The global Aminoethylethanolamine Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Grade (Above 99%, Below 99%), By Application (Chelating Agent, Surfactants, Textile Additives, Fabric Softeners, Lubricants, Others).

The market for aminoethylethanolamine (AEEA) is diverse, serving various industrial applications such as coatings, lubricants, and personal care products. Key trends shaping the future of this industry include the development of novel AEEA derivatives with tailored functionalities such as corrosion inhibition, emulsification, and pH adjustment, enabling their use in specialized formulations for automotive, metalworking, and cosmetics industries. Additionally, advancements in process optimization and purification techniques enhance the purity and performance of AEEA, meeting the stringent requirements of industrial applications while minimizing impurities and environmental impact. Moreover, the adoption of AEEA as a key intermediate in the synthesis of specialty chemicals and pharmaceuticals offers opportunities for innovation and diversification in downstream industries. As industries seek sustainable and high-performance solutions for their process and product needs, the demand for AEEA is expected to continue growing, driving market expansion and fostering innovation in this sector.

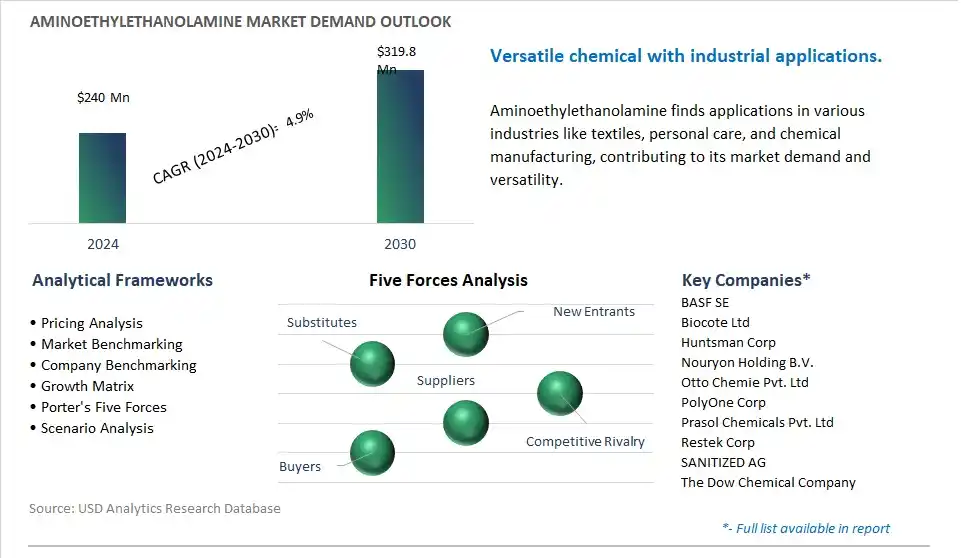

The market report analyses the leading companies in the industry including BASF SE, Biocote Ltd, Huntsman Corp, Nouryon Holding B.V., Otto Chemie Pvt. Ltd, PolyOne Corp, Prasol Chemicals Pvt. Ltd, Restek Corp, SANITIZED AG, The Dow Chemical Company.

The growing demand for ethanolamines in personal care products is driven by their multifunctional properties and versatility in formulations. Aminoethylethanolamine is commonly used as an intermediate in the production of surfactants, emulsifiers, and pH adjusters in various personal care and cosmetic formulations such as shampoos, conditioners, lotions, and creams. With increasing consumer focus on skincare, haircare, and hygiene, there is a rising demand for high-performance ingredients that offer moisturizing, conditioning, and foaming properties. Manufacturers are incorporating aminoethylethanolamine into their formulations to enhance product efficacy, sensory attributes, and consumer appeal, driving the emphasis on innovation and performance-driven solutions in personal care products.

A key driver propelling the market for aminoethylethanolamine is the expansion of industrial applications and chemical manufacturing processes where aminoethylethanolamine is used as a versatile intermediate for the synthesis of various chemicals, resins, and pharmaceuticals. Aminoethylethanolamine is utilized in the production of chelating agents, corrosion inhibitors, lubricants, and textile auxiliaries, as well as in the synthesis of pharmaceutical compounds and epoxy resins. With the growth of sectors such as chemical processing, oil and gas, and pharmaceuticals, there is a corresponding increase in demand for aminoethylethanolamine as a key raw material for manufacturing processes. The expansion of industrial applications drives market demand for aminoethylethanolamine as a critical component in chemical production and process industries, meeting the needs of diverse end-users and applications.

Aminoethylethanolamine companies are developing environmentally friendly formulations and green technologies that address sustainability concerns and regulatory requirements. Aminoethylethanolamine is subject to scrutiny due to its potential environmental impact and toxicity, leading to the need for safer and more sustainable alternatives. Manufacturers aim to capitalize on this opportunity by investing in research and development to develop eco-friendly formulations and green manufacturing processes that reduce the environmental footprint of aminoethylethanolamine production and usage. This includes the development of bio-based alternatives, green chemistry approaches, and waste reduction strategies that enhance the sustainability profile of aminoethylethanolamine and its derivatives.

The Aminoethylethanolamine (AEEA) market operates through a well-established value chain involving diverse key stages and a variety of companies. Beginning with raw material acquisition, chemical companies including Dow Chemical Company and BASF SE play pivotal roles in supplying ethylene oxide and ammonia, essential for AEEA production.

Specialized chemical companies including Huntsman Corporation, BASF SE, and Nouryon take charge of AEEA production, employing precise reactions between ethylene oxide and ammonia. Optional purification and processing steps are managed either by AEEA producers themselves or by specialty chemical companies. Storage and packaging activities are overseen by producers and chemical storage and logistics companies, ensuring efficient handling and transportation of AEEA to end users across different industries.

In the distribution and sales stage, chemical distributors specializing in industrial chemicals facilitate the distribution of AEEA to various end-user industries, including textiles, chemicals, pharmaceuticals, personal care, and aerospace. Additionally, AEEA producers engage in direct sales, catering to the diverse needs of end users. Textile manufacturers utilize AEEA for fabric, while chemical companies incorporate it into surfactants for detergents and cleaners. Pharmaceutical and personal care product manufacturers integrate AEEA as an intermediate in products including sunscreens, and its limited application in aerospace and construction includes its use as an additive in lubricants for specific purposes.

In the Aminoethylethanolamine Market, the above 99% grade segment is the largest, driven by diverse pivotal factors. Aminoethylethanolamine (AEEA) is a versatile chemical compound used in various industrial applications, including the production of surfactants, chelating agents, corrosion inhibitors, and pharmaceutical intermediates. The above 99% grade AEEA offers higher purity and quality compared to its below 99% grade counterpart, making it suitable for demanding applications that require precise formulations and superior performance. Industries such as textiles, coatings, agrochemicals, and personal care rely on high-purity AEEA to ensure the effectiveness and stability of their products. In addition, stringent quality standards and regulatory requirements further drive the demand for above 99% grade AEEA in industries where product quality and consistency are paramount. As industries continue to prioritize efficiency, sustainability, and product performance, the above 99% grade segment is expected to maintain its dominance in the Aminoethylethanolamine Market. Additionally, advancements in manufacturing technologies and processes may further enhance the production and availability of above 99% grade AEEA, sustaining its leading position in the market.

In the Aminoethylethanolamine Market, the surfactants segment is the fastest-growing sector, driven by diverse significant factors. Aminoethylethanolamine (AEEA) is widely used in the production of surfactants due to its excellent wetting, foaming, and emulsifying properties. Surfactants are essential ingredients in various industries, including household and industrial cleaning products, personal care products, agrochemicals, and oilfield chemicals. With the growing demand for environmentally friendly and biodegradable surfactants, there is an increasing preference for AEEA-derived surfactants as they offer improved performance and sustainability compared to traditional surfactants. In addition, the versatility of AEEA allows for the production of a wide range of surfactants tailored to specific applications, contributing to its rapid growth in the market. Additionally, the expanding industrial and agricultural sectors, coupled with the rising awareness of the importance of cleanliness and hygiene, further drive the demand for AEEA-based surfactants. As industries continue to innovate and develop new formulations to meet evolving consumer preferences and regulatory requirements, the surfactants segment is expected to experience sustained growth in the Aminoethylethanolamine Market.

By Grade

Above 99%

Below 99%

By Application

Chelating Agent

Surfactants

Textile Additives

Fabric Softeners

Lubricants

Others

BASF SE

Biocote Ltd

Huntsman Corp

Nouryon Holding B.V.

Otto Chemie Pvt. Ltd

PolyOne Corp

Prasol Chemicals Pvt. Ltd

Restek Corp

SANITIZED AG

The Dow Chemical Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Aminoethylethanolamine Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Aminoethylethanolamine Market Size Outlook, $ Million, 2021 to 2030

3.2 Aminoethylethanolamine Market Outlook by Type, $ Million, 2021 to 2030

3.3 Aminoethylethanolamine Market Outlook by Product, $ Million, 2021 to 2030

3.4 Aminoethylethanolamine Market Outlook by Application, $ Million, 2021 to 2030

3.5 Aminoethylethanolamine Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Aminoethylethanolamine Industry

4.2 Key Market Trends in Aminoethylethanolamine Industry

4.3 Potential Opportunities in Aminoethylethanolamine Industry

4.4 Key Challenges in Aminoethylethanolamine Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Aminoethylethanolamine Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Aminoethylethanolamine Market Outlook by Segments

7.1 Aminoethylethanolamine Market Outlook by Segments, $ Million, 2021- 2030

By Grade

Above 99%

Below 99%

By Application

Chelating Agent

Surfactants

Textile Additives

Fabric Softeners

Lubricants

Others

8 North America Aminoethylethanolamine Market Analysis and Outlook To 2030

8.1 Introduction to North America Aminoethylethanolamine Markets in 2024

8.2 North America Aminoethylethanolamine Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Aminoethylethanolamine Market size Outlook by Segments, 2021-2030

By Grade

Above 99%

Below 99%

By Application

Chelating Agent

Surfactants

Textile Additives

Fabric Softeners

Lubricants

Others

9 Europe Aminoethylethanolamine Market Analysis and Outlook To 2030

9.1 Introduction to Europe Aminoethylethanolamine Markets in 2024

9.2 Europe Aminoethylethanolamine Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Aminoethylethanolamine Market Size Outlook by Segments, 2021-2030

By Grade

Above 99%

Below 99%

By Application

Chelating Agent

Surfactants

Textile Additives

Fabric Softeners

Lubricants

Others

10 Asia Pacific Aminoethylethanolamine Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Aminoethylethanolamine Markets in 2024

10.2 Asia Pacific Aminoethylethanolamine Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Aminoethylethanolamine Market size Outlook by Segments, 2021-2030

By Grade

Above 99%

Below 99%

By Application

Chelating Agent

Surfactants

Textile Additives

Fabric Softeners

Lubricants

Others

11 South America Aminoethylethanolamine Market Analysis and Outlook To 2030

11.1 Introduction to South America Aminoethylethanolamine Markets in 2024

11.2 South America Aminoethylethanolamine Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Aminoethylethanolamine Market size Outlook by Segments, 2021-2030

By Grade

Above 99%

Below 99%

By Application

Chelating Agent

Surfactants

Textile Additives

Fabric Softeners

Lubricants

Others

12 Middle East and Africa Aminoethylethanolamine Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Aminoethylethanolamine Markets in 2024

12.2 Middle East and Africa Aminoethylethanolamine Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Aminoethylethanolamine Market size Outlook by Segments, 2021-2030

By Grade

Above 99%

Below 99%

By Application

Chelating Agent

Surfactants

Textile Additives

Fabric Softeners

Lubricants

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

Biocote Ltd

Huntsman Corp

Nouryon Holding B.V.

Otto Chemie Pvt. Ltd

PolyOne Corp

Prasol Chemicals Pvt. Ltd

Restek Corp

SANITIZED AG

The Dow Chemical Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Grade

Above 99%

Below 99%

By Application

Chelating Agent

Surfactants

Textile Additives

Fabric Softeners

Lubricants

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Aminoethylethanolamine is forecast to reach $319.8 Million in 2030 from $240 Million in 2024, registering a CAGR of 4.9% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, Biocote Ltd, Huntsman Corp, Nouryon Holding B.V., Otto Chemie Pvt. Ltd, PolyOne Corp, Prasol Chemicals Pvt. Ltd, Restek Corp, SANITIZED AG, The Dow Chemical Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume