The global Anchors and Grouts Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By End-User (Commercial, Industrial, Infrastructure, Residential, Others), By Type (Cementitious Fixing Anchors and Grouts, Resin Fixing Anchors and Grouts, Others).

Anchors and grouts are essential construction materials used for securing structural elements, equipment, and machinery to concrete, masonry, or rock substrates in various civil engineering and construction applications in 2024. Anchors are mechanical fasteners designed to provide load-bearing support by transferring forces between the attached component and the substrate. They come in various types such as expansion anchors, adhesive anchors, and mechanical anchors, each suitable for specific substrate conditions and load requirements. Grouts are fluid or semi-fluid materials injected into voids, gaps, or spaces between structural elements and the substrate to provide stability, support, and load transfer. They are commonly used for filling gaps around anchor bolts, reinforcing dowels, and stabilizing foundation elements. Anchors and grouts are widely used in construction projects such as bridges, tunnels, dams, buildings, and industrial facilities where structural integrity and stability are paramount. With advancements in materials and construction techniques, anchors and grouts to play a critical role in ensuring the safety, durability, and performance of infrastructure and built environments worldwide.

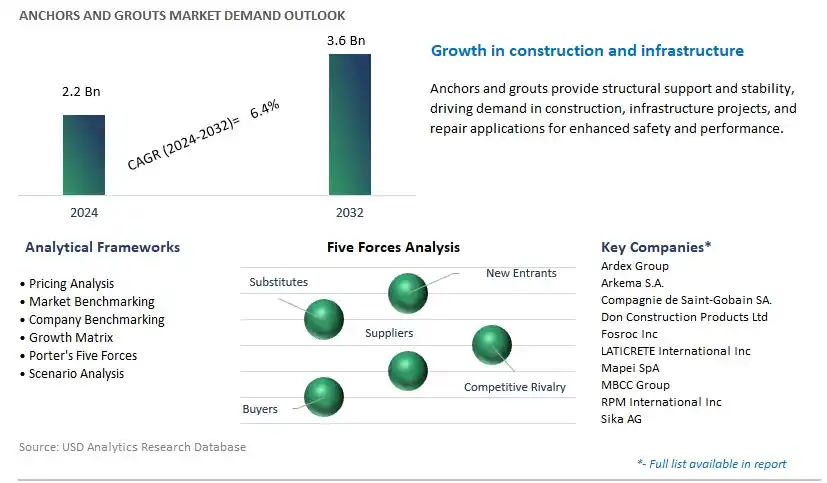

The market report analyses the leading companies in the industry including Ardex Group, Arkema S.A., Compagnie de Saint-Gobain SA., Don Construction Products Ltd, Fosroc Inc, LATICRETE International Inc, Mapei SpA, MBCC Group, RPM International Inc, Sika AG, and others.

A prominent trend in the anchors and grouts market is the increasing demand for infrastructure rehabilitation and repair solutions, driven by aging infrastructure, urbanization, and the need for resilient structures. As existing infrastructure assets deteriorate over time, there is a growing requirement for anchoring and grouting solutions to strengthen foundations, stabilize structures, and address structural integrity issues. This trend is particularly pronounced in regions with aging infrastructure networks, such as North America and Europe, where governments are prioritizing infrastructure maintenance and upgrading programs to ensure public safety and asset longevity. Additionally, the expansion of transportation networks, utilities, and industrial facilities further fuels the demand for anchors and grouts, positioning the market for steady growth.

The primary driver fueling the growth of the anchors and grouts market is the continuous expansion of construction and infrastructure development activities globally. Anchors and grouts play a critical role in the construction of new infrastructure projects such as bridges, dams, tunnels, and high-rise buildings by providing structural stability and support. Moreover, the renovation and retrofitting of existing structures, coupled with the demand for resilient and earthquake-resistant designs, drive the adoption of anchors and grouts in structural reinforcement and retrofit applications. The rapid urbanization in emerging economies, along with investments in smart cities and sustainable infrastructure, further boost market demand for anchors and grouts, creating opportunities for manufacturers and suppliers.

An emerging opportunity within the anchors and grouts market lies in innovation focused on high-performance materials and application techniques to address evolving customer needs and industry requirements. Advances in material science, such as the development of high-strength polymers, fiber-reinforced composites, and environmentally friendly grouting compounds, offer opportunities to enhance the performance, durability, and sustainability of anchors and grouts. Additionally, innovations in application methods, such as robotic installation systems, 3D printing technologies, and advanced injection techniques, can improve efficiency, accuracy, and safety in anchor and grout installations. By investing in research and development initiatives and collaborating with industry partners, companies can capitalize on these opportunities to differentiate their products, expand their market presence, and meet the growing demand for innovative anchoring and grouting solutions.

The Infrastructure segment is the largest in the Anchors and Grouts Market by end-user, primarily due to the extensive use of anchors and grouts in large-scale construction projects such as bridges, tunnels, highways, and dams. Infrastructure projects require robust anchoring and grouting solutions to ensure structural stability, durability, and safety. Anchors are essential for securing heavy machinery, equipment, and structural elements to concrete, rock, or soil substrates, while grouts are used for filling voids, stabilizing foundations, and improving load transfer between structural elements. The critical role of anchors and grouts in infrastructure construction, coupled with the ongoing investments in infrastructure development globally, drives the demand for these products in the infrastructure sector. Additionally, the increasing focus on retrofitting and repairing aging infrastructure further boosts the demand for anchors and grouts, as they are essential for reinforcing and strengthening existing structures. Therefore, driven by the significant demand from infrastructure projects and the continuous investments in infrastructure development worldwide, the Infrastructure segment dominates the Anchors and Grouts Market.

The Resin Fixing Anchors and Grouts segment emerge as the fastest-growing in the Anchors and Grouts Market by type, primarily due to their superior performance, versatility, and ease of installation in various construction applications. Resin fixing anchors and grouts utilize epoxy or polyester resins to bond anchors securely to concrete, masonry, or other substrates, providing high load-bearing capacity and excellent resistance to vibration, corrosion, and chemical exposure. These characteristics make resin fixing systems particularly suitable for demanding and critical applications in industries such as construction, infrastructure, and industrial manufacturing. Additionally, resin fixing anchors and grouts offer faster curing times compared to cementitious alternatives, allowing for quicker installation and project completion, which is highly beneficial for time-sensitive construction projects. The versatility of resin fixing systems also enables them to be used in a wide range of environments, including damp or submerged conditions, making them preferred solutions for challenging construction scenarios. As industries increasingly prioritize efficiency, durability, and performance in construction projects, the demand for resin fixing anchors and grouts is expected to experience rapid growth, driving the expansion of the Resin Fixing Anchors and Grouts segment in the market.

By End-User

Commercial

Industrial

Infrastructure

Residential

Others

By Type

Cementitious Fixing Anchors and Grouts

Resin Fixing Anchors and Grouts

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Ardex Group

Arkema S.A.

Compagnie de Saint-Gobain SA.

Don Construction Products Ltd

Fosroc Inc

LATICRETE International Inc

Mapei SpA

MBCC Group

RPM International Inc

Sika AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Anchors and Grouts Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Anchors and Grouts Market Size Outlook, $ Million, 2021 to 2032

3.2 Anchors and Grouts Market Outlook by Type, $ Million, 2021 to 2032

3.3 Anchors and Grouts Market Outlook by Product, $ Million, 2021 to 2032

3.4 Anchors and Grouts Market Outlook by Application, $ Million, 2021 to 2032

3.5 Anchors and Grouts Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Anchors and Grouts Industry

4.2 Key Market Trends in Anchors and Grouts Industry

4.3 Potential Opportunities in Anchors and Grouts Industry

4.4 Key Challenges in Anchors and Grouts Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Anchors and Grouts Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Anchors and Grouts Market Outlook by Segments

7.1 Anchors and Grouts Market Outlook by Segments, $ Million, 2021- 2032

By End-User

Commercial

Industrial

Infrastructure

Residential

Others

By Type

Cementitious Fixing Anchors and Grouts

Resin Fixing Anchors and Grouts

Others

8 North America Anchors and Grouts Market Analysis and Outlook To 2032

8.1 Introduction to North America Anchors and Grouts Markets in 2024

8.2 North America Anchors and Grouts Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Anchors and Grouts Market size Outlook by Segments, 2021-2032

By End-User

Commercial

Industrial

Infrastructure

Residential

Others

By Type

Cementitious Fixing Anchors and Grouts

Resin Fixing Anchors and Grouts

Others

9 Europe Anchors and Grouts Market Analysis and Outlook To 2032

9.1 Introduction to Europe Anchors and Grouts Markets in 2024

9.2 Europe Anchors and Grouts Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Anchors and Grouts Market Size Outlook by Segments, 2021-2032

By End-User

Commercial

Industrial

Infrastructure

Residential

Others

By Type

Cementitious Fixing Anchors and Grouts

Resin Fixing Anchors and Grouts

Others

10 Asia Pacific Anchors and Grouts Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Anchors and Grouts Markets in 2024

10.2 Asia Pacific Anchors and Grouts Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Anchors and Grouts Market size Outlook by Segments, 2021-2032

By End-User

Commercial

Industrial

Infrastructure

Residential

Others

By Type

Cementitious Fixing Anchors and Grouts

Resin Fixing Anchors and Grouts

Others

11 South America Anchors and Grouts Market Analysis and Outlook To 2032

11.1 Introduction to South America Anchors and Grouts Markets in 2024

11.2 South America Anchors and Grouts Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Anchors and Grouts Market size Outlook by Segments, 2021-2032

By End-User

Commercial

Industrial

Infrastructure

Residential

Others

By Type

Cementitious Fixing Anchors and Grouts

Resin Fixing Anchors and Grouts

Others

12 Middle East and Africa Anchors and Grouts Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Anchors and Grouts Markets in 2024

12.2 Middle East and Africa Anchors and Grouts Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Anchors and Grouts Market size Outlook by Segments, 2021-2032

By End-User

Commercial

Industrial

Infrastructure

Residential

Others

By Type

Cementitious Fixing Anchors and Grouts

Resin Fixing Anchors and Grouts

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Ardex Group

Arkema S.A.

Compagnie de Saint-Gobain SA.

Don Construction Products Ltd

Fosroc Inc

LATICRETE International Inc

Mapei SpA

MBCC Group

RPM International Inc

Sika AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By End-User

Commercial

Industrial

Infrastructure

Residential

Others

By Type

Cementitious Fixing Anchors and Grouts

Resin Fixing Anchors and Grouts

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Anchors and Grouts Market Size is valued at $2.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.4% to reach $3.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Ardex Group, Arkema S.A., Compagnie de Saint-Gobain SA., Don Construction Products Ltd, Fosroc Inc, LATICRETE International Inc, Mapei SpA, MBCC Group, RPM International Inc, Sika AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume