The global Aramid Prepreg Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Para-aramid, Meta-aramid), By End-User (Aerospace, Automotive, Electronics, Sports and Leisure, Others).

Aramid prepreg is a composite material consisting of aramid fibers impregnated with a thermosetting resin matrix, typically epoxy or phenolic resin, in 2024. Aramid fibers, such as those made from poly-paraphenylene terephthalamide (PPTA), are known for their exceptional strength, stiffness, and resistance to abrasion and impact. When combined with a resin matrix and cured under heat and pressure, aramid prepreg produces lightweight and high-performance composite laminates with outstanding mechanical properties. Aramid prepreg is widely used in aerospace, automotive, marine, and sporting goods industries for applications requiring lightweight and durable components, such as aircraft structures, vehicle armor, boat hulls, and sporting equipment. These materials offer advantages such as high strength-to-weight ratio, fatigue resistance, and dimensional stability, making them ideal for demanding applications where performance and reliability are critical. With ongoing advancements in composite manufacturing processes and material technologies, aramid prepreg s to be a preferred choice for engineers and designers seeking innovative solutions for lightweight and high-performance structures and components.

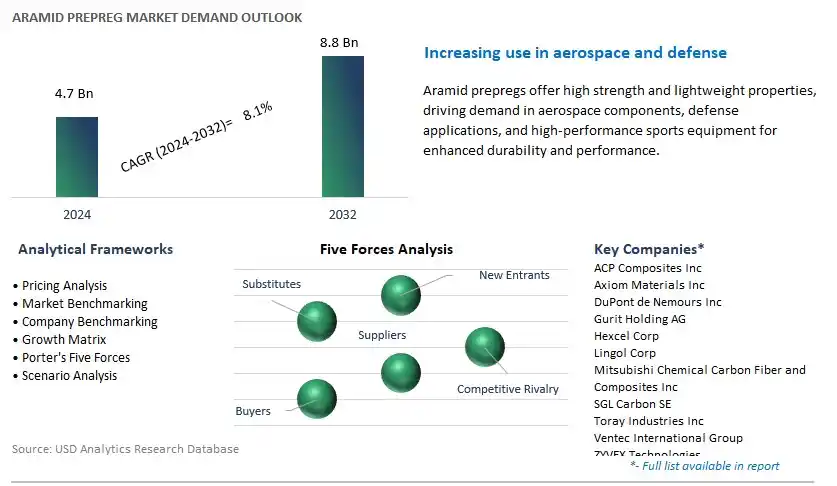

The market report analyses the leading companies in the industry including ACP Composites Inc, Axiom Materials Inc, DuPont de Nemours Inc, Gurit Holding AG, Hexcel Corp, Lingol Corp, Mitsubishi Chemical Carbon Fiber and Composites Inc, SGL Carbon SE, Toray Industries Inc, Ventec International Group, ZYVEX Technologies, and others.

A prominent trend in the aramid prepreg market is the increasing demand for lightweight and high-performance materials across industries such as aerospace, automotive, defense, and sports equipment. As manufacturers seek to improve fuel efficiency, reduce emissions, and enhance performance in their products, there is a growing preference for aramid prepregs due to their exceptional strength-to-weight ratio, durability, and resistance to heat and chemicals. This trend is driven by factors including the emphasis on lightweighting strategies, advancements in composite materials technology, and the need for innovative solutions to meet stringent performance requirements. As industries continue to prioritize lightweight and high-strength materials, the demand for aramid prepregs is expected to rise, driving market growth in the coming years.

The primary driver fueling the growth of the aramid prepreg market is the continuous advancements in composite manufacturing technologies and processes. Aramid prepregs are manufactured using advanced techniques such as hot-melt impregnation, resin infusion, and autoclave curing, which enable precise control over fiber alignment, resin content, and material properties. Moreover, developments in resin formulations, curing methods, and surface treatments enhance the mechanical properties, surface finish, and processability of aramid prepregs, making them suitable for a wide range of applications. Additionally, the integration of automation, robotics, and digital simulation tools into manufacturing processes streamlines production, reduces lead times, and improves cost-effectiveness, driving the adoption of aramid prepregs in various industries.

An emerging opportunity within the aramid prepreg market lies in the expansion into new applications and emerging markets beyond traditional sectors such as aerospace and defense. While these industries remain significant consumers of aramid prepregs, there is untapped potential in sectors such as renewable energy, transportation, marine, and construction, where lightweight and high-strength materials offer significant benefits. Aramid prepregs can be used to manufacture components such as wind turbine blades, automotive body panels, boat hulls, and architectural structures, offering superior performance and durability compared to traditional materials. By exploring new applications and addressing evolving customer needs, manufacturers of aramid prepregs can capitalize on opportunities for market expansion, diversification, and revenue growth in the dynamic landscape of advanced materials.

The Para-aramid segment is the largest in the Aramid Prepreg Market by type, primarily due to its extensive use in high-performance applications requiring exceptional strength, heat resistance, and dimensional stability. Para-aramid fibers, such as Kevlar®, are renowned for their remarkable tensile strength, modulus, and resistance to abrasion, making them ideal for applications in aerospace, defense, automotive, and sporting goods industries. Aramid prepregs based on para-aramid fibers offer outstanding mechanical properties, lightweight construction, and resistance to chemicals and extreme temperatures, making them indispensable in critical applications where safety and reliability are paramount. Additionally, the versatility of para-aramid prepregs allows for their use in various manufacturing processes, including autoclave curing, compression molding, and filament winding, enabling the production of complex and high-performance composite structures. As industries continue to demand lightweight and durable materials for advanced engineering applications, the Para-aramid segment maintains its dominance in the Aramid Prepreg Market.

The Electronics segment is the fastest-growing in the Aramid Prepreg Market by end-user, driven by the increasing demand for lightweight and high-performance materials in the electronics industry. Aramid prepregs offer unique properties such as high strength-to-weight ratio, excellent dimensional stability, and resistance to heat and chemicals, making them suitable for various electronic applications. In the electronics sector, aramid prepregs are used to manufacture printed circuit boards (PCBs), flexible circuits, and other electronic components where durability, reliability, and thermal management are critical. With the continuous advancements in electronics technology, including the miniaturization of electronic devices and the development of high-frequency and high-speed applications, there is a growing need for advanced materials that can meet stringent performance requirements. Aramid prepregs provide solutions to these challenges by offering lightweight yet robust materials that can withstand the rigors of electronic manufacturing processes and ensure the long-term reliability of electronic products. As the electronics industry continues to evolve and innovate, the demand for aramid prepregs in electronic applications is expected to experience rapid growth, driving the expansion of the Electronics segment in the Aramid Prepreg Market.

By Type

Para-aramid

Meta-aramid

By End-User

Aerospace

Automotive

Electronics

Sports and Leisure

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ACP Composites Inc

Axiom Materials Inc

DuPont de Nemours Inc

Gurit Holding AG

Hexcel Corp

Lingol Corp

Mitsubishi Chemical Carbon Fiber and Composites Inc

SGL Carbon SE

Toray Industries Inc

Ventec International Group

ZYVEX Technologies

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Aramid Prepreg Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Aramid Prepreg Market Size Outlook, $ Million, 2021 to 2032

3.2 Aramid Prepreg Market Outlook by Type, $ Million, 2021 to 2032

3.3 Aramid Prepreg Market Outlook by Product, $ Million, 2021 to 2032

3.4 Aramid Prepreg Market Outlook by Application, $ Million, 2021 to 2032

3.5 Aramid Prepreg Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Aramid Prepreg Industry

4.2 Key Market Trends in Aramid Prepreg Industry

4.3 Potential Opportunities in Aramid Prepreg Industry

4.4 Key Challenges in Aramid Prepreg Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Aramid Prepreg Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Aramid Prepreg Market Outlook by Segments

7.1 Aramid Prepreg Market Outlook by Segments, $ Million, 2021- 2032

By Type

Para-aramid

Meta-aramid

By End-User

Aerospace

Automotive

Electronics

Sports and Leisure

Others

8 North America Aramid Prepreg Market Analysis and Outlook To 2032

8.1 Introduction to North America Aramid Prepreg Markets in 2024

8.2 North America Aramid Prepreg Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Aramid Prepreg Market size Outlook by Segments, 2021-2032

By Type

Para-aramid

Meta-aramid

By End-User

Aerospace

Automotive

Electronics

Sports and Leisure

Others

9 Europe Aramid Prepreg Market Analysis and Outlook To 2032

9.1 Introduction to Europe Aramid Prepreg Markets in 2024

9.2 Europe Aramid Prepreg Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Aramid Prepreg Market Size Outlook by Segments, 2021-2032

By Type

Para-aramid

Meta-aramid

By End-User

Aerospace

Automotive

Electronics

Sports and Leisure

Others

10 Asia Pacific Aramid Prepreg Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Aramid Prepreg Markets in 2024

10.2 Asia Pacific Aramid Prepreg Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Aramid Prepreg Market size Outlook by Segments, 2021-2032

By Type

Para-aramid

Meta-aramid

By End-User

Aerospace

Automotive

Electronics

Sports and Leisure

Others

11 South America Aramid Prepreg Market Analysis and Outlook To 2032

11.1 Introduction to South America Aramid Prepreg Markets in 2024

11.2 South America Aramid Prepreg Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Aramid Prepreg Market size Outlook by Segments, 2021-2032

By Type

Para-aramid

Meta-aramid

By End-User

Aerospace

Automotive

Electronics

Sports and Leisure

Others

12 Middle East and Africa Aramid Prepreg Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Aramid Prepreg Markets in 2024

12.2 Middle East and Africa Aramid Prepreg Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Aramid Prepreg Market size Outlook by Segments, 2021-2032

By Type

Para-aramid

Meta-aramid

By End-User

Aerospace

Automotive

Electronics

Sports and Leisure

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ACP Composites Inc

Axiom Materials Inc

DuPont de Nemours Inc

Gurit Holding AG

Hexcel Corp

Lingol Corp

Mitsubishi Chemical Carbon Fiber and Composites Inc

SGL Carbon SE

Toray Industries Inc

Ventec International Group

ZYVEX Technologies

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Para-aramid

Meta-aramid

By End-User

Aerospace

Automotive

Electronics

Sports and Leisure

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Aramid Prepreg Market Size is valued at $4.7 Billion in 2024 and is forecast to register a growth rate (CAGR) of 8.1% to reach $8.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ACP Composites Inc, Axiom Materials Inc, DuPont de Nemours Inc, Gurit Holding AG, Hexcel Corp, Lingol Corp, Mitsubishi Chemical Carbon Fiber and Composites Inc, SGL Carbon SE, Toray Industries Inc, Ventec International Group, ZYVEX Technologies

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume