organization

9 Europe Artificial Bone Market Analysis and Outlook To 2030

9.1 Introduction to Europe Artificial Bone Markets in 2024

9.2 Europe Artificial Bone Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Artificial Bone Market Size Outlook by Segments, 2021-2030

By Material

Ceramics

Hydroxyapatite

Composite

Polymer

Others

By End-User

Hospitals

Specialty clinics

Research organization

10 Asia Pacific Artificial Bone Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Artificial Bone Markets in 2024

10.2 Asia Pacific Artificial Bone Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Artificial Bone Market size Outlook by Segments, 2021-2030

By Material

Ceramics

Hydroxyapatite

Composite

Polymer

Others

By End-User

Hospitals

Specialty clinics

Research organization

11 South America Artificial Bone Market Analysis and Outlook To 2030

11.1 Introduction to South America Artificial Bone Markets in 2024

11.2 South America Artificial Bone Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Artificial Bone Market size Outlook by Segments, 2021-2030

By Material

Ceramics

Hydroxyapatite

Composite

Polymer

Others

By End-User

Hospitals

Specialty clinics

Research organization

12 Middle East and Africa Artificial Bone Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Artificial Bone Markets in 2024

12.2 Middle East and Africa Artificial Bone Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Artificial Bone Market size Outlook by Segments, 2021-2030

By Material

Ceramics

Hydroxyapatite

Composite

Polymer

Others

By End-User

Hospitals

Specialty clinics

Research organization

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Aditus Medical GmbH

Bando Chemical Industries Ltd

Baxter International Inc

Biomatlante SAS

Curasan Inc

Graftys SA

HOYA Corp

Johnson and Johnson Services Inc

Koninklijke DSM NV

Maxigen Biotech Inc

Medtronic Plc

Mindray Bio Medical Electronics Co. Ltd

Nuvasive Inc

Orthofix Medical Inc

Smith and Nephew plc

Stryker Corp

Xtant Medical Holdings Inc

Ziacom Medical S.L.

Zimmer Biomet Holdings Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Ceramics

Hydroxyapatite

Composite

Polymer

Others

By End-User

Hospitals

Specialty clinics

Research organization

The global Artificial Bone Market is one of the lucrative growth markets, poised to register a 8.2% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aditus Medical GmbH, Bando Chemical Industries Ltd, Baxter International Inc, Biomatlante SAS, Curasan Inc, Graftys SA, HOYA Corp, Johnson and Johnson Services Inc, Koninklijke DSM NV, Maxigen Biotech Inc, Medtronic Plc, Mindray Bio Medical Electronics Co. Ltd, Nuvasive Inc, Orthofix Medical Inc, Smith and Nephew plc, Stryker Corp, Xtant Medical Holdings Inc, Ziacom Medical S.L., Zimmer Biomet Holdings Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume