The global Anti-Static Oil Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Textile, Electronics, Automotive, Aviation, Others), By Product (Temporary anti-static oil, Permanent anti-static oil).

Anti-static oil is a specialized lubricant formulated to dissipate static electricity and prevent electrostatic discharge (ESD) in industrial machinery and equipment in 2024. These oils are designed to reduce the buildup of static charges on surfaces, especially in applications where flammable or explosive materials are present, such as oil refineries, chemical plants, and manufacturing facilities. Anti-static oils contain additives that enhance their conductivity and ability to neutralize static charges, minimizing the risk of sparks or ignition that could lead to fires or explosions. They are commonly used in hydraulic systems, gearboxes, bearings, and other machinery components to ensure safe operation in hazardous environments. Anti-static oils offer additional benefits such as lubrication, corrosion protection, and extended equipment life, making them essential for maintaining the reliability and safety of industrial equipment in high-risk areas.

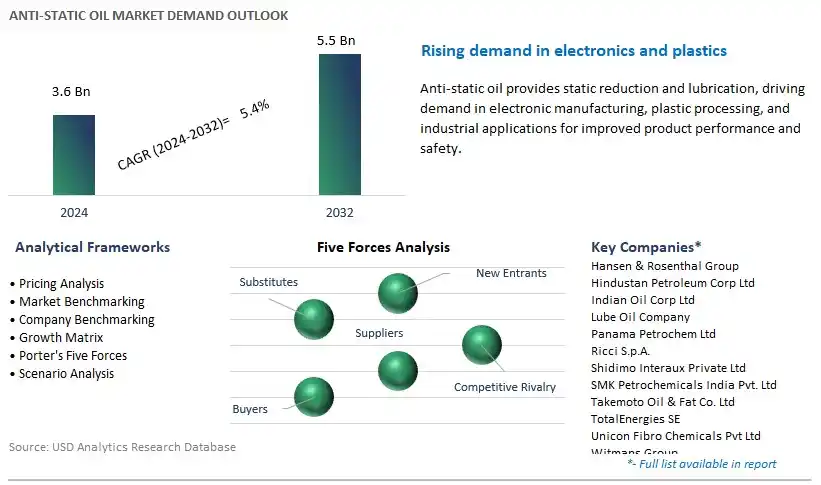

The market report analyses the leading companies in the industry including Hansen & Rosenthal Group, Hindustan Petroleum Corp Ltd, Indian Oil Corp Ltd, Lube Oil Company, Panama Petrochem Ltd, Ricci S.p.A., Shidimo Interaux Private Ltd, SMK Petrochemicals India Pvt. Ltd, Takemoto Oil & Fat Co. Ltd, TotalEnergies SE, Unicon Fibro Chemicals Pvt Ltd, Witmans Group, and others.

A prominent trend in the anti-static oil market is the increasing demand driven by the growth of electronics and semiconductor manufacturing industries. With the proliferation of electronic devices and the expansion of semiconductor production facilities, there is a growing need for anti-static solutions to prevent electrostatic discharge (ESD) and protect sensitive electronic components during manufacturing, handling, and storage processes. This trend is fueled by advancements in technology, the miniaturization of electronic devices, and the rising complexity of semiconductor circuits, which increase susceptibility to ESD damage. As manufacturers prioritize product quality and reliability, the demand for anti-static oils to mitigate ESD risks continues to rise, driving market growth in the electronics and semiconductor sectors.

The primary driver fueling the growth of the anti-static oil market is the implementation of stringent electrostatic discharge (ESD) protection standards and industry regulations across various sectors. Industries such as electronics, automotive, aerospace, and healthcare have established guidelines and standards to ensure the safe handling and operation of electrostatic-sensitive devices (ESDs) and equipment. Anti-static oils play a crucial role in ESD mitigation by providing a protective barrier against static electricity buildup and discharge. Moreover, compliance with ESD protection standards is often a requirement for manufacturers to maintain product quality, reliability, and regulatory compliance, driving the adoption of anti-static oils as part of comprehensive ESD control programs.

An emerging opportunity within the anti-static oil market lies in diversification into new applications and industries beyond traditional sectors such as electronics and semiconductor manufacturing. While these industries remain significant consumers of anti-static oils, there is untapped potential in sectors such as packaging, textiles, printing, and pharmaceuticals, where static electricity poses risks to product quality, safety, and performance. Anti-static oils can be applied to a variety of materials and surfaces to reduce static charge accumulation and minimize the risk of damage or contamination. By exploring new applications and addressing evolving customer needs, manufacturers of anti-static oils can capitalize on opportunities for market expansion and diversification, thereby enhancing their competitiveness and revenue growth potential.

The Electronics segment is the largest in the Anti-Static Oil Market by application, primarily due to the critical role of anti-static oils in maintaining the integrity and functionality of electronic components and devices. In the electronics industry, static electricity poses a significant risk to sensitive electronic equipment, leading to potential damage or malfunction. Anti-static oils are specifically formulated to dissipate static charges and prevent electrostatic discharge (ESD) that can adversely affect electronic components during manufacturing, assembly, storage, and transportation. These oils are applied to various electronic parts, including circuit boards, connectors, semiconductors, and integrated circuits, to reduce friction and surface resistivity, ensuring proper functioning and reliability of electronic devices. With the continuous advancements in electronics technology and the proliferation of electronic devices in consumer, industrial, and automotive sectors, the demand for anti-static oils in the electronics industry remains consistently high. Moreover, as manufacturers strive to meet stringent quality standards and regulatory requirements for ESD protection, the Electronics segment maintains its dominance in the Anti-Static Oil Market.

The Temporary Anti-Static Oil segment is the fastest-growing in the Anti-Static Oil Market by product, driven by increasing adoption and demand. Temporary anti-static oils are designed to provide short-term protection against electrostatic discharge (ESD) by forming a thin, temporary layer on surfaces, which dissipates static charges upon application. These oils offer quick and easy application, making them suitable for use in various industries, including electronics manufacturing, packaging, printing, and textiles. With the rising awareness of ESD risks and the need for temporary anti-static solutions to protect sensitive equipment and materials during handling, storage, and transportation, the demand for temporary anti-static oils is experiencing rapid growth. Moreover, temporary anti-static oils offer cost-effective ESD protection compared to permanent solutions, making them a preferred choice for applications where long-term protection is not required or feasible. As industries continue to prioritize ESD prevention and safety, the Temporary Anti-Static Oil segment is expected to maintain its fast growth trajectory in the market.

By Application

Textile

Electronics

Automotive

Aviation

Others

By Product

Temporary anti-static oil

Permanent anti-static oilCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Hansen & Rosenthal Group

Hindustan Petroleum Corp Ltd

Indian Oil Corp Ltd

Lube Oil Company

Panama Petrochem Ltd

Ricci S.p.A.

Shidimo Interaux Private Ltd

SMK Petrochemicals India Pvt. Ltd

Takemoto Oil & Fat Co. Ltd

TotalEnergies SE

Unicon Fibro Chemicals Pvt Ltd

Witmans Group

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Anti Static Oil Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Anti Static Oil Market Size Outlook, $ Million, 2021 to 2032

3.2 Anti Static Oil Market Outlook by Type, $ Million, 2021 to 2032

3.3 Anti Static Oil Market Outlook by Product, $ Million, 2021 to 2032

3.4 Anti Static Oil Market Outlook by Application, $ Million, 2021 to 2032

3.5 Anti Static Oil Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Anti Static Oil Industry

4.2 Key Market Trends in Anti Static Oil Industry

4.3 Potential Opportunities in Anti Static Oil Industry

4.4 Key Challenges in Anti Static Oil Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Anti Static Oil Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Anti Static Oil Market Outlook by Segments

7.1 Anti Static Oil Market Outlook by Segments, $ Million, 2021- 2032

By Application

Textile

Electronics

Automotive

Aviation

Others

By Product

Temporary anti-static oil

Permanent anti-static oil

8 North America Anti Static Oil Market Analysis and Outlook To 2032

8.1 Introduction to North America Anti Static Oil Markets in 2024

8.2 North America Anti Static Oil Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Anti Static Oil Market size Outlook by Segments, 2021-2032

By Application

Textile

Electronics

Automotive

Aviation

Others

By Product

Temporary anti-static oil

Permanent anti-static oil

9 Europe Anti Static Oil Market Analysis and Outlook To 2032

9.1 Introduction to Europe Anti Static Oil Markets in 2024

9.2 Europe Anti Static Oil Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Anti Static Oil Market Size Outlook by Segments, 2021-2032

By Application

Textile

Electronics

Automotive

Aviation

Others

By Product

Temporary anti-static oil

Permanent anti-static oil

10 Asia Pacific Anti Static Oil Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Anti Static Oil Markets in 2024

10.2 Asia Pacific Anti Static Oil Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Anti Static Oil Market size Outlook by Segments, 2021-2032

By Application

Textile

Electronics

Automotive

Aviation

Others

By Product

Temporary anti-static oil

Permanent anti-static oil

11 South America Anti Static Oil Market Analysis and Outlook To 2032

11.1 Introduction to South America Anti Static Oil Markets in 2024

11.2 South America Anti Static Oil Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Anti Static Oil Market size Outlook by Segments, 2021-2032

By Application

Textile

Electronics

Automotive

Aviation

Others

By Product

Temporary anti-static oil

Permanent anti-static oil

12 Middle East and Africa Anti Static Oil Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Anti Static Oil Markets in 2024

12.2 Middle East and Africa Anti Static Oil Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Anti Static Oil Market size Outlook by Segments, 2021-2032

By Application

Textile

Electronics

Automotive

Aviation

Others

By Product

Temporary anti-static oil

Permanent anti-static oil

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Hansen & Rosenthal Group

Hindustan Petroleum Corp Ltd

Indian Oil Corp Ltd

Lube Oil Company

Panama Petrochem Ltd

Ricci S.p.A.

Shidimo Interaux Private Ltd

SMK Petrochemicals India Pvt. Ltd

Takemoto Oil & Fat Co. Ltd

TotalEnergies SE

Unicon Fibro Chemicals Pvt Ltd

Witmans Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Textile

Electronics

Automotive

Aviation

Others

By Product

Temporary anti-static oil

Permanent anti-static oil

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Anti-Static Oil Market Size is valued at $3.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.4% to reach $5.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Hansen & Rosenthal Group, Hindustan Petroleum Corp Ltd, Indian Oil Corp Ltd, Lube Oil Company, Panama Petrochem Ltd, Ricci S.p.A., Shidimo Interaux Private Ltd, SMK Petrochemicals India Pvt. Ltd, Takemoto Oil & Fat Co. Ltd, TotalEnergies SE, Unicon Fibro Chemicals Pvt Ltd, Witmans Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume