The global Adhesion Promoters Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Silane, Maleic Anhydride, Chlorinated Polyolefins, Titanate & Zirconate, Others), By Product (Plastics & Composites, Paints & Coatings, Rubber, Adhesives, Metals, Others).

Adhesion promoters are chemical additives used to improve the bond strength between substrates and coatings, adhesives, or sealants in various industries in 2024. These promoters work by enhancing the adhesion properties of the substrate surface, promoting wetting, and increasing the interfacial bonding between the substrate and the applied material. Adhesion promoters are commonly used on substrates such as metals, plastics, glass, ceramics, and composites to improve adhesion performance and prevent issues such as delamination, peeling, or blistering. These additives can be incorporated into formulations of paints, adhesives, primers, and coatings to optimize adhesion on challenging surfaces or under harsh environmental conditions. With their ability to enhance adhesion and bond strength, adhesion promoters play a critical role in ensuring the reliability and durability of bonded assemblies and coated surfaces in industries such as automotive, aerospace, electronics, and construction.

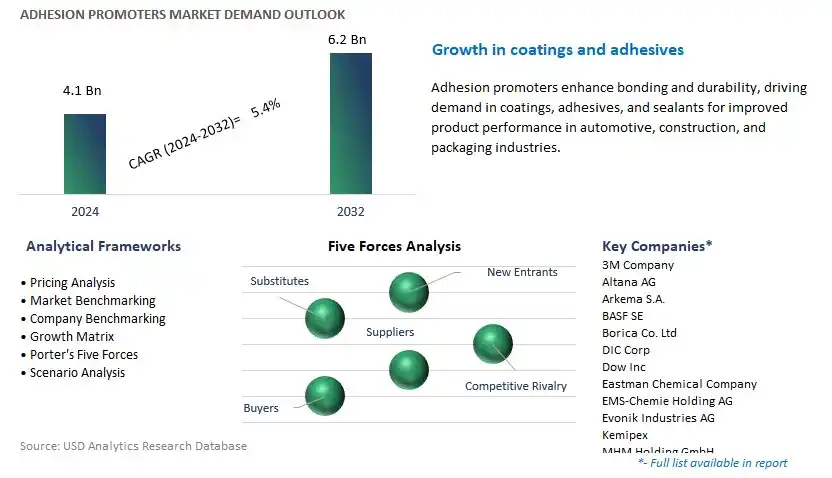

The market report analyses the leading companies in the industry including 3M Company, Altana AG, Arkema S.A., BASF SE, Borica Co. Ltd, DIC Corp, Dow Inc, Eastman Chemical Company, EMS-Chemie Holding AG, Evonik Industries AG, Kemipex, MHM Holding GmbH, Momentive Performance Materials Inc, Nagase & Co. Ltd, Nippon Paper Industries Co. Ltd, Nouryon, Shin Etsu Chemical Co. Ltd, Toyobo Co. Ltd, and others.

A prominent trend in the adhesion promoters market is the rising demand for high-performance adhesives across various industries such as automotive, construction, and electronics. As manufacturers seek to enhance the durability, strength, and longevity of bonded surfaces, the need for effective adhesion promoters has intensified. This trend is driven by factors including the growing emphasis on lightweight materials, advancements in bonding technologies, and the expansion of applications requiring reliable adhesive solutions. Consequently, the adhesion promoters market is witnessing a shift towards innovative formulations capable of delivering superior bonding performance under diverse operating conditions.

The primary driver fueling the growth of the adhesion promoters market is the continuous advancement in material science and surface treatment technologies. Innovations in polymer chemistry, nanotechnology, and surface modification techniques have enabled the development of adhesion promoters with enhanced compatibility, adhesion strength, and chemical resistance properties. These technological advancements empower manufacturers to tailor adhesion promoter formulations to specific substrate materials and bonding requirements, thereby addressing complex bonding challenges encountered in modern industrial applications. Additionally, the integration of novel additives and surface modification agents into adhesion promoter formulations further augments their performance, driving market expansion.

An emerging opportunity within the adhesion promoters market lies in the increasing focus on sustainable adhesive solutions and environmentally friendly manufacturing practices. With growing environmental concerns and regulatory pressures to reduce VOC emissions and hazardous chemical usage, there is a rising demand for eco-friendly adhesion promoters derived from renewable resources or exhibiting low toxicity levels. Manufacturers have the opportunity to capitalize on this trend by investing in research and development initiatives aimed at developing bio-based, waterborne, or solvent-free adhesion promoter formulations. By offering sustainable alternatives without compromising performance, companies can cater to the evolving needs of environmentally conscious customers and gain a competitive edge in the marketplace.

Silane is the largest segment in the Adhesion Promoters Market by product, driven by its superior performance and wide range of applications. Silane adhesion promoters are particularly effective in enhancing the bonding strength between organic polymers and inorganic substrates, making them indispensable in various industries such as automotive, construction, electronics, and coatings. Their ability to form strong chemical bonds at the interface improves the durability and longevity of materials, which is crucial in demanding applications. In the automotive industry, silane is widely used to improve the adhesion of paints, coatings, and sealants to metal and plastic surfaces, contributing to better performance and resistance to environmental factors.

The Plastics & Composites segment is the fastest-growing in the Adhesion Promoters Market by product, propelled by the burgeoning demand for advanced adhesion solutions in the plastics and composite manufacturing industries. Plastics and composites are ubiquitous materials in various sectors, including automotive, aerospace, electronics, and construction, owing to their lightweight, durable, and versatile nature. However, ensuring strong adhesion between these materials and other substrates has been a longstanding challenge. Adhesion promoters play a pivotal role in overcoming this challenge by facilitating bonding between dissimilar materials, improving compatibility, and enhancing overall performance. With the increasing adoption of plastics and composites in lightweighting initiatives, the demand for effective adhesion promoters has surged. Manufacturers are seeking innovative solutions to address specific application requirements, such as bonding thermoplastics, thermosets, or fiber-reinforced composites to metals, glass, or other polymers. This heightened demand for tailored adhesion promoters, coupled with advancements in formulation technologies to meet evolving performance standards and regulatory requirements, positions the Plastics & Composites segment at the forefront of growth in the Adhesion Promoters Market. As industries continue to prioritize lightweighting, sustainability, and performance, the demand for specialized adhesion promoters for plastics and composites is expected to accelerate, driving the robust expansion of this segment.

By Product

Silane

Maleic Anhydride

Chlorinated Polyolefins

Titanate & Zirconate

Others

By Product

Plastics & Composites

Paints & Coatings

Rubber

Adhesives

Metals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Altana AG

Arkema S.A.

BASF SE

Borica Co. Ltd

DIC Corp

Dow Inc

Eastman Chemical Company

EMS-Chemie Holding AG

Evonik Industries AG

Kemipex

MHM Holding GmbH

Momentive Performance Materials Inc

Nagase & Co. Ltd

Nippon Paper Industries Co. Ltd

Nouryon

Shin Etsu Chemical Co. Ltd

Toyobo Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Adhesion Promoters Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Adhesion Promoters Market Size Outlook, $ Million, 2021 to 2032

3.2 Adhesion Promoters Market Outlook by Type, $ Million, 2021 to 2032

3.3 Adhesion Promoters Market Outlook by Product, $ Million, 2021 to 2032

3.4 Adhesion Promoters Market Outlook by Application, $ Million, 2021 to 2032

3.5 Adhesion Promoters Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Adhesion Promoters Industry

4.2 Key Market Trends in Adhesion Promoters Industry

4.3 Potential Opportunities in Adhesion Promoters Industry

4.4 Key Challenges in Adhesion Promoters Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Adhesion Promoters Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Adhesion Promoters Market Outlook by Segments

7.1 Adhesion Promoters Market Outlook by Segments, $ Million, 2021- 2032

By Product

Silane

Maleic Anhydride

Chlorinated Polyolefins

Titanate & Zirconate

Others

By Product

Plastics & Composites

Paints & Coatings

Rubber

Adhesives

Metals

Others

8 North America Adhesion Promoters Market Analysis and Outlook To 2032

8.1 Introduction to North America Adhesion Promoters Markets in 2024

8.2 North America Adhesion Promoters Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Adhesion Promoters Market size Outlook by Segments, 2021-2032

By Product

Silane

Maleic Anhydride

Chlorinated Polyolefins

Titanate & Zirconate

Others

By Product

Plastics & Composites

Paints & Coatings

Rubber

Adhesives

Metals

Others

9 Europe Adhesion Promoters Market Analysis and Outlook To 2032

9.1 Introduction to Europe Adhesion Promoters Markets in 2024

9.2 Europe Adhesion Promoters Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Adhesion Promoters Market Size Outlook by Segments, 2021-2032

By Product

Silane

Maleic Anhydride

Chlorinated Polyolefins

Titanate & Zirconate

Others

By Product

Plastics & Composites

Paints & Coatings

Rubber

Adhesives

Metals

Others

10 Asia Pacific Adhesion Promoters Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Adhesion Promoters Markets in 2024

10.2 Asia Pacific Adhesion Promoters Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Adhesion Promoters Market size Outlook by Segments, 2021-2032

By Product

Silane

Maleic Anhydride

Chlorinated Polyolefins

Titanate & Zirconate

Others

By Product

Plastics & Composites

Paints & Coatings

Rubber

Adhesives

Metals

Others

11 South America Adhesion Promoters Market Analysis and Outlook To 2032

11.1 Introduction to South America Adhesion Promoters Markets in 2024

11.2 South America Adhesion Promoters Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Adhesion Promoters Market size Outlook by Segments, 2021-2032

By Product

Silane

Maleic Anhydride

Chlorinated Polyolefins

Titanate & Zirconate

Others

By Product

Plastics & Composites

Paints & Coatings

Rubber

Adhesives

Metals

Others

12 Middle East and Africa Adhesion Promoters Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Adhesion Promoters Markets in 2024

12.2 Middle East and Africa Adhesion Promoters Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Adhesion Promoters Market size Outlook by Segments, 2021-2032

By Product

Silane

Maleic Anhydride

Chlorinated Polyolefins

Titanate & Zirconate

Others

By Product

Plastics & Composites

Paints & Coatings

Rubber

Adhesives

Metals

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Altana AG

Arkema S.A.

BASF SE

Borica Co. Ltd

DIC Corp

Dow Inc

Eastman Chemical Company

EMS-Chemie Holding AG

Evonik Industries AG

Kemipex

MHM Holding GmbH

Momentive Performance Materials Inc

Nagase & Co. Ltd

Nippon Paper Industries Co. Ltd

Nouryon

Shin Etsu Chemical Co. Ltd

Toyobo Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Silane

Maleic Anhydride

Chlorinated Polyolefins

Titanate & Zirconate

Others

By Product

Plastics & Composites

Paints & Coatings

Rubber

Adhesives

Metals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Adhesion Promoters Market Size is valued at $4.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.4% to reach $6.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Altana AG, Arkema S.A., BASF SE, Borica Co. Ltd, DIC Corp, Dow Inc, Eastman Chemical Company, EMS-Chemie Holding AG, Evonik Industries AG, Kemipex, MHM Holding GmbH, Momentive Performance Materials Inc, Nagase & Co. Ltd, Nippon Paper Industries Co. Ltd, Nouryon, Shin Etsu Chemical Co. Ltd, Toyobo Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume