The global Adhesives and Sealants Distribution Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Adhesives Technology (Water-borne, Solvent-borne, Reactive, Hot Melt, Others), By Sealant Product (Silicone, Polyurethane, Acrylic, Polyvinyl Acetate, Others), By End-User (Building and Construction, Paper, Board, and Packaging, Transportation, Woodworking, Footwear and Leather, Healthcare, Electrical and Electronics, Others), By Distribution Channel (Direct Selling, Traditional Trade, Modern Trade).

Adhesives and sealants distribution involves the sourcing, procurement, and distribution of a wide range of adhesive and sealant products to various industries and end-users in 2024. Distributors play a crucial role in the supply chain by connecting manufacturers of adhesives and sealants with customers and end-users seeking reliable and high-quality products for their applications. Adhesives and sealants distributors typically maintain extensive inventories of products from multiple manufacturers, offering a diverse selection of adhesives, sealants, tapes, and related accessories to meet the needs of different industries and applications. These distributors provide value-added services such as technical support, product customization, and logistics solutions to ensure timely delivery and optimal performance of adhesive and sealant products. With their expertise in product selection, industry knowledge, and customer service, adhesives and sealants distributors play a vital role in facilitating the efficient and cost-effective procurement of adhesive and sealant solutions for diverse applications in industries such as automotive, construction, aerospace, electronics, and packaging.

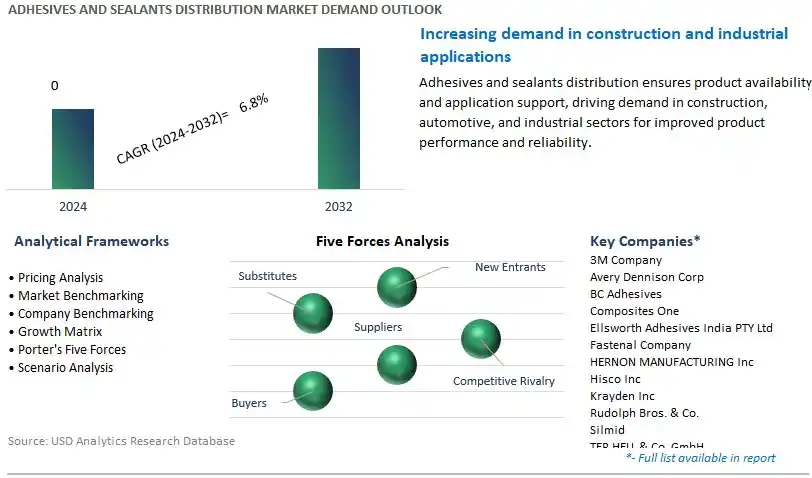

The market report analyses the leading companies in the industry including 3M Company, Avery Dennison Corp, BC Adhesives, Composites One, Ellsworth Adhesives India PTY Ltd, Fastenal Company, HERNON MANUFACTURING Inc, Hisco Inc, Krayden Inc, Rudolph Bros. & Co., Silmid, TER HELL & Co. GmbH, W.W. Grainger Inc, and others.

A prominent trend in the adhesives and sealants distribution market is the increasing shift towards online distribution channels. With the rise of e-commerce platforms and digitalization trends, buyers are increasingly opting for the convenience and accessibility offered by online purchasing channels. This trend is further accelerated by factors such as the COVID-19 pandemic, which has highlighted the importance of digital platforms for business continuity. As a result, distributors in the adhesives and sealants market are investing in robust online platforms, expanding their digital presence, and leveraging technology to streamline the ordering process, enhance customer experience, and reach a wider audience.

The primary driver fueling the growth of the adhesives and sealants distribution market is the sustained demand from various end-use industries such as automotive, construction, packaging, and electronics. Adhesives and sealants play a critical role in bonding, sealing, and protecting components and structures across these sectors, driving the need for efficient distribution networks to ensure timely availability of products. Moreover, factors such as urbanization, infrastructure development, and advancements in manufacturing processes are further propelling market demand. Distributors are capitalizing on these opportunities by expanding their product portfolios, strengthening partnerships with manufacturers, and optimizing supply chain operations to meet evolving customer requirements.

An emerging opportunity within the adhesives and sealants distribution market lies in the provision of value-added services and customization options to meet the specific needs of customers. As buyers increasingly seek tailored solutions and technical support, distributors can differentiate themselves by offering services such as product selection assistance, technical training, application support, and custom packaging solutions. By partnering closely with manufacturers and leveraging their expertise, distributors can provide comprehensive solutions that address the unique challenges faced by customers in different industries and applications. Additionally, the adoption of digital tools and data analytics can enable distributors to gain insights into customer preferences and behavior, facilitating personalized offerings and enhancing customer loyalty.

Water-borne adhesives emerge as the largest segment in the Adhesives and Sealants Distribution Market by adhesives technology, owing to their eco-friendliness, versatility, and widespread applications. Water-borne adhesives are formulated using water as a carrier solvent, making them low in volatile organic compounds (VOCs) and environmentally preferable compared to solvent-borne alternatives. This eco-friendly characteristic aligns with growing environmental regulations and consumer preferences for sustainable products. Additionally, water-borne adhesives offer excellent adhesion properties across various substrates, including paper, cardboard, wood, textiles, and plastics, making them suitable for diverse industries such as packaging, woodworking, construction, and automotive. Their ability to form strong bonds, combined with easy clean-up and low odor, enhances their appeal to manufacturers seeking efficient and user-friendly adhesive solutions. Moreover, ongoing advancements in formulation technology have improved the performance and durability of water-borne adhesives, further driving their adoption across industries. As sustainability and performance remain key priorities for manufacturers and end-users alike, the dominance of water-borne adhesives in the market is expected to continue, solidifying their position as the largest segment in the Adhesives and Sealants Distribution Market.

Polyurethane sealants stand out as the fastest-growing segment in the Adhesives and Sealants Distribution Market by sealant product, driven by their exceptional versatility, durability, and broad range of applications. Polyurethane sealants offer superior adhesion to various substrates, including concrete, wood, metal, and plastics, making them ideal for construction, automotive, aerospace, and marine industries. Their ability to withstand extreme weather conditions, temperature fluctuations, and exposure to chemicals and UV radiation makes them highly sought-after for outdoor applications such as sealing joints, cracks, and gaps in building structures, vehicles, and vessels. Moreover, polyurethane sealants exhibit excellent elasticity and movement accommodation, allowing them to accommodate structural movements without compromising adhesion or integrity. This versatility and performance have fuelled the increasing demand for polyurethane sealants across diverse sectors, driving the segment's rapid growth in the Adhesives and Sealants Distribution Market. As industries continue to prioritize durability, sustainability, and performance in sealant applications, polyurethane sealants are expected to maintain their trajectory of robust growth, consolidating their position as the fastest-growing segment in the market.

The Building and Construction sector is the largest segment in the Adhesives and Sealants Distribution Market by end-user, driven by robust construction activities worldwide and the increasing adoption of advanced adhesive and sealant solutions in architectural, civil engineering, and infrastructure projects. Adhesives and sealants play a critical role in the construction industry, facilitating bonding, sealing, and joining of various materials such as concrete, wood, metal, glass, and plastics. In building applications, adhesives are used for installing flooring, wall panels, tiles, and insulation materials, while sealants are employed for sealing joints, cracks, and gaps to enhance structural integrity and weatherproofing. The growing demand for energy-efficient and sustainable building materials has led to increased use of sealants for air and moisture barrier systems, contributing to the segment's growth. Moreover, advancements in adhesive and sealant technologies, such as low-VOC formulations and green building certifications, align with sustainability goals and regulatory requirements, further driving their adoption in the construction sector. As urbanization, infrastructure development, and renovation projects continue to expand globally, the demand for adhesives and sealants in the building and construction industry is expected to remain strong, solidifying its position as the largest segment in the market.

The Modern Trade segment is the fastest-growing in the Adhesives and Sealants Distribution Market by distribution channel, propelled by the evolving retail landscape and shifting consumer preferences towards convenience, variety, and quality assurance. Modern trade channels, including large retail chains, specialty stores, and online platforms, offer a diverse range of adhesive and sealant products from various manufacturers, providing consumers with easy access to a wide selection under one roof or through online platforms. This convenience factor, coupled with the ability to compare products, read reviews, and access detailed product information online, has contributed to the growing popularity of modern trade channels among consumers seeking adhesive and sealant solutions for their diverse needs. Moreover, modern trade channels often offer promotional discounts, loyalty programs, and value-added services, enhancing the overall shopping experience and attracting more consumers. The increasing digitalization of retail and the rise of e-commerce platforms have further accelerated the growth of modern trade channels, enabling seamless transactions, doorstep delivery, and enhanced customer engagement. As consumers continue to prioritize convenience, product availability, and shopping experience, the Modern Trade segment is expected to maintain its rapid growth trajectory in the Adhesives and Sealants Distribution Market.

By Adhesives Technology

Water-borne

-Acrylic

-Polyvinyl Acetate (PVA) Emulsion

-Ethylene Vinyl Acetate (EVA) Emulsion

-Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

-Others

Solvent-borne

-Chloroprene Rubber

-Poly Acrylate (Pas)

-SBC Resin Adhesives

-Others

Reactive

-Polyurethane

-Epoxy

-Cyanoacrylate

-Modified Acrylic

-Anaerobic

-Silicone

-Others

Hot Melt

-Ethylene Vinyl Acetate

-Styrenic Block Copolymers

-Thermoplastic Polyurethane

-Others

Others

By Sealant Product

Silicone

Polyurethane

Acrylic

Polyvinyl Acetate

Others

By End-User

Building and Construction

Paper, Board, and Packaging

Transportation

Woodworking

Footwear and Leather

Healthcare

Electrical and Electronics

Others

By Distribution Channel

Direct Selling

Traditional Trade

Modern TradeCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Avery Dennison Corp

BC Adhesives

Composites One

Ellsworth Adhesives India PTY Ltd

Fastenal Company

HERNON MANUFACTURING Inc

Hisco Inc

Krayden Inc

Rudolph Bros. & Co.

Silmid

TER HELL & Co. GmbH

W.W. Grainger Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Adhesives and Sealants Distribution Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Adhesives and Sealants Distribution Market Size Outlook, $ Million, 2021 to 2032

3.2 Adhesives and Sealants Distribution Market Outlook by Type, $ Million, 2021 to 2032

3.3 Adhesives and Sealants Distribution Market Outlook by Product, $ Million, 2021 to 2032

3.4 Adhesives and Sealants Distribution Market Outlook by Application, $ Million, 2021 to 2032

3.5 Adhesives and Sealants Distribution Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Adhesives and Sealants Distribution Industry

4.2 Key Market Trends in Adhesives and Sealants Distribution Industry

4.3 Potential Opportunities in Adhesives and Sealants Distribution Industry

4.4 Key Challenges in Adhesives and Sealants Distribution Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Adhesives and Sealants Distribution Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Adhesives and Sealants Distribution Market Outlook by Segments

7.1 Adhesives and Sealants Distribution Market Outlook by Segments, $ Million, 2021- 2032

By Adhesives Technology

Water-borne

-Acrylic

-Polyvinyl Acetate (PVA) Emulsion

-Ethylene Vinyl Acetate (EVA) Emulsion

-Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

-Others

Solvent-borne

-Chloroprene Rubber

-Poly Acrylate (Pas)

-SBC Resin Adhesives

-Others

Reactive

-Polyurethane

-Epoxy

-Cyanoacrylate

-Modified Acrylic

-Anaerobic

-Silicone

-Others

Hot Melt

-Ethylene Vinyl Acetate

-Styrenic Block Copolymers

-Thermoplastic Polyurethane

-Others

Others

By Sealant Product

Silicone

Polyurethane

Acrylic

Polyvinyl Acetate

Others

By End-User

Building and Construction

Paper, Board, and Packaging

Transportation

Woodworking

Footwear and Leather

Healthcare

Electrical and Electronics

Others

By Distribution Channel

Direct Selling

Traditional Trade

Modern Trade

8 North America Adhesives and Sealants Distribution Market Analysis and Outlook To 2032

8.1 Introduction to North America Adhesives and Sealants Distribution Markets in 2024

8.2 North America Adhesives and Sealants Distribution Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Adhesives and Sealants Distribution Market size Outlook by Segments, 2021-2032

By Adhesives Technology

Water-borne

-Acrylic

-Polyvinyl Acetate (PVA) Emulsion

-Ethylene Vinyl Acetate (EVA) Emulsion

-Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

-Others

Solvent-borne

-Chloroprene Rubber

-Poly Acrylate (Pas)

-SBC Resin Adhesives

-Others

Reactive

-Polyurethane

-Epoxy

-Cyanoacrylate

-Modified Acrylic

-Anaerobic

-Silicone

-Others

Hot Melt

-Ethylene Vinyl Acetate

-Styrenic Block Copolymers

-Thermoplastic Polyurethane

-Others

Others

By Sealant Product

Silicone

Polyurethane

Acrylic

Polyvinyl Acetate

Others

By End-User

Building and Construction

Paper, Board, and Packaging

Transportation

Woodworking

Footwear and Leather

Healthcare

Electrical and Electronics

Others

By Distribution Channel

Direct Selling

Traditional Trade

Modern Trade

9 Europe Adhesives and Sealants Distribution Market Analysis and Outlook To 2032

9.1 Introduction to Europe Adhesives and Sealants Distribution Markets in 2024

9.2 Europe Adhesives and Sealants Distribution Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Adhesives and Sealants Distribution Market Size Outlook by Segments, 2021-2032

By Adhesives Technology

Water-borne

-Acrylic

-Polyvinyl Acetate (PVA) Emulsion

-Ethylene Vinyl Acetate (EVA) Emulsion

-Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

-Others

Solvent-borne

-Chloroprene Rubber

-Poly Acrylate (Pas)

-SBC Resin Adhesives

-Others

Reactive

-Polyurethane

-Epoxy

-Cyanoacrylate

-Modified Acrylic

-Anaerobic

-Silicone

-Others

Hot Melt

-Ethylene Vinyl Acetate

-Styrenic Block Copolymers

-Thermoplastic Polyurethane

-Others

Others

By Sealant Product

Silicone

Polyurethane

Acrylic

Polyvinyl Acetate

Others

By End-User

Building and Construction

Paper, Board, and Packaging

Transportation

Woodworking

Footwear and Leather

Healthcare

Electrical and Electronics

Others

By Distribution Channel

Direct Selling

Traditional Trade

Modern Trade

10 Asia Pacific Adhesives and Sealants Distribution Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Adhesives and Sealants Distribution Markets in 2024

10.2 Asia Pacific Adhesives and Sealants Distribution Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Adhesives and Sealants Distribution Market size Outlook by Segments, 2021-2032

By Adhesives Technology

Water-borne

-Acrylic

-Polyvinyl Acetate (PVA) Emulsion

-Ethylene Vinyl Acetate (EVA) Emulsion

-Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

-Others

Solvent-borne

-Chloroprene Rubber

-Poly Acrylate (Pas)

-SBC Resin Adhesives

-Others

Reactive

-Polyurethane

-Epoxy

-Cyanoacrylate

-Modified Acrylic

-Anaerobic

-Silicone

-Others

Hot Melt

-Ethylene Vinyl Acetate

-Styrenic Block Copolymers

-Thermoplastic Polyurethane

-Others

Others

By Sealant Product

Silicone

Polyurethane

Acrylic

Polyvinyl Acetate

Others

By End-User

Building and Construction

Paper, Board, and Packaging

Transportation

Woodworking

Footwear and Leather

Healthcare

Electrical and Electronics

Others

By Distribution Channel

Direct Selling

Traditional Trade

Modern Trade

11 South America Adhesives and Sealants Distribution Market Analysis and Outlook To 2032

11.1 Introduction to South America Adhesives and Sealants Distribution Markets in 2024

11.2 South America Adhesives and Sealants Distribution Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Adhesives and Sealants Distribution Market size Outlook by Segments, 2021-2032

By Adhesives Technology

Water-borne

-Acrylic

-Polyvinyl Acetate (PVA) Emulsion

-Ethylene Vinyl Acetate (EVA) Emulsion

-Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

-Others

Solvent-borne

-Chloroprene Rubber

-Poly Acrylate (Pas)

-SBC Resin Adhesives

-Others

Reactive

-Polyurethane

-Epoxy

-Cyanoacrylate

-Modified Acrylic

-Anaerobic

-Silicone

-Others

Hot Melt

-Ethylene Vinyl Acetate

-Styrenic Block Copolymers

-Thermoplastic Polyurethane

-Others

Others

By Sealant Product

Silicone

Polyurethane

Acrylic

Polyvinyl Acetate

Others

By End-User

Building and Construction

Paper, Board, and Packaging

Transportation

Woodworking

Footwear and Leather

Healthcare

Electrical and Electronics

Others

By Distribution Channel

Direct Selling

Traditional Trade

Modern Trade

12 Middle East and Africa Adhesives and Sealants Distribution Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Adhesives and Sealants Distribution Markets in 2024

12.2 Middle East and Africa Adhesives and Sealants Distribution Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Adhesives and Sealants Distribution Market size Outlook by Segments, 2021-2032

By Adhesives Technology

Water-borne

-Acrylic

-Polyvinyl Acetate (PVA) Emulsion

-Ethylene Vinyl Acetate (EVA) Emulsion

-Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

-Others

Solvent-borne

-Chloroprene Rubber

-Poly Acrylate (Pas)

-SBC Resin Adhesives

-Others

Reactive

-Polyurethane

-Epoxy

-Cyanoacrylate

-Modified Acrylic

-Anaerobic

-Silicone

-Others

Hot Melt

-Ethylene Vinyl Acetate

-Styrenic Block Copolymers

-Thermoplastic Polyurethane

-Others

Others

By Sealant Product

Silicone

Polyurethane

Acrylic

Polyvinyl Acetate

Others

By End-User

Building and Construction

Paper, Board, and Packaging

Transportation

Woodworking

Footwear and Leather

Healthcare

Electrical and Electronics

Others

By Distribution Channel

Direct Selling

Traditional Trade

Modern Trade

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Avery Dennison Corp

BC Adhesives

Composites One

Ellsworth Adhesives India PTY Ltd

Fastenal Company

HERNON MANUFACTURING Inc

Hisco Inc

Krayden Inc

Rudolph Bros. & Co.

Silmid

TER HELL & Co. GmbH

W.W. Grainger Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Adhesives Technology

Water-borne

-Acrylic

-Polyvinyl Acetate (PVA) Emulsion

-Ethylene Vinyl Acetate (EVA) Emulsion

-Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

-Others

Solvent-borne

-Chloroprene Rubber

-Poly Acrylate (Pas)

-SBC Resin Adhesives

-Others

Reactive

-Polyurethane

-Epoxy

-Cyanoacrylate

-Modified Acrylic

-Anaerobic

-Silicone

-Others

Hot Melt

-Ethylene Vinyl Acetate

-Styrenic Block Copolymers

-Thermoplastic Polyurethane

-Others

Others

By Sealant Product

Silicone

Polyurethane

Acrylic

Polyvinyl Acetate

Others

By End-User

Building and Construction

Paper, Board, and Packaging

Transportation

Woodworking

Footwear and Leather

Healthcare

Electrical and Electronics

Others

By Distribution Channel

Direct Selling

Traditional Trade

Modern Trade

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Adhesives and Sealants Distribution Market Size is valued at $ in 2024 and is forecast to register a growth rate (CAGR) of 6.8% to reach $ by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Avery Dennison Corp, BC Adhesives, Composites One, Ellsworth Adhesives India PTY Ltd, Fastenal Company, HERNON MANUFACTURING Inc, Hisco Inc, Krayden Inc, Rudolph Bros. & Co., Silmid, TER HELL & Co. GmbH, W.W. Grainger Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume