The global Anti-corrosion Coatings Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Chlorinated Rubber, Others), By Technology (Solvent Borne, Waterborne, Powder-Based Coating, Others), By End-User (Marine, Oil & Gas, Industrial, Infrastructure, Power Generation, Automotive & Transportation, Others).

The market for anti-corrosion coatings is expanding with the increasing need to protect infrastructure, equipment, and assets from corrosion damage. Key trends shaping the future of this industry include the development of advanced coating formulations with improved corrosion resistance, adhesion, and durability, capable of withstanding harsh environmental conditions and extending the service life of coated surfaces. Additionally, advancements in coating technologies such as nano-coatings, epoxy-based coatings, and zinc-rich primers offer superior barrier protection and cathodic protection, reducing the risk of corrosion-related failures and maintenance costs. Moreover, the adoption of environmentally friendly coatings with low VOC emissions and heavy metal-free formulations aligns with sustainability goals and regulatory requirements, driving market growth and innovation in eco-friendly anti-corrosion solutions. As industries across sectors prioritize asset protection and maintenance, the demand for anti-corrosion coatings is expected to continue growing, driving innovation and market expansion in this sector.

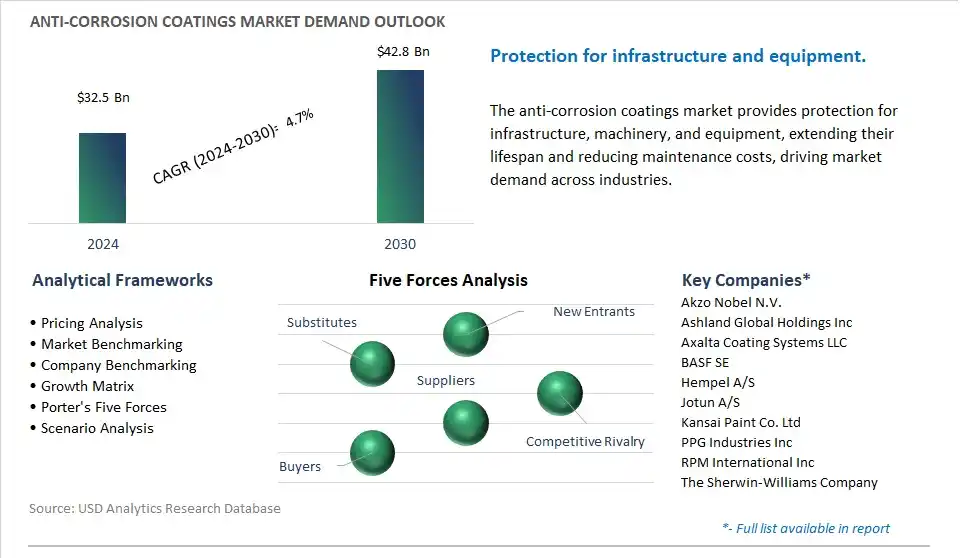

The market report analyses the leading companies in the industry including Akzo Nobel N.V., Ashland Global Holdings Inc, Axalta Coating Systems LLC, BASF SE, Hempel A/S, Jotun A/S, Kansai Paint Co. Ltd, PPG Industries Inc, RPM International Inc, The Sherwin-Williams Company.

Anti-corrosion coatings companies are focusing on environmental sustainability, driven by regulatory pressures, consumer preferences, and industry initiatives to reduce carbon footprint and minimize environmental impact. Anti-corrosion coatings play a crucial role in protecting metal surfaces from degradation and extending their lifespan, but traditional coatings often contain hazardous chemicals and volatile organic compounds (VOCs) that pose risks to human health and the environment. Accordingly, there is a growing demand for eco-friendly and sustainable anti-corrosion coatings that offer effective protection while minimizing environmental harm. This is leading to the development of water-based coatings, low-VOC formulations, and bio-based alternatives, driving the commitment to sustainable coating solutions and responsible environmental stewardship.

A key driver propelling the market for anti-corrosion coatings is the growth in infrastructure development, industrial activities, and investments in asset protection and maintenance across various sectors such as construction, oil and gas, transportation, and marine. Corrosion poses significant economic and safety risks, resulting in costly repairs, downtime, and asset failures. As industries strive to extend the service life of infrastructure, equipment, and machinery, there is a growing need for effective corrosion protection solutions that prevent degradation, reduce maintenance costs, and ensure operational reliability. Anti-corrosion coatings offer a cost-effective and efficient means of safeguarding metal substrates against corrosion, thereby driving market demand for coatings that meet performance requirements and regulatory standards in diverse applications and industries.

Anti-corrosion coatings companies are focusing on innovation and advancement in coating technologies to address emerging challenges and meet evolving customer needs. With rapid advancements in materials science, nanotechnology, and surface engineering, there is potential to develop next-generation anti-corrosion coatings with enhanced durability, adhesion, and resistance to harsh environments. Manufacturers aim to capitalize on this opportunity by investing in research and development to explore novel coating formulations, nanostructured materials, and functional additives that offer superior corrosion protection, longer service life, and reduced environmental impact. Additionally, there is opportunity to develop smart coatings with self-healing, self-cleaning, or anti-fouling properties, as well as coatings that provide additional functionalities such as fire resistance, thermal insulation, or antimicrobial properties.

The anti-corrosion coatings market is structured through a series of interconnected stages involving raw material acquisition, research and development, manufacturing, quality control and testing, packaging and storage, distribution and sales, and Further, end-user applications. Chemical companies play a pivotal role in providing resins, while pigment and filler manufacturers and solvent and additive producers contribute to sourcing raw materials.

Paint and coating manufacturers including AkzoNobel N.V., PPG Industries, and Sherwin-Williams Company lead in R&D efforts to develop innovative coatings, which are then manufactured in large-scale operations. Quality control measures are implemented both internally by manufacturers and through independent testing laboratories to ensure adherence to industry standards. These coatings are then packaged, stored, and distributed through various channels, including direct sales teams, industrial distributors, and online retailers, reaching end-users in diverse sectors including construction, oil and gas, marine, power generation, and manufacturing.

The market's robustness is demonstrated by the involvement of leading players including AkzoNobel N.V., PPG Industries, and Sherwin-Williams Company, alongside numerous regional and specialty manufacturers.

In the Anti-Corrosion Coatings Market, the zinc segment is the largest, driven by diverse critical factors. Zinc-based anti-corrosion coatings are widely recognized for their exceptional corrosion protection properties and versatile applications across various industries. These coatings consist of zinc-rich primers or zinc-rich paints formulated with a high concentration of zinc dust or flakes suspended in a binder matrix. Zinc coatings offer excellent sacrificial protection to steel substrates by acting as a physical barrier against corrosion and providing cathodic protection through galvanic action. In addition, zinc coatings are known for their self-healing capabilities, wherein the zinc particles corrode sacrificially to protect the underlying steel substrate, thus extending the service life of coated structures and equipment in harsh environments. Additionally, zinc-based coatings are favored for their ease of application, fast drying times, and compatibility with a wide range of topcoat systems, enhancing their appeal to coating applicators and end-users. The robust demand for zinc coatings stems from their widespread use in industries such as automotive, marine, infrastructure, oil and gas, and industrial manufacturing, where corrosion protection is critical for prolonging the lifespan of assets and reducing maintenance costs. Further, advancements in zinc coating formulations, including the development of environmentally friendly and low-VOC formulations, further bolster the growth of the zinc segment in the Anti-corrosion coating market.

In the Anti-Corrosion Coatings Market, the waterborne segment is the fastest-growing sector, driven by diverse pivotal factors. Waterborne anti-corrosion coatings are experiencing rapid adoption due to their environmentally friendly nature, low volatile organic compound (VOC) content, and compliance with stringent regulatory standards on emissions and toxicity. As sustainability becomes increasingly important in coating formulations, waterborne technologies offer a compelling solution by reducing environmental impact and promoting safer working conditions for applicators. In addition, advancements in waterborne coating formulations have resulted in improved performance characteristics, such as enhanced corrosion resistance, durability, and adhesion to substrates, making them suitable for a wide range of applications in industries such as automotive, construction, aerospace, and marine. Additionally, the shift toward waterborne coatings is driven by growing consumer awareness and preference for eco-friendly products, prompting manufacturers to invest in research and development efforts to innovate and expand their waterborne coating portfolios. As a result, the waterborne segment experiences accelerated growth in the Anti-Corrosion Coatings Market, reflecting the industry's commitment to sustainability and regulatory compliance while meeting the demand for high-performance corrosion protection solutions.

In the Anti-Corrosion Coatings Market, the infrastructure segment is the fastest-growing sector, driven by diverse significant factors. With rapid urbanization and industrialization, there is a heightened focus on the maintenance and protection of infrastructure assets such as bridges, highways, tunnels, and buildings against corrosion. Infrastructure projects, both new constructions and maintenance activities, require effective anti-corrosion coatings to ensure the longevity and structural integrity of these critical assets. Corrosion-related deterioration can lead to safety hazards, increased maintenance costs, and service disruptions, emphasizing the importance of robust corrosion protection solutions in infrastructure applications. Additionally, the introduction of advanced coating technologies and formulations tailored to the specific needs of infrastructure projects, such as high-build coatings for concrete surfaces and coatings resistant to harsh environmental conditions, further drives the demand for anti-corrosion coatings in this segment. Further, government initiatives aimed at infrastructure development and modernization, coupled with investments in transportation, utilities, and public works projects, contribute to the growth of the infrastructure segment in the Anti-Corrosion Coatings Market. As infrastructure continues to expand globally, particularly in emerging economies, the demand for anti-corrosion coatings is expected to surge, positioning the infrastructure segment as a key driver of market growth.

By Type

Epoxy

Polyurethane

Acrylic

Alkyd

Zinc

Chlorinated Rubber

Others

By Technology

Solvent Borne

Waterborne

Powder-Based Coating

Others

By End-User

Marine

Oil & Gas

Industrial

Infrastructure

Power Generation

Automotive & Transportation

Others

Akzo Nobel N.V.

Ashland Global Holdings Inc

Axalta Coating Systems LLC

BASF SE

Hempel A/S

Jotun A/S

Kansai Paint Co. Ltd

PPG Industries Inc

RPM International Inc

The Sherwin-Williams Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Anti-corrosion Coatings Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Anti-corrosion Coatings Market Size Outlook, $ Million, 2021 to 2030

3.2 Anti-corrosion Coatings Market Outlook by Type, $ Million, 2021 to 2030

3.3 Anti-corrosion Coatings Market Outlook by Product, $ Million, 2021 to 2030

3.4 Anti-corrosion Coatings Market Outlook by Application, $ Million, 2021 to 2030

3.5 Anti-corrosion Coatings Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Anti-corrosion Coatings Industry

4.2 Key Market Trends in Anti-corrosion Coatings Industry

4.3 Potential Opportunities in Anti-corrosion Coatings Industry

4.4 Key Challenges in Anti-corrosion Coatings Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Anti-corrosion Coatings Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Anti-corrosion Coatings Market Outlook by Segments

7.1 Anti-corrosion Coatings Market Outlook by Segments, $ Million, 2021- 2030

By Type

Epoxy

Polyurethane

Acrylic

Alkyd

Zinc

Chlorinated Rubber

Others

By Technology

Solvent Borne

Waterborne

Powder-Based Coating

Others

By End-User

Marine

Oil & Gas

Industrial

Infrastructure

Power Generation

Automotive & Transportation

Others

8 North America Anti-corrosion Coatings Market Analysis and Outlook To 2030

8.1 Introduction to North America Anti-corrosion Coatings Markets in 2024

8.2 North America Anti-corrosion Coatings Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Anti-corrosion Coatings Market size Outlook by Segments, 2021-2030

By Type

Epoxy

Polyurethane

Acrylic

Alkyd

Zinc

Chlorinated Rubber

Others

By Technology

Solvent Borne

Waterborne

Powder-Based Coating

Others

By End-User

Marine

Oil & Gas

Industrial

Infrastructure

Power Generation

Automotive & Transportation

Others

9 Europe Anti-corrosion Coatings Market Analysis and Outlook To 2030

9.1 Introduction to Europe Anti-corrosion Coatings Markets in 2024

9.2 Europe Anti-corrosion Coatings Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Anti-corrosion Coatings Market Size Outlook by Segments, 2021-2030

By Type

Epoxy

Polyurethane

Acrylic

Alkyd

Zinc

Chlorinated Rubber

Others

By Technology

Solvent Borne

Waterborne

Powder-Based Coating

Others

By End-User

Marine

Oil & Gas

Industrial

Infrastructure

Power Generation

Automotive & Transportation

Others

10 Asia Pacific Anti-corrosion Coatings Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Anti-corrosion Coatings Markets in 2024

10.2 Asia Pacific Anti-corrosion Coatings Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Anti-corrosion Coatings Market size Outlook by Segments, 2021-2030

By Type

Epoxy

Polyurethane

Acrylic

Alkyd

Zinc

Chlorinated Rubber

Others

By Technology

Solvent Borne

Waterborne

Powder-Based Coating

Others

By End-User

Marine

Oil & Gas

Industrial

Infrastructure

Power Generation

Automotive & Transportation

Others

11 South America Anti-corrosion Coatings Market Analysis and Outlook To 2030

11.1 Introduction to South America Anti-corrosion Coatings Markets in 2024

11.2 South America Anti-corrosion Coatings Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Anti-corrosion Coatings Market size Outlook by Segments, 2021-2030

By Type

Epoxy

Polyurethane

Acrylic

Alkyd

Zinc

Chlorinated Rubber

Others

By Technology

Solvent Borne

Waterborne

Powder-Based Coating

Others

By End-User

Marine

Oil & Gas

Industrial

Infrastructure

Power Generation

Automotive & Transportation

Others

12 Middle East and Africa Anti-corrosion Coatings Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Anti-corrosion Coatings Markets in 2024

12.2 Middle East and Africa Anti-corrosion Coatings Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Anti-corrosion Coatings Market size Outlook by Segments, 2021-2030

By Type

Epoxy

Polyurethane

Acrylic

Alkyd

Zinc

Chlorinated Rubber

Others

By Technology

Solvent Borne

Waterborne

Powder-Based Coating

Others

By End-User

Marine

Oil & Gas

Industrial

Infrastructure

Power Generation

Automotive & Transportation

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Akzo Nobel N.V.

Ashland Global Holdings Inc

Axalta Coating Systems LLC

BASF SE

Hempel A/S

Jotun A/S

Kansai Paint Co. Ltd

PPG Industries Inc

RPM International Inc

The Sherwin-Williams Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Epoxy

Polyurethane

Acrylic

Alkyd

Zinc

Chlorinated Rubber

Others

By Technology

Solvent Borne

Waterborne

Powder-Based Coating

Others

By End-User

Marine

Oil & Gas

Industrial

Infrastructure

Power Generation

Automotive & Transportation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Anti-corrosion Coatings is forecast to reach $42.8 Billion in 2030 from $32.5 Billion in 2024, registering a CAGR of 4.7% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Akzo Nobel N.V., Ashland Global Holdings Inc, Axalta Coating Systems LLC, BASF SE, Hempel A/S, Jotun A/S, Kansai Paint Co. Ltd, PPG Industries Inc, RPM International Inc, The Sherwin-Williams Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume