The global Alkyl Polyglucosides Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Raw Material (Fatty Alcohol, Glucose, Others), By Application (Personal Care, Home Care, Industrial, Textile, Others).

The market for alkyl polyglucosides (APGs) is witnessing significant growth driven by the increasing demand for sustainable and biodegradable surfactants in various applications such as personal care, household cleaning, and industrial formulations. Key trends shaping the future of this industry include the development of APG-based surfactants with enhanced performance characteristics such as foaming, wetting, and emulsification properties, enabling their use as effective alternatives to traditional petroleum-based surfactants. Additionally, advancements in green chemistry and bioprocessing techniques enable the production of APGs from renewable feedstocks such as corn, wheat, and sugarcane, reducing reliance on fossil resources and minimizing environmental impact. Moreover, the adoption of APGs in eco-friendly formulations and green product lines aligns with consumer preferences for sustainable and environmentally responsible products, driving market growth and fostering innovation in the surfactants industry.

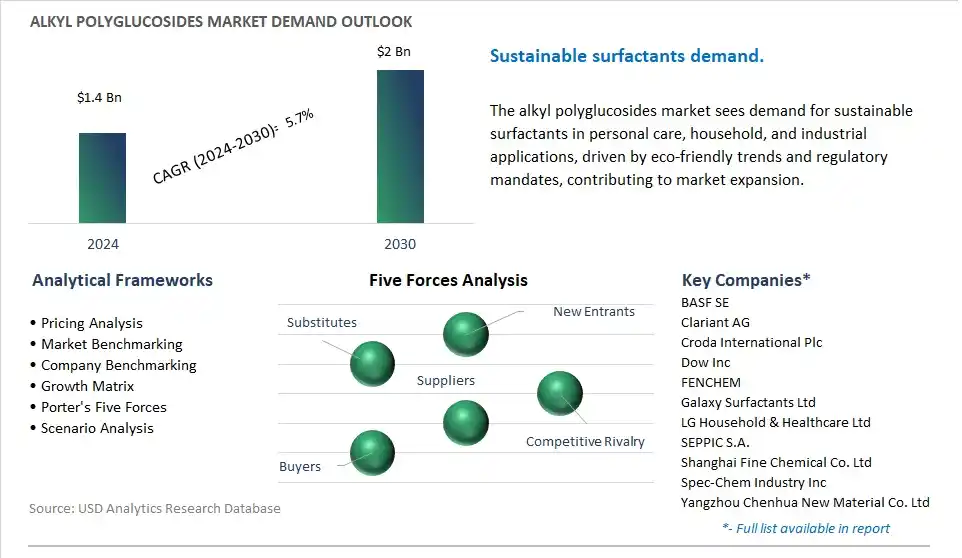

The market report analyses the leading companies in the industry including BASF SE, Clariant AG, Croda International Plc, Dow Inc, FENCHEM, Galaxy Surfactants Ltd, LG Household & Healthcare Ltd, SEPPIC S.A., Shanghai Fine Chemical Co. Ltd, Spec-Chem Industry Inc, Yangzhou Chenhua New Material Co. Ltd.

The rising demand for eco-friendly surfactants, driven by increasing environmental awareness and initiatives to reduce the use of conventional surfactants derived from petrochemicals. APGs are non-ionic surfactants derived from renewable resources such as glucose and fatty alcohols, making them biodegradable, non-toxic, and environmentally friendly. With growing concerns over pollution and sustainability, there is a shift towards the adoption of APGs in various applications including personal care, household cleaning, and industrial formulations.

A key driver propelling the market for alkyl polyglucosides is the consumer preference for natural and safe ingredients in personal care, home care, and cosmetic products. With increasing awareness of the potential health risks associated with synthetic chemicals and petroleum-based ingredients, consumers are seeking products formulated with natural, plant-derived ingredients such as APGs. APGs offer a safe and gentle alternative to conventional surfactants, suitable for sensitive skin and eco-conscious consumers. As consumer demand for natural and sustainable products continues to grow, manufacturers are incorporating APGs into their formulations to meet market preferences and gain a competitive edge. The consumer preference for natural and safe ingredients drives market demand for alkyl polyglucosides as key components in green formulations.

Alkyl polyglucosides companies are investing in the expansion into new applications and markets beyond traditional personal care and home care sectors. While APGs are widely used in cosmetics, shampoos, and dishwashing detergents, there is potential for their adoption in emerging markets such as agriculture, textiles, and oilfield chemicals. Manufacturers aim to capitalize on this opportunity by developing specialized APG formulations tailored to the specific needs of these industries, such as bio-based pesticides, eco-friendly textile auxiliaries, and environmentally friendly drilling fluids.

The Alkyl Polyglucosides (APG) Market begins with raw material production, involving the creation of fatty alcohols from plant-based oils and glucose derived from starch-rich crops. Companies including BASF SE and Stepan Company specialize in fatty alcohol production, while starch processors including ADM and Cargill supply glucose. The next stage encompasses APG production, where chemical companies including BASF and Seppic engage in the chemical reaction between fatty alcohols and glucose to create APGs, tailored for specific properties. Purification and processing follow suit, typically managed by the companies involved in APG production, ensuring the product meets desired specifications.

Distribution and sales efforts are crucial for reaching industrial end-users across sectors including cosmetics, personal care, homecare detergents, industrial cleaning, textile processing, and even food and beverage to a limited extent. Chemical distributors including Brenntag AG and APG manufacturers facilitate the warehousing and distribution process, catering to diverse industries.

End users, including cosmetics and personal care companies including L'Oreal and Unilever, homecare detergent manufacturers including Procter & Gamble and Henkel AG, as well as industrial cleaning product companies, rely on APGs for their biodegradability, sustainability benefits, and gentle cleansing properties, highlighting their importance across various industries.

Within the Alkyl Polyglucosides Market, the glucose segment is the largest, driven by diverse pivotal factors. Glucose, a natural sugar derived from plants such as corn, wheat, and potatoes, serves as a primary raw material in the production of alkyl polyglucosides (APGs). APGs are non-ionic surfactants known for their excellent biodegradability, low toxicity, and mildness, making them highly sought after in various industries including personal care, household cleaning, and industrial applications. The abundance and renewability of glucose as a raw material make it a cost-effective and sustainable choice for APG production, contributing to its dominance in the market. Additionally, the growing consumer preference for eco-friendly and naturally derived ingredients in consumer products has further bolstered the demand for APGs derived from glucose. As industries continue to prioritize sustainability and environmental responsibility, the glucose segment is expected to maintain its leading position in the alkyl polyglucosides market.

Among the diverse applications in the Alkyl Polyglucosides Market, the home care segment is the fastest-growing sector, driven by diverse significant factors. Alkyl polyglucosides (APGs) are increasingly being utilized in home care products such as laundry detergents, dishwashing liquids, and surface cleaners due to their excellent cleaning performance, biodegradability, and mildness. As consumers become more conscious of the environmental impact of traditional cleaning chemicals and seek safer alternatives for use in their homes, the demand for APG-based home care products has surged. In addition, the rising trend toward sustainable living and eco-friendly practices has propelled the adoption of APGs by manufacturers of home care products, further driving growth in this segment. Additionally, advancements in APG formulations, including improved solubility and compatibility with other ingredients, have expanded their applicability in a wide range of home care formulations, contributing to the rapid growth of the home care segment in the alkyl polyglucosides market.

By Raw Material

Fatty Alcohol

Glucose

Others

By Application

Personal Care

Home Care

Industrial

Textile

Others

BASF SE

Clariant AG

Croda International Plc

Dow Inc

FENCHEM

Galaxy Surfactants Ltd

LG Household & Healthcare Ltd

SEPPIC S.A.

Shanghai Fine Chemical Co. Ltd

Spec-Chem Industry Inc

Yangzhou Chenhua New Material Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Alkyl Polyglucosides Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Alkyl Polyglucosides Market Size Outlook, $ Million, 2021 to 2030

3.2 Alkyl Polyglucosides Market Outlook by Type, $ Million, 2021 to 2030

3.3 Alkyl Polyglucosides Market Outlook by Product, $ Million, 2021 to 2030

3.4 Alkyl Polyglucosides Market Outlook by Application, $ Million, 2021 to 2030

3.5 Alkyl Polyglucosides Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Alkyl Polyglucosides Industry

4.2 Key Market Trends in Alkyl Polyglucosides Industry

4.3 Potential Opportunities in Alkyl Polyglucosides Industry

4.4 Key Challenges in Alkyl Polyglucosides Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Alkyl Polyglucosides Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Alkyl Polyglucosides Market Outlook by Segments

7.1 Alkyl Polyglucosides Market Outlook by Segments, $ Million, 2021- 2030

By Raw Material

Fatty Alcohol

Glucose

Others

By Application

Personal Care

Home Care

Industrial

Textile

Others

8 North America Alkyl Polyglucosides Market Analysis and Outlook To 2030

8.1 Introduction to North America Alkyl Polyglucosides Markets in 2024

8.2 North America Alkyl Polyglucosides Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Alkyl Polyglucosides Market size Outlook by Segments, 2021-2030

By Raw Material

Fatty Alcohol

Glucose

Others

By Application

Personal Care

Home Care

Industrial

Textile

Others

9 Europe Alkyl Polyglucosides Market Analysis and Outlook To 2030

9.1 Introduction to Europe Alkyl Polyglucosides Markets in 2024

9.2 Europe Alkyl Polyglucosides Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Alkyl Polyglucosides Market Size Outlook by Segments, 2021-2030

By Raw Material

Fatty Alcohol

Glucose

Others

By Application

Personal Care

Home Care

Industrial

Textile

Others

10 Asia Pacific Alkyl Polyglucosides Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Alkyl Polyglucosides Markets in 2024

10.2 Asia Pacific Alkyl Polyglucosides Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Alkyl Polyglucosides Market size Outlook by Segments, 2021-2030

By Raw Material

Fatty Alcohol

Glucose

Others

By Application

Personal Care

Home Care

Industrial

Textile

Others

11 South America Alkyl Polyglucosides Market Analysis and Outlook To 2030

11.1 Introduction to South America Alkyl Polyglucosides Markets in 2024

11.2 South America Alkyl Polyglucosides Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Alkyl Polyglucosides Market size Outlook by Segments, 2021-2030

By Raw Material

Fatty Alcohol

Glucose

Others

By Application

Personal Care

Home Care

Industrial

Textile

Others

12 Middle East and Africa Alkyl Polyglucosides Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Alkyl Polyglucosides Markets in 2024

12.2 Middle East and Africa Alkyl Polyglucosides Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Alkyl Polyglucosides Market size Outlook by Segments, 2021-2030

By Raw Material

Fatty Alcohol

Glucose

Others

By Application

Personal Care

Home Care

Industrial

Textile

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

Clariant AG

Croda International Plc

Dow Inc

FENCHEM

Galaxy Surfactants Ltd

LG Household & Healthcare Ltd

SEPPIC S.A.

Shanghai Fine Chemical Co. Ltd

Spec-Chem Industry Inc

Yangzhou Chenhua New Material Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Raw Material

Fatty Alcohol

Glucose

Others

By Application

Personal Care

Home Care

Industrial

Textile

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Alkyl Polyglucosides is forecast to reach $2 Billion in 2030 from $1.4 Billion in 2024, registering a CAGR of 5.7% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, Clariant AG, Croda International Plc, Dow Inc, FENCHEM, Galaxy Surfactants Ltd, LG Household & Healthcare Ltd, SEPPIC S.A., Shanghai Fine Chemical Co. Ltd, Spec-Chem Industry Inc, Yangzhou Chenhua New Material Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume