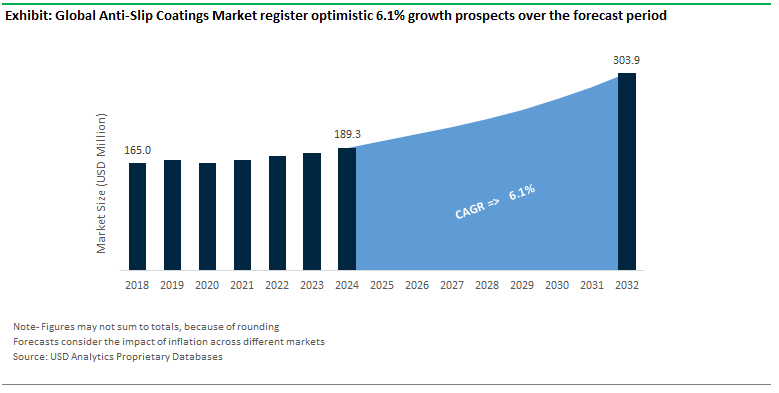

Anti-Slip Coatings Market Size is estimated to increase at a 6.1% CAGR over the forecast period from $189.3 Million 2024 to $304 Million in 2032.

The growing demand to reduce the chance of slips and falls in indoors and outdoors in the retail, commercial, industrial, and residential environments is encouraging the market for anti-slip coatings. Extra protection, ease of installation, cost-effectiveness, suitable for wide range of applications are among the leading advantages marketed by companies. Increasing focus on workplace safety, rapid urbanization and ongoing infrastructure development, including the construction of commercial buildings, residential complexes, and public spaces, renovation and maintenance of existing structures, advances in coating technology, increased focus on aesthetic and functional properties, and others are increasingly driving the market outlook.

Stringent regulations including OSHA's standards for walking-working surfaces (29 CFR Part 1910 Subpart D) mandate the use of slip-resistant surfaces in workplaces, ANSI/NFSI B101.1-2018 provides guidelines for measuring slip resistance on walking surfaces, EN 13365 specifies performance requirements for slip resistance in pedestrian areas, EN 13893 specifies methods for determining the slip resistance, ISO 10545-17 specifies test methods, HSE (UK) regulations and guidelines for workplace safety, International Building Code (IBC) and International Residential Code (IRC), and others continue to fuel the sales volume.

Companies are investing in high performance floor coating systems used for industrial & domestic applications. New formulations of anti-slip coatings incorporate high-performance polymers such as polyurethane and epoxy, which offer improved durability, flexibility, and resistance to wear and chemicals. Further, the use of micro-textures and additive particles like aluminum oxide or silica to increase friction and provide better slip resistance is observed.

Anti-slip coatings with UV-resistant properties, resist extreme weather conditions, including temperature fluctuations, eco-friendly anti-slip coatings that are low in volatile organic compounds (VOCs), self-leveling anti-slip coatings, non-slip thermal spray, Nano Technology based coatings, quick-drying anti-slip coatings, coatings with antimicrobial properties to prevent the growth of bacteria and fungi, and others are gaining significant business growth. In addition to granular particles made from plastic, glass, silica or garnet, soft biomasses such as wood, hemp, straw and cork are being used for the manufacture of anti-slip coatings.

The market report analyses the leading companies in the industry including 3M Company, Akzo Nobel N.V., Axalta Coating Systems, Hempel A/S, Henkel AG & Co. KGaA, Jotun A/S, PPG Industries Inc, Randolph Products Co., Sika AG, The Sherwin-Williams Company, and others.

Rapid urbanization and infrastructure development, including new construction projects and renovations, drive the need for anti-slip coatings in residential, commercial, and industrial applications. The World Economic Forum (WEF) identified that the global infrastructure investment reached $4 trillion in 2023 while according to the U.S. Census Bureau, total construction spending in the United States was approximately $1.88 trillion in 2023.

While Eurostat identified the construction output in the European Union to be €1.5 trillion in 2023. Further, China National Building Materials Group Corporation reported that China’s construction industry experienced a growth rate of 7.2% in 2023, presenting strong demand growth for anti-slip coatings. In addition, renovation and maintenance of existing structures also contribute to the market as property owners seek to enhance safety features with anti-slip coatings. For instance, over $580 Billion is spent on renovation activities in the US, driving the long-term market outlook.

The need for slip-resistant surfaces in industrial facilities, including manufacturing plants and warehouses, drives demand for durable and effective anti-slip coatings. The U.S. Census Bureau reported that the U.S. manufacturing sector had an output of approximately $2.5 trillion in 2023. The European Commission's report highlighted a 3.2% increase in the manufacturing sector's output in 2024. Japan Ministry of Economy, Trade and Industry (METI) reported a 2.9% increase in industrial production while China National Bureau of Statistics (NBS) identified industrial output grew by 4.8% in 2023.

In addition, robust growth in emerging economies contributes to the rapid industrial sector demand for anti-slip coatings. In addition, the healthcare sector requires anti-slip coatings with antimicrobial properties to ensure safety and hygiene in hospitals and clinics. Global Health Expenditure Database estimates the global healthcare expenditure to grow at an annual rate of 4.7% over the forecast period. Such robust healthcare infrastructure growth fuels the demand for anti-bacterial anti-slip coatings.

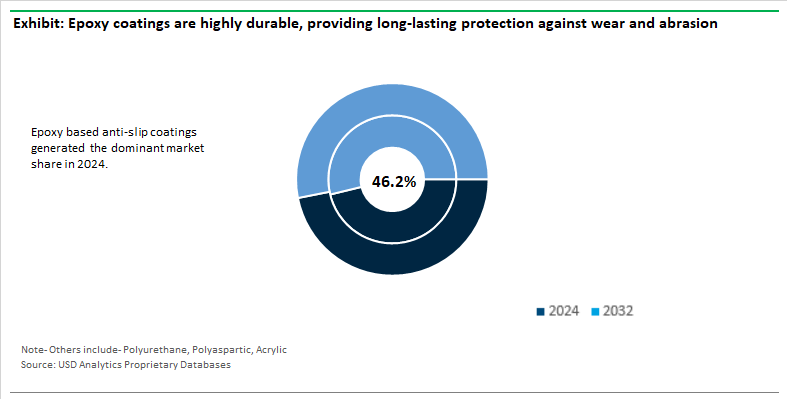

Epoxy based anti-slip coatings accounted for 46.2% of the global market share, followed by Polyurethane coatings with 21.3% market share and the rest held by Polyaspartic and Acrylic coatings. Epoxy coatings are highly durable, providing long-lasting protection against wear, abrasion, and impacts for around a decade with adequate maintenance. In addition, Epoxy-based coatings offer superior adhesion to various substrates, including concrete, metal, and wood. Leading companies market epoxy coatings with a tensile adhesion strength of up to 2,000 psi. Epoxy coatings with anti-slip additives also can achieve a slip resistance rating of up to 0.9, which makes them ideal for areas prone to wet or oily conditions. Further, Epoxy floors are easy to clean and maintain due to their seamless and non-porous surface and are available in various colors and finishes, allowing for aesthetic customization. In addition, Epoxy coatings cure quickly, allowing for rapid installation and minimal downtime. This is particularly advantageous for commercial and industrial settings where minimizing disruption is essential.

Water-based anti-slip coatings are the largest segment in the industry due to their low volatile organic compound (VOC) emissions. According to the Environmental Protection Agency (EPA), water-based coatings can reduce VOC emissions by up to 90% compared to solvent-based alternatives. In particular, recent advances in water-based coating technology have improved their performance, making them competitive with solvent-based coatings in terms of durability, adhesion, and slip resistance. Improved durability and chemical resistance of water-based coatings lead to their increased adoption in industrial and heavy-duty applications, estimated around 15% market penetration in the past few years.

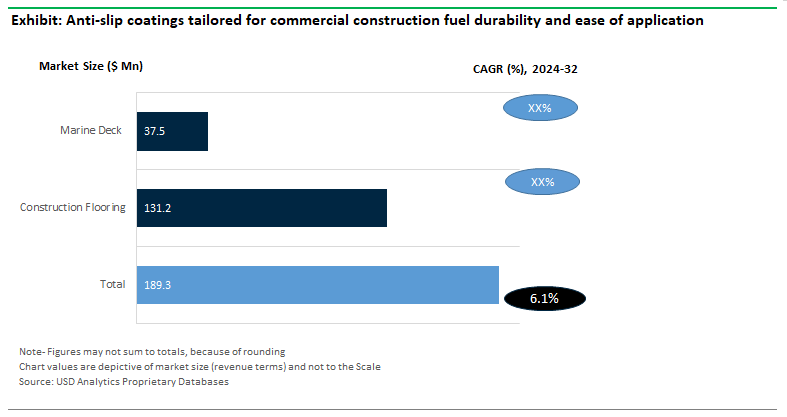

Construction flooring represents the largest segment in the anti-slip coatings market, holding a substantial 69.3% revenue share, followed by Marine Deck (19.8% market share), and others. Driven by high traffic in commercial buildings, the demand for durable and safe flooring solutions is paramount. Anti-slip coatings are commonly used in areas such as lobbies, stairwells, and corridors to ensure safety and compliance with regulations.

Companies like Sherwin-Williams and Rust-Oleum have developed specialized anti-slip coatings tailored for commercial construction, offering enhanced durability and ease of application. For example, Sherwin-Williams’ ArmorSeal line is specifically designed for high-traffic commercial areas, providing a balance of aesthetic appeal and safety. Further, innovations by companies like BASF and Valspar include coatings with improved abrasion resistance and longer life spans. BASF’s MasterTop series, for instance, incorporates advanced polymers that offer enhanced slip resistance and longevity, making it ideal for high-wear areas in both commercial and industrial settings.

The National Association of Home Builders (NAHB) highlights that industrial construction, particularly in warehousing and manufacturing sectors, has seen a consistent growth rate of over 5% annually. PPG Industries and Hempel have developed industrial-grade anti-slip coatings, such as the PPG SigmaCover series, which are resistant to chemicals and heavy wear, ensuring safety in harsh industrial environments. In addition, public infrastructure projects present strong growth prospects.

The U.S. Department of Transportation (DOT) has allocated over $1 trillion for infrastructure development under the Infrastructure Investment and Jobs Act (IIJA) by 2026. Accordingly, companies like Sika and Jotun have responded to this demand with products like Sika’s Sikafloor series, which offers high-performance anti-slip solutions specifically designed for large-scale infrastructure projects.

The Asia Pacific region is poised to become the largest and fastest-growing market for anti-slip coatings, projected to capture a significant 55% market share and achieve a 7.2% compound annual growth rate (CAGR) during the forecast period. The growth is driven by rapid industrialization, urbanization, infrastructure development, and stringent safety regulations across key countries in the region.

According to the World Bank, China’s GDP grew by 5.5% in 2023, while India’s GDP expanded by 6.1%. As part of the BRI, China has been investing heavily in infrastructure projects across Asia, including roads, bridges, ports, and public transportation systems while The Indian government’s Smart Cities Mission, which aims to develop 100 smart cities with modern infrastructure, also contributes to the demand for anti-slip coatings. This economic growth is fueling extensive construction activities, particularly in industrial and commercial sectors, which in turn drives demand for anti-slip coatings. In addition, robust residential construction activity fuels the market outlook. According to the United Nations, the urban population in Asia is expected to grow by 1.2 billion people by 2050, supporting strong market prospects.

In addition, Asia Pacific is home to major manufacturing hubs for anti-slip coatings, with companies like Nippon Paint, Asian Paints, and Kansai Paint leading the market. These companies are increasingly investing in R&D activities. For instance, Nippon Paint has launched a series of water-based anti-slip coatings specifically designed for the Asia Pacific market, which are environmentally friendly and meet local regulatory standards. Similarly, Asian Paints introduced a new range of industrial anti-slip coatings that offer enhanced durability and chemical resistance, catering to the region’s growing industrial sector.

The anti-slip coatings market is characterized by a mix of both global and regional players, reflecting a moderately fragmented competitive landscape. The market is highly competitive with companies focusing on differentiating their products through innovations in formulation, such as developing water-based, eco-friendly, and fast-curing coatings. 3M Company, Akzo Nobel N.V., Axalta Coating Systems, Hempel A/S, Henkel AG & Co. KGaA, Jotun A/S, PPG Industries Inc, Randolph Products Co., Sika AG, The Sherwin-Williams Company, and others continue to dominate the industry. Leading companies are focusing on expanding their presence in emerging markets such as Asia Pacific, which is experiencing rapid industrialization and urbanization. Establishing local manufacturing facilities and partnerships with regional distributors are common strategies to increase market penetration.

|

Parameter |

Details |

|

Market Size (2024) |

$189.3 Million |

|

Market Size (2032) |

$304 Million |

|

Market Growth Rate (2024- 2032) |

6.1% |

|

Largest Segment- Type |

Epoxy-based (46.6% Market Share) |

|

Fastest Growing Segment- Technology |

Water-based Anti-Slip Coating |

|

Fastest Growing Market- Region |

Asia Pacific (7.2% Growth) |

|

Largest End-User Industry |

Construction Flooring (69.3%) |

|

Segments |

Type, Technology, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

3M Company, Akzo Nobel N.V., Axalta Coating Systems, Hempel A/S, Henkel AG & Co. KGaA, Jotun A/S, PPG Industries Inc, Randolph Products Co., Sika AG, The Sherwin-Williams Company |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

The Anti-Slip Coatings industry is characterized by the presence of capital-intensive companies across the industry from raw material procurement to final product distribution.

Resin

Epoxy

Polyurethane

Polyaspartic

Acrylic

Type

Water-based

Solvent-based

End-User

Construction flooring

Marine deck

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Akzo Nobel N.V.

Axalta Coating Systems

Hempel A/S

Henkel AG & Co. KGaA

Jotun A/S

PPG Industries Inc

Randolph Products Co.

Sika AG

The Sherwin-Williams Company

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Anti-Slip Coatings Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Anti-Slip Coatings Market Size by Segments, 2018- 2023

Key Statistics, 2024

Anti-Slip Coatings Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Anti-Slip Coatings Types, 2018-2023

Anti-Slip Coatings Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Anti-Slip Coatings Applications, 2018-2023

8. Anti-Slip Coatings Market Size Outlook by Segments, 2024- 2032

Anti-Slip Coatings Market Size Outlook by Resin, USD Million, 2024-2032

Growth Comparison (y-o-y) across Anti-Slip Coatings Resins, 2024-2032

Anti-Slip Coatings Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Anti-Slip Coatings Types, 2024-2032

Anti-Slip Coatings Market Size Outlook by End-Users, USD Million, 2024-2032

Growth Comparison (y-o-y) across Anti-Slip Coatings End-Users, 2024-2032

9. Anti-Slip Coatings Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

United States Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

United States Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

11. Canada Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Canada Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Canada Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

12. Mexico Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Mexico Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Mexico Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

13. Germany Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Germany Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Germany Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

14. France Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

France Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

France Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

France Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

United Kingdom Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

United Kingdom Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

10. Spain Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Spain Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Spain Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

16. Italy Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Italy Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Italy Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

17. Benelux Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Benelux Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Benelux Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

18. Nordic Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Nordic Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Nordic Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Rest of Europe Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Rest of Europe Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

20. China Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

China Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

China Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

China Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

21. India Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

India Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

India Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

India Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

22. Japan Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Japan Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Japan Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

23. South Korea Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

South Korea Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

South Korea Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

24. Australia Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Australia Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Australia Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

25. South East Asia Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

South East Asia Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

South East Asia Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

27. Brazil Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Brazil Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Brazil Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

28. Argentina Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Argentina Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Argentina Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Rest of South America Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Rest of South America Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

United Arab Emirates Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

United Arab Emirates Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Saudi Arabia Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Saudi Arabia Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Rest of Middle East Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Rest of Middle East Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

33. South Africa Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

South Africa Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

South Africa Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Anti-Slip Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Anti-Slip Coatings Market Size Outlook by Type, 2021- 2032

Rest of Africa Anti-Slip Coatings Market Size Outlook by Application, 2021- 2032

Rest of Africa Anti-Slip Coatings Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Resin

Epoxy

Polyurethane

Polyaspartic

Acrylic

Type

Water-based

Solvent-based

End-User

Construction flooring

Marine deck

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Anti-Slip Coatings Market Size is valued at $189.3 Million in 2024 and is forecast to register a growth rate (CAGR) of 6.1% to reach $304 Million by 2032.

Epoxy-based (46.6% Market Share), Construction Flooring (69.3%), Water-based Anti-Slip Coating

3M Company, Akzo Nobel N.V., Axalta Coating Systems, Hempel A/S, Henkel AG & Co. KGaA, Jotun A/S, PPG Industries Inc, Randolph Products Co., Sika AG, The Sherwin-Williams Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume

Asia Pacific (7.2% Growth)