The global Aluminum Curtain Walls Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Stick Built, Semi Unitized, Unitized), By Installation (ew Construction, Refurbishment), By End-User (Residential, Commercial).

The market for aluminum curtain walls is undergoing a transformation driven by advancements in architectural design, energy efficiency, and sustainability. Key trends shaping the future of this industry include the development of lightweight and high-strength aluminum alloys that offer enhanced structural performance and design flexibility, allowing architects to create innovative and visually striking building facades. Additionally, advancements in curtain wall systems, such as thermally broken designs and integrated insulation, improve energy efficiency and indoor comfort while reducing heating and cooling costs. Moreover, the adoption of sustainable building practices, such as green certifications and lifecycle assessments, drives the demand for aluminum curtain walls as they contribute to energy savings, material recyclability, and durability. As architects and developers prioritize sustainable and aesthetically pleasing building envelopes, the demand for aluminum curtain walls is expected to continue growing, driving innovation and market expansion in this sector.

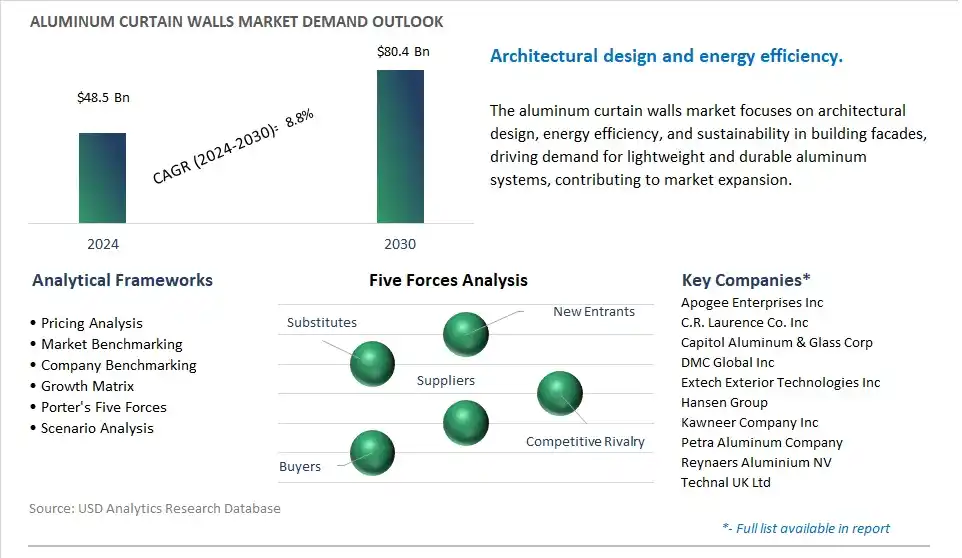

The market report analyses the leading companies in the industry including Apogee Enterprises Inc, C.R. Laurence Co. Inc, Capitol Aluminum & Glass Corp, DMC Global Inc, Extech Exterior Technologies Inc, Hansen Group, Kawneer Company Inc, Petra Aluminum Company, Reynaers Aluminium NV, Technal UK Ltd.

Aluminum curtain wall vendors are increasing adoption of sustainable building materials, driven by a growing emphasis on environmental responsibility and energy efficiency in construction projects. Aluminum curtain walls offer several sustainability advantages, including recyclability, durability, and thermal performance, making them a preferred choice for architects and developers seeking green building solutions. With stricter building codes, green building certifications, and sustainability goals driving construction practices, there is a rising demand for aluminum curtain walls as a sustainable alternative to traditional building materials.

A key driver propelling the market for aluminum curtain walls is urbanization and infrastructure development, particularly in emerging economies experiencing rapid urban growth and modernization. Aluminum curtain walls are extensively used in commercial buildings, office towers, residential complexes, and institutional facilities to provide structural support, weather protection, and aesthetic appeal. With increasing urbanization, population migration to cities, and investment in infrastructure projects, there is a growing demand for modern building facades that offer architectural flexibility, energy efficiency, and design versatility. The need for innovative building solutions to meet the demands of urban development drives market demand for aluminum curtain walls as essential components in contemporary construction projects.

The integration of advanced technologies and design innovations to enhance performance, functionality, and aesthetics present strong growth prospects. Manufacturers aim to capitalize on this opportunity by developing aluminum curtain wall systems with features such as energy-efficient glazing, integrated shading systems, and smart building controls that optimize natural light, indoor comfort, and energy usage. Additionally, there is potential for the incorporation of digital fabrication techniques, parametric design tools, and sustainable materials to create bespoke curtain wall solutions that meet the unique requirements of architects, developers, and building owners. By offering innovative curtain wall systems that combine technology-driven performance with architectural excellence, manufacturers aim to gain market shares in the market, attract high-value projects, and drive growth in the aluminum curtain walls sector.

The aluminum curtain wall market involves diverse key stages, with aluminum production, where major players including Rio Tinto and Alcoa Corporation supply aluminum ingots. Aluminum extrusion companies including Sapa Profiles Inc. and Hydro Extrusion then shape these ingots into various profiles for curtain wall framing, with manufacturers having in-house extrusion capabilities.

Glass fabrication follows, with companies including Asahi Glass Co., Ltd. and Saint-Gobain S.A. manufacturing insulated glass units and pre-cutting glass panels for curtain wall assembly. Architectural firms and engineering companies handle curtain wall design and engineering, specifying materials and profiles, while curtain wall fabrication companies including Permasteelisa Group and Kawneer Company, Inc. fabricate and assemble curtain wall panels. Specialist installation companies then install the curtain wall systems on buildings, with subsequent maintenance and after-sales service provided by specialist facade maintenance companies, curtain wall manufacturers, and building maintenance service providers.

Key players include major aluminum producers including Norsk Hydro ASA, aluminum extrusion companies including Hydro Extrusion, and architectural glass manufacturers including Asahi Glass Co., Ltd. Curtain wall fabrication companies including Permasteelisa Group and specialist installation companies contribute to the market's growth, supported by architectural firms and engineering companies involved in design and engineering.

In the Aluminum Curtain Walls Market, the unitized segment is the largest, driven by diverse pivotal factors. Unitized curtain wall systems offer numerous advantages over stick-built and semi-unitized systems, making them increasingly popular among architects, developers, and contractors. Unitized systems are prefabricated off-site, allowing for faster installation and reduced on-site labor costs. In addition, the factory-controlled manufacturing process ensures higher quality and precision in fabrication, leading to improved performance and durability of the curtain wall system. Additionally, unitized systems offer enhanced thermal and acoustic insulation, contributing to energy efficiency and occupant comfort. The growing trend toward sustainable building practices and green certifications has further boosted the adoption of unitized curtain walls, as they allow for greater control over material waste and energy consumption during construction. As urbanization continues to drive demand for high-rise buildings and commercial developments, the unitized segment is expected to maintain its dominance in the aluminum curtain walls market.

In the Aluminum Curtain Walls Market, the new construction segment is the fastest-growing sector, driven by diverse significant factors. As urbanization continues to accelerate and new commercial and residential developments emerge worldwide, there is a growing demand for innovative and aesthetically pleasing building facades. Aluminum curtain walls are favored by architects and developers for their versatility, durability, and modern appearance, making them a popular choice for new construction projects. Additionally, advancements in building technologies and materials have led to the development of more efficient and cost-effective curtain wall systems, further fueling their adoption in new construction. In addition, stringent building regulations and codes aimed at improving energy efficiency and safety have led to an increased emphasis on high-performance building envelopes, driving the demand for aluminum curtain walls in new construction applications. As the global construction industry continues to expand, particularly in emerging markets, the new construction segment is expected to sustain its rapid growth trajectory in the aluminum curtain walls market.

In the Aluminum Curtain Walls Market, the commercial segment is the fastest-growing sector, driven by diverse significant factors. Commercial buildings, including office complexes, shopping malls, hotels, and institutional facilities, increasingly demand curtain wall systems to create visually appealing facades while maximizing natural light and energy efficiency. Aluminum curtain walls offer architects and developers the flexibility to design striking and modern exteriors that enhance the overall aesthetic appeal of commercial structures. Additionally, the trend toward sustainable building practices has propelled the adoption of aluminum curtain walls in commercial construction, as they contribute to improved thermal performance and energy savings. In addition, the rapid urbanization and economic growth in emerging markets have led to a surge in commercial construction activities, further driving the demand for aluminum curtain walls. As businesses seek to create iconic landmarks and functional spaces, the commercial segment is poised to continue its rapid growth trajectory in the aluminum curtain walls market.

By Type

Stick Built

Semi Unitized

Unitized

By Installation

New Construction

Refurbishment

By End-User

Residential

Commercial

Apogee Enterprises Inc

C.R. Laurence Co. Inc

Capitol Aluminum & Glass Corp

DMC Global Inc

Extech Exterior Technologies Inc

Hansen Group

Kawneer Company Inc

Petra Aluminum Company

Reynaers Aluminium NV

Technal UK Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Aluminum Curtain Walls Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Aluminum Curtain Walls Market Size Outlook, $ Million, 2021 to 2030

3.2 Aluminum Curtain Walls Market Outlook by Type, $ Million, 2021 to 2030

3.3 Aluminum Curtain Walls Market Outlook by Product, $ Million, 2021 to 2030

3.4 Aluminum Curtain Walls Market Outlook by Application, $ Million, 2021 to 2030

3.5 Aluminum Curtain Walls Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Aluminum Curtain Walls Industry

4.2 Key Market Trends in Aluminum Curtain Walls Industry

4.3 Potential Opportunities in Aluminum Curtain Walls Industry

4.4 Key Challenges in Aluminum Curtain Walls Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Aluminum Curtain Walls Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Aluminum Curtain Walls Market Outlook by Segments

7.1 Aluminum Curtain Walls Market Outlook by Segments, $ Million, 2021- 2030

By Type

Stick Built

Semi Unitized

Unitized

By Installation

New Construction

Refurbishment

By End-User

Residential

Commercial

8 North America Aluminum Curtain Walls Market Analysis and Outlook To 2030

8.1 Introduction to North America Aluminum Curtain Walls Markets in 2024

8.2 North America Aluminum Curtain Walls Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Aluminum Curtain Walls Market size Outlook by Segments, 2021-2030

By Type

Stick Built

Semi Unitized

Unitized

By Installation

New Construction

Refurbishment

By End-User

Residential

Commercial

9 Europe Aluminum Curtain Walls Market Analysis and Outlook To 2030

9.1 Introduction to Europe Aluminum Curtain Walls Markets in 2024

9.2 Europe Aluminum Curtain Walls Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Aluminum Curtain Walls Market Size Outlook by Segments, 2021-2030

By Type

Stick Built

Semi Unitized

Unitized

By Installation

New Construction

Refurbishment

By End-User

Residential

Commercial

10 Asia Pacific Aluminum Curtain Walls Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Aluminum Curtain Walls Markets in 2024

10.2 Asia Pacific Aluminum Curtain Walls Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Aluminum Curtain Walls Market size Outlook by Segments, 2021-2030

By Type

Stick Built

Semi Unitized

Unitized

By Installation

New Construction

Refurbishment

By End-User

Residential

Commercial

11 South America Aluminum Curtain Walls Market Analysis and Outlook To 2030

11.1 Introduction to South America Aluminum Curtain Walls Markets in 2024

11.2 South America Aluminum Curtain Walls Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Aluminum Curtain Walls Market size Outlook by Segments, 2021-2030

By Type

Stick Built

Semi Unitized

Unitized

By Installation

New Construction

Refurbishment

By End-User

Residential

Commercial

12 Middle East and Africa Aluminum Curtain Walls Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Aluminum Curtain Walls Markets in 2024

12.2 Middle East and Africa Aluminum Curtain Walls Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Aluminum Curtain Walls Market size Outlook by Segments, 2021-2030

By Type

Stick Built

Semi Unitized

Unitized

By Installation

New Construction

Refurbishment

By End-User

Residential

Commercial

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Apogee Enterprises Inc

C.R. Laurence Co. Inc

Capitol Aluminum & Glass Corp

DMC Global Inc

Extech Exterior Technologies Inc

Hansen Group

Kawneer Company Inc

Petra Aluminum Company

Reynaers Aluminium NV

Technal UK Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Stick Built

Semi Unitized

Unitized

By Installation

New Construction

Refurbishment

By End-User

Residential

Commercial

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Aluminum Curtain Walls is forecast to reach $80.4 Billion in 2030 from $48.5 Billion in 2024, registering a CAGR of 8.8% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Apogee Enterprises Inc, C.R. Laurence Co. Inc, Capitol Aluminum & Glass Corp, DMC Global Inc, Extech Exterior Technologies Inc, Hansen Group, Kawneer Company Inc, Petra Aluminum Company, Reynaers Aluminium NV, Technal UK Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume