The global Agriculture Grade Zinc Chemicals Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Zinc Oxide, Zinc Sulphate, EDTA, Chelated Zinc, Sulphur Zinc Bentonite, Zinc Chloride, Others), By Application (Animal Feed, Chemical Fertilizer, Others).

The market for agriculture grade zinc chemicals is experiencing significant growth driven by the increasing awareness of zinc's crucial role in crop nutrition and soil health. Key trends shaping the future of this industry include the development of innovative zinc fertilizers and soil amendments tailored to different crops, soil types, and regional agricultural practices. Additionally, advancements in zinc chelates and micronutrient formulations enhance the bioavailability and uptake of zinc by plants, ensuring optimal growth, yield, and nutritional quality. Moreover, the adoption of precision agriculture technologies, such as soil mapping and nutrient management software, enables targeted application of zinc fertilizers based on crop needs and soil deficiencies, maximizing resource efficiency and minimizing environmental impact. As farmers seek to improve crop productivity, resilience, and nutritional value in the face of climate change and growing global food demand, the demand for agriculture grade zinc chemicals is expected to continue growing, driving innovation and market expansion in this sector.

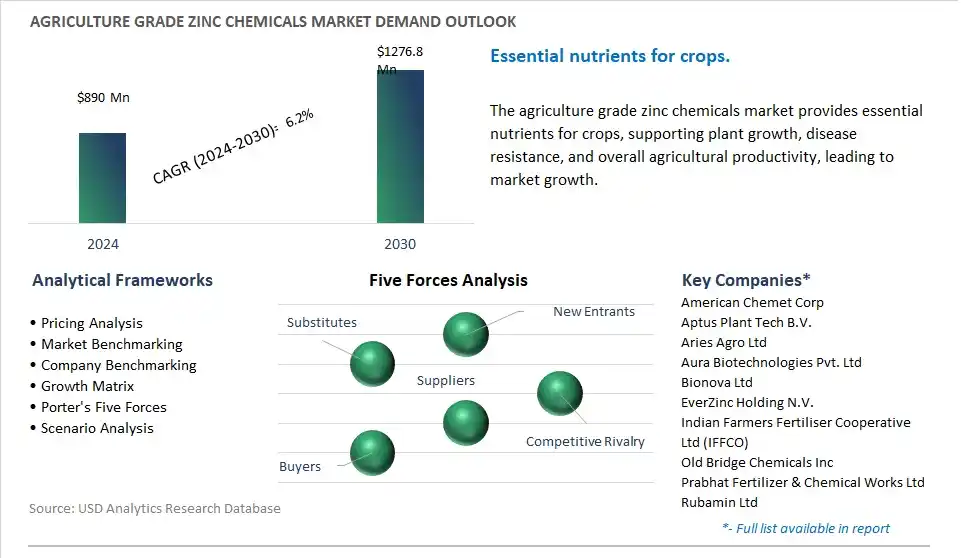

The market report analyses the leading companies in the industry including American Chemet Corp, Aptus Plant Tech B.V., Aries Agro Ltd, Aura Biotechnologies Pvt. Ltd, Bionova Ltd, EverZinc Holding N.V., Indian Farmers Fertiliser Cooperative Ltd (IFFCO), Old Bridge Chemicals Inc, Prabhat Fertilizer & Chemical Works Ltd, Rubamin Ltd, Sulphur Mills Ltd, Syngenta Crop Protection AG (ChemChina), Tiger-Sul Products LLC, UPL Ltd, Yara International ASA, YK Laboratories, Zochem Inc, Zochem LLC.

Zinc is an essential micronutrient for plant growth and development, playing a crucial role in various physiological processes such as photosynthesis, enzyme activity, and hormone regulation. However, many soils are deficient in zinc, leading to decreased crop yields and quality. To address this deficiency, farmers are incorporating zinc fertilizers into their soil management practices to enhance crop productivity and ensure optimal nutrient uptake by plants.

A key driver propelling the market for agriculture-grade zinc chemicals is the rising demand for high-quality crops and nutrient-rich foods among consumers worldwide. As awareness of the link between diet and health grows, there is increasing demand for fruits, vegetables, and grains that are rich in essential nutrients such as zinc. Zinc plays a critical role in human health, supporting immune function, growth, and development. Accordngly, there is a growing emphasis on optimizing zinc levels in agricultural soils to produce crops with higher nutritional value and better health benefits. The demand for agriculture-grade zinc chemicals is driven by the need to address zinc deficiencies in soils and ensure the production of nutrient-rich foods to meet consumer preferences for healthy and sustainable diets.

Development of innovative formulations to enhance zinc availability, efficiency, and uptake by plants is widely observed. Manufacturers aim to capitalize on this opportunity by investing in research and development to develop zinc fertilizers with improved solubility, stability, and compatibility with different soil types and cropping systems. Additionally, there is potential for the development of zinc chelates, complexes, or nanostructures that offer enhanced nutrient delivery and utilization by crops. By offering innovative zinc formulations that address the specific needs of farmers and agronomic conditions, manufacturers aim to gain market shares in the market and meet the growing demand for effective zinc fertilizers.

The Agriculture Grade Zinc Chemicals Market encompasses diverse crucial stages, with mining companies including Glencore plc and Teck Resources Limited, which extract zinc ore and process it to obtain zinc concentrates. Smelting and refining companies including Nyrstar NV and Korea Zinc Co., Ltd. then convert these concentrates into metallic zinc through various techniques. Further, specialty chemical companies including Umicore and Prayon SA transform refined zinc metal into agriculture-grade zinc chemicals, including Zinc Oxide and Zinc Sulfate. Distribution and sales are handled by agricultural input distributors including Nutrien Ltd., which supplies zinc chemicals to fertilizer manufacturers and large farms.

Further, farmers, the end users, apply these zinc chemicals to their crops to enhance plant health and yields, considering factors including product choice, nutrient availability, environmental impact, and regulatory compliance throughout the Market Ecosystem.

The Zinc Sulphate segment is the largest segment in the Agriculture Grade Zinc Chemicals Market due to its widespread use and versatility in agricultural applications. Zinc sulphate is a highly soluble compound that provides a readily available source of zinc, an essential micronutrient for plant growth and development. It is commonly used as a zinc fertilizer to correct zinc deficiencies in soils and crops, particularly in regions where zinc availability is limited. Zinc sulphate helps enhance plant health, root development, and overall crop productivity by promoting enzyme activity, photosynthesis, and nutrient uptake. In addition, zinc sulphate can be applied through various methods such as foliar sprays, soil applications, and fertigation, making it suitable for different cropping systems and agronomic practices. With increasing awareness of the importance of micronutrient management in agriculture and the growing emphasis on sustainable crop production, the demand for zinc sulphate as a key component of zinc fertilizers continues to rise, solidifying its position as the largest segment in the Agriculture Grade Zinc Chemicals Market.

The Animal Feed segment is the fastest-growing segment in the agriculture-grade zinc Chemicals Market due to the increasing awareness of zinc's crucial role in animal nutrition and health. Zinc is an essential micronutrient for animals, playing key roles in immune function, growth, reproduction, and overall metabolic processes. Zinc deficiency in livestock can lead to reduced growth rates, impaired immune response, and increased susceptibility to diseases, resulting in significant economic losses for farmers and livestock producers. As a result, there is a growing trend toward supplementing animal diets with zinc to meet nutritional requirements and optimize animal performance. Zinc compounds such as zinc oxide and zinc sulphate are commonly added to animal feed formulations to ensure adequate zinc intake. In addition, with the rising demand for high-quality animal products and the increasing focus on animal welfare and health, the use of zinc additives in animal feed is expected to continue expanding rapidly, driving the growth of the Animal Feed segment in the Agriculture Grade Zinc Chemicals Market.

By Type

Zinc Oxide

Zinc Sulphate

EDTA

Chelated Zinc

Sulphur Zinc Bentonite

Zinc Chloride

Others

By Application

Animal Feed

Chemical Fertilizer

Others

American Chemet Corp

Aptus Plant Tech B.V.

Aries Agro Ltd

Aura Biotechnologies Pvt. Ltd

Bionova Ltd

EverZinc Holding N.V.

Indian Farmers Fertiliser Cooperative Ltd (IFFCO)

Old Bridge Chemicals Inc

Prabhat Fertilizer & Chemical Works Ltd

Rubamin Ltd

Sulphur Mills Ltd

Syngenta Crop Protection AG (ChemChina)

Tiger-Sul Products LLC

UPL Ltd

Yara International ASA

YK Laboratories

Zochem Inc

Zochem LLC

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Agriculture Grade Zinc Chemicals Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Agriculture Grade Zinc Chemicals Market Size Outlook, $ Million, 2021 to 2030

3.2 Agriculture Grade Zinc Chemicals Market Outlook by Type, $ Million, 2021 to 2030

3.3 Agriculture Grade Zinc Chemicals Market Outlook by Product, $ Million, 2021 to 2030

3.4 Agriculture Grade Zinc Chemicals Market Outlook by Application, $ Million, 2021 to 2030

3.5 Agriculture Grade Zinc Chemicals Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Agriculture Grade Zinc Chemicals Industry

4.2 Key Market Trends in Agriculture Grade Zinc Chemicals Industry

4.3 Potential Opportunities in Agriculture Grade Zinc Chemicals Industry

4.4 Key Challenges in Agriculture Grade Zinc Chemicals Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Agriculture Grade Zinc Chemicals Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Agriculture Grade Zinc Chemicals Market Outlook by Segments

7.1 Agriculture Grade Zinc Chemicals Market Outlook by Segments, $ Million, 2021- 2030

By Type

Zinc Oxide

Zinc Sulphate

EDTA

Chelated Zinc

Sulphur Zinc Bentonite

Zinc Chloride

Others

By Application

Animal Feed

Chemical Fertilizer

Others

8 North America Agriculture Grade Zinc Chemicals Market Analysis and Outlook To 2030

8.1 Introduction to North America Agriculture Grade Zinc Chemicals Markets in 2024

8.2 North America Agriculture Grade Zinc Chemicals Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Agriculture Grade Zinc Chemicals Market size Outlook by Segments, 2021-2030

By Type

Zinc Oxide

Zinc Sulphate

EDTA

Chelated Zinc

Sulphur Zinc Bentonite

Zinc Chloride

Others

By Application

Animal Feed

Chemical Fertilizer

Others

9 Europe Agriculture Grade Zinc Chemicals Market Analysis and Outlook To 2030

9.1 Introduction to Europe Agriculture Grade Zinc Chemicals Markets in 2024

9.2 Europe Agriculture Grade Zinc Chemicals Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Agriculture Grade Zinc Chemicals Market Size Outlook by Segments, 2021-2030

By Type

Zinc Oxide

Zinc Sulphate

EDTA

Chelated Zinc

Sulphur Zinc Bentonite

Zinc Chloride

Others

By Application

Animal Feed

Chemical Fertilizer

Others

10 Asia Pacific Agriculture Grade Zinc Chemicals Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Agriculture Grade Zinc Chemicals Markets in 2024

10.2 Asia Pacific Agriculture Grade Zinc Chemicals Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Agriculture Grade Zinc Chemicals Market size Outlook by Segments, 2021-2030

By Type

Zinc Oxide

Zinc Sulphate

EDTA

Chelated Zinc

Sulphur Zinc Bentonite

Zinc Chloride

Others

By Application

Animal Feed

Chemical Fertilizer

Others

11 South America Agriculture Grade Zinc Chemicals Market Analysis and Outlook To 2030

11.1 Introduction to South America Agriculture Grade Zinc Chemicals Markets in 2024

11.2 South America Agriculture Grade Zinc Chemicals Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Agriculture Grade Zinc Chemicals Market size Outlook by Segments, 2021-2030

By Type

Zinc Oxide

Zinc Sulphate

EDTA

Chelated Zinc

Sulphur Zinc Bentonite

Zinc Chloride

Others

By Application

Animal Feed

Chemical Fertilizer

Others

12 Middle East and Africa Agriculture Grade Zinc Chemicals Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Agriculture Grade Zinc Chemicals Markets in 2024

12.2 Middle East and Africa Agriculture Grade Zinc Chemicals Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Agriculture Grade Zinc Chemicals Market size Outlook by Segments, 2021-2030

By Type

Zinc Oxide

Zinc Sulphate

EDTA

Chelated Zinc

Sulphur Zinc Bentonite

Zinc Chloride

Others

By Application

Animal Feed

Chemical Fertilizer

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

American Chemet Corp

Aptus Plant Tech B.V.

Aries Agro Ltd

Aura Biotechnologies Pvt. Ltd

Bionova Ltd

EverZinc Holding N.V.

Indian Farmers Fertiliser Cooperative Ltd (IFFCO)

Old Bridge Chemicals Inc

Prabhat Fertilizer & Chemical Works Ltd

Rubamin Ltd

Sulphur Mills Ltd

Syngenta Crop Protection AG (ChemChina)

Tiger-Sul Products LLC

UPL Ltd

Yara International ASA

YK Laboratories

Zochem Inc

Zochem LLC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Zinc Oxide

Zinc Sulphate

EDTA

Chelated Zinc

Sulphur Zinc Bentonite

Zinc Chloride

Others

By Application

Animal Feed

Chemical Fertilizer

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Agriculture Grade Zinc Chemicals is forecast to reach $1276.8 Million in 2030 from $890 Million in 2024, registering a CAGR of 6.2% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

American Chemet Corp, Aptus Plant Tech B.V., Aries Agro Ltd, Aura Biotechnologies Pvt. Ltd, Bionova Ltd, EverZinc Holding N.V., Indian Farmers Fertiliser Cooperative Ltd (IFFCO), Old Bridge Chemicals Inc, Prabhat Fertilizer & Chemical Works Ltd, Rubamin Ltd, Sulphur Mills Ltd, Syngenta Crop Protection AG (ChemChina), Tiger-Sul Products LLC, UPL Ltd, Yara International ASA, YK Laboratories, Zochem Inc, Zochem LLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume