The global Aluminum Ingots Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By End-User (Automotive, Aerospace, Building and Construction, Semiconductor, Electrical and Electronics, Others).

Aluminum ingots serve as the primary raw material for the production of various aluminum-based products across industries such as automotive, aerospace, construction, and packaging in 2024. These ingots are cast from molten aluminum and typically undergo further processing such as rolling, extrusion, or forging to manufacture components and products with specific properties and applications. Aluminum ingots are valued for their lightweight, corrosion resistance, and recyclability, making them indispensable in industries where these properties are crucial. In automotive manufacturing, aluminum ingots are used to produce engine blocks, wheels, and body panels to reduce weight and improve fuel efficiency. In aerospace, aluminum ingots are utilized for aircraft structural components and fuselage sections due to their high strength-to-weight ratio. Further, aluminum ingots find applications in construction for window frames, roofing, and structural elements due to their durability and aesthetic appeal. With the increasing demand for lightweight and sustainable materials, aluminum ingots to play a vital role in driving innovation and progress across various industries.

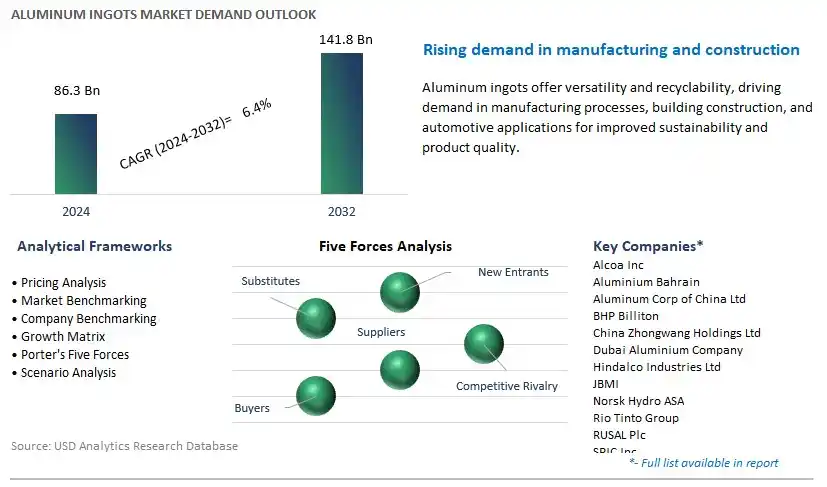

The market report analyses the leading companies in the industry including Alcoa Inc, Aluminium Bahrain, Aluminum Corp of China Ltd, BHP Billiton, China Zhongwang Holdings Ltd, Dubai Aluminium Company, Hindalco Industries Ltd, JBMI, Norsk Hydro ASA, Rio Tinto Group, RUSAL Plc, SPIC Inc, United Company, Xinfa Group Co. Ltd, and others.

A prominent trend in the aluminum ingots market is the increasing demand for lightweight materials in automotive and aerospace industries. As manufacturers seek to enhance fuel efficiency, reduce emissions, and improve performance, there is a growing preference for aluminum ingots as a primary material for producing lightweight components such as engine blocks, chassis, and aircraft structures. This trend is driven by stringent regulatory standards, technological advancements in material science, and shifting consumer preferences towards eco-friendly and fuel-efficient vehicles. Additionally, the rise of electric vehicles and the need for electrification components further contribute to the demand for aluminum ingots, positioning them as a critical material for sustainable mobility solutions.

The primary driver fueling the growth of the aluminum ingots market is the continuous expansion of construction and infrastructure development activities globally. Aluminum ingots are essential raw materials used in the construction industry for manufacturing structural components, facades, doors, windows, and roofing systems. With rapid urbanization, population growth, and infrastructure modernization projects, there is a steady demand for aluminum ingots to support the construction of residential, commercial, and industrial buildings, as well as transportation infrastructure such as bridges, railways, and airports. Moreover, the emphasis on sustainable building practices and energy-efficient construction further drives the adoption of aluminum ingots due to their recyclability, durability, and corrosion resistance properties.

An emerging opportunity within the aluminum ingots market lies in the integration of renewable energy sources in the production process to enhance sustainability and reduce carbon emissions. With increasing scrutiny on the environmental footprint of industrial activities, aluminum producers have the opportunity to invest in renewable energy technologies such as solar, wind, and hydroelectric power to power their smelting operations. By transitioning towards renewable energy sources, aluminum ingot manufacturers can reduce their reliance on fossil fuels, mitigate greenhouse gas emissions, and align with global climate targets. Additionally, adopting sustainable practices can enhance brand reputation, attract environmentally conscious customers, and create long-term value for stakeholders.

The Building and Construction segment is the largest in the Aluminum Ingots Market by end-user, owing to the extensive use of aluminum ingots in architectural, structural, and decorative applications within the construction industry. Aluminum ingots serve as the raw material for manufacturing various building components, including window frames, doors, roofing panels, curtain walls, and structural supports. The popularity of aluminum in construction is attributed to its unique combination of properties, including lightweight, corrosion resistance, durability, and ability to be easily fabricated into complex shapes. These characteristics make aluminum an attractive choice for modern architectural designs, where aesthetics, sustainability, and performance are key considerations. Moreover, the increasing focus on green building practices and energy-efficient construction materials further drives the demand for aluminum ingots in the building and construction sector. As urbanization and infrastructure development continue to expand globally, the Building and Construction segment is expected to maintain its dominance in the Aluminum Ingots Market.

By End-User

Automotive

Aerospace

Building and Construction

Semiconductor

Electrical and Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alcoa Inc

Aluminium Bahrain

Aluminum Corp of China Ltd

BHP Billiton

China Zhongwang Holdings Ltd

Dubai Aluminium Company

Hindalco Industries Ltd

JBMI

Norsk Hydro ASA

Rio Tinto Group

RUSAL Plc

SPIC Inc

United Company

Xinfa Group Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Aluminum Ingots Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Aluminum Ingots Market Size Outlook, $ Million, 2021 to 2032

3.2 Aluminum Ingots Market Outlook by Type, $ Million, 2021 to 2032

3.3 Aluminum Ingots Market Outlook by Product, $ Million, 2021 to 2032

3.4 Aluminum Ingots Market Outlook by Application, $ Million, 2021 to 2032

3.5 Aluminum Ingots Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Aluminum Ingots Industry

4.2 Key Market Trends in Aluminum Ingots Industry

4.3 Potential Opportunities in Aluminum Ingots Industry

4.4 Key Challenges in Aluminum Ingots Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Aluminum Ingots Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Aluminum Ingots Market Outlook by Segments

7.1 Aluminum Ingots Market Outlook by Segments, $ Million, 2021- 2032

By End-User

Automotive

Aerospace

Building and Construction

Semiconductor

Electrical and Electronics

Others

8 North America Aluminum Ingots Market Analysis and Outlook To 2032

8.1 Introduction to North America Aluminum Ingots Markets in 2024

8.2 North America Aluminum Ingots Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Aluminum Ingots Market size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace

Building and Construction

Semiconductor

Electrical and Electronics

Others

9 Europe Aluminum Ingots Market Analysis and Outlook To 2032

9.1 Introduction to Europe Aluminum Ingots Markets in 2024

9.2 Europe Aluminum Ingots Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Aluminum Ingots Market Size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace

Building and Construction

Semiconductor

Electrical and Electronics

Others

10 Asia Pacific Aluminum Ingots Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Aluminum Ingots Markets in 2024

10.2 Asia Pacific Aluminum Ingots Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Aluminum Ingots Market size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace

Building and Construction

Semiconductor

Electrical and Electronics

Others

11 South America Aluminum Ingots Market Analysis and Outlook To 2032

11.1 Introduction to South America Aluminum Ingots Markets in 2024

11.2 South America Aluminum Ingots Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Aluminum Ingots Market size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace

Building and Construction

Semiconductor

Electrical and Electronics

Others

12 Middle East and Africa Aluminum Ingots Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Aluminum Ingots Markets in 2024

12.2 Middle East and Africa Aluminum Ingots Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Aluminum Ingots Market size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace

Building and Construction

Semiconductor

Electrical and Electronics

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Alcoa Inc

Aluminium Bahrain

Aluminum Corp of China Ltd

BHP Billiton

China Zhongwang Holdings Ltd

Dubai Aluminium Company

Hindalco Industries Ltd

JBMI

Norsk Hydro ASA

Rio Tinto Group

RUSAL Plc

SPIC Inc

United Company

Xinfa Group Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By End-User

Automotive

Aerospace

Building and Construction

Semiconductor

Electrical and Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Aluminum Ingots Market Size is valued at $86.3 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.4% to reach $141.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alcoa Inc, Aluminium Bahrain, Aluminum Corp of China Ltd, BHP Billiton, China Zhongwang Holdings Ltd, Dubai Aluminium Company, Hindalco Industries Ltd, JBMI, Norsk Hydro ASA, Rio Tinto Group, RUSAL Plc, SPIC Inc, United Company, Xinfa Group Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume