The increasing role of adhesion barriers as medical implants to prevent adhesions—fibrous bands that form between tissues and organs following surgery is encouraging new product launches. The barriers continue to play a crucial role in improving surgical outcomes and patient recovery by reducing the risk of post-operative complications.

Leading companies are marketing adhesion barriers in diverse forms including films, gels, and liquids for application during surgery to create a physical separation between tissues and organs. Leading companies continue to invest in new product launches that significantly reduces the incidence, extent and severity of adhesions following diverse surgeries. Bioabsorbable products that can prevent postoperative pain and improve surgical outcomes are widely marketed. The absence of suitable alternatives remains one of the key factors promoting innovation in the industry.

The incidence of adhesions ranges from 67–93% after general abdominal surgery with rates up to 97% after open gynecologic pelvic procedures according to the study- “An Overview of Postoperative Intraabdominal Adhesions and Their Role on Female Infertility”. Surgical post-operative adhesions lead to serious clinical complications including small bowel obstruction, abdominal and pelvic pain, infertility. According to the NIH, 310 million major surgeries are performed each year worldwide with around 40 to 50 million in USA and 20 million in Europe. Gynaecological, general, orthopaedic, cardiovascular, neurological, urological, reconstructive, and other surgeries continue to rely on advanced barriers.

Increasing awareness of adhesion barriers coupled with availability for diverse applications drive the sales across healthcare settings. Adhesion barriers offer improved patient outcomes and reduced healthcare costs across a range of surgical procedures. Adhesion barriers in open surgery reduce costs compared to no adhesion barrier ($4376 versus $4482) according to the modelling study in BMC. Adhesion barriers minimize the formation of fibrous bands that develop between tissues and organs following surgery. By preventing adhesions, these barriers decrease the likelihood of complications such as bowel obstructions, infertility, and chronic pain. Further, the use of adhesion barriers leads to better surgical outcomes by reducing the need for reoperations and subsequent complications.

Technological advancements and novel product launches are set to shape the adhesion barriers industry. In particular, leading companies are marketing products focused on improved patient outcomes, minimized complications, and advancing surgical techniques. For instance, Gunze Launched TENALEAF™ absorbable adhesion barrier in 2022, Innovia launches hot-melt barrier film for fridge and freezer labels in 2024.

Similarly, Seprafilm (Genzyme) markets bioresorbable adhesion barrier film composed of sodium hyaluronate and carboxymethylcellulose. Strong prospects for bio-absorbable adhesion barriers for specific applications are encouraging new product launches. In particular, most launches are focusing abdominal and pelvic surgeries. Products with enhanced biocompatibility, tunable degradation kinetics, and targeted drug delivery capabilities are widely preferred across healthcare settings.

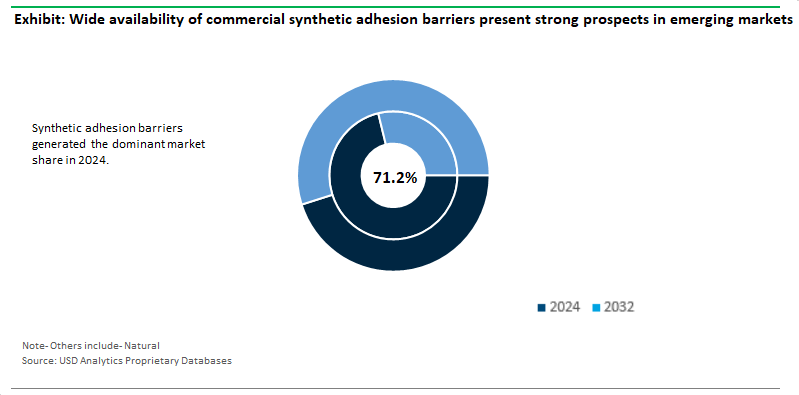

In 2024, Synthetic Adhesion Barriers accounted for the dominant 71.2% market share. Synthetic adhesion barriers including hyaluronic acid, regenerated cellulose, polyethylene glycol, and others gain wide popularity owing to their cost-effectiveness. Wide availability of commercial synthetic adhesion barriers present strong prospects in emerging markets.

Synthetic adhesion barriers are typically produced using highly purified materials and undergo rigorous sterilization processes to minimize the risk of contamination and infection. Further, Synthetic adhesion barriers often have longer shelf lives compared to natural barriers, allowing for extended storage and easier inventory management. By using synthetic polymers, healthcare providers can minimize concerns regarding infectious agents, prions, or allergens present in biological tissues.

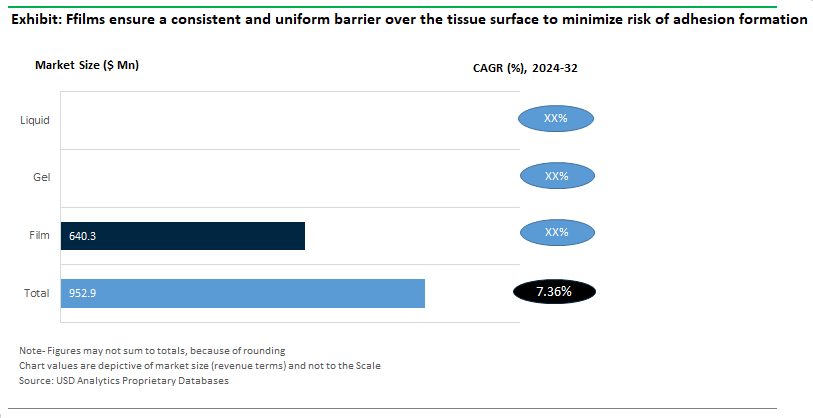

Adhesion barriers Films accounted for 67.2% market share in 2024. The films ensure a consistent and uniform barrier over the tissue surface, minimizing the risk of adhesion formation across the entire surgical site. In addition, these are typically pre-cut or pre-shaped for easy application, reducing the need for extensive preparation or manipulation during surgery.

Films are commonly used in abdominal and pelvic surgeries, including laparoscopic procedures, hysterectomy, and bowel resections, to prevent post-operative adhesions. Further, films are widely utilized in orthopedic procedures including tendon repair and joint arthroplasty to protect against intra-articular adhesions and fibrosis. In addition, films in cardiac bypass procedures and lung resections minimize pericardial and pleural adhesions.

On the other hand, Liquids can penetrate deep into tissue layers and inaccessible areas, providing comprehensive coverage and adhesion prevention throughout the surgical site. Oxiplex® (FzioMed, Inc.), Guardix-SG® (SyntheMed, Inc.), and other liquids are widely marketed and clinically proven to reduce the incidence and severity of post-operative adhesions.

The Asia-Pacific region is poised to remain the fastest-growing market for Adhesion Barriers vendors, projected to expand at a CAGR of 7.8% during the forecast period. In particular, the rapid expansion of China's healthcare infrastructure and the increasing accessibility of advanced medical treatments drive the sales volume. With over 1 million healthcare institutions in the country, adhesion barriers play a crucial role in reducing the risk of post-operative complications in older patients undergoing surgeries. The government is also encouraging domestic companies to manufacture adhesion barriers. Similarly, high urbanization rates, growing middle-class incomes, and government and private investments in healthcare infrastructure in India are encouraging US and UK companies to expand through organic and inorganic expansion strategies.

The global Adhesion Barriers market is fragmented with the presence of both local and global players. Leading companies included in the study are Actamax Surgical Materials LLC, AlloSource Inc, Anika Therapeutics Inc, Arc Medical Devices Inc, Atrium Medical Corp, Baxter International Inc, Becton, Dickinson and Company, Betatech Medical GmbH, BiosCompass LLC, CG Bio Inc, CorMatrix Cardiovascular Inc, FzioMed Inc, GUNZE Ltd, Hangzhou Singclean Medical Products Co. Ltd, Innocoll Pharmaceuticals Ltd, Integra LifeSciences Holdings Corp, Johnson & Johnson, Leader Biomedical Group B.V., Luna Innovations Inc, MAST Biosurgery AG, PlantTec Medical GmbH, Seikagaku Corp, Terumo Corp, W. L. Gore & Associates Inc, Xlynk Surgical LLC, and others.

|

Parameter |

Details |

|

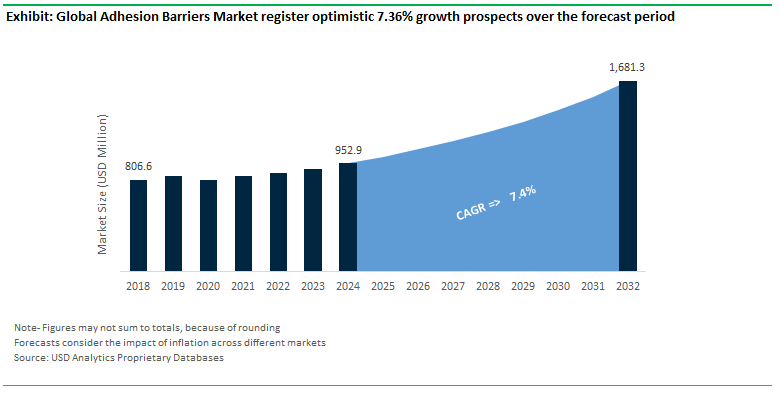

Market Size (2024) |

$952.9 Million |

|

Market Size (2032) |

$1.7 Billion |

|

Market Growth Rate |

7.36% |

|

Largest Segment- Type |

Synthetic adhesion barriers (71.2% Market Share) |

|

Fastest Growing Market- Region |

Asia Pacific (7.8% CAGR) |

|

Largest Segment- Form |

Adhesion Barrier Films (67.2% Revenue Share) |

|

Largest Segment- Indication |

Orthopedic Surgeries ($262 Million) |

|

Segments |

Types, Forms, Applications, End-Users |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Actamax Surgical Materials LLC, AlloSource Inc, Anika Therapeutics Inc, Arc Medical Devices Inc, Atrium Medical Corp, Baxter International Inc, Becton, Dickinson and Company, Betatech Medical GmbH, BiosCompass LLC, CG Bio Inc, CorMatrix Cardiovascular Inc, FzioMed Inc, GUNZE Ltd, Hangzhou Singclean Medical Products Co. Ltd, Innocoll Pharmaceuticals Ltd, Integra LifeSciences Holdings Corp, Johnson & Johnson, Leader Biomedical Group B.V., Luna Innovations Inc, MAST Biosurgery AG, PlantTec Medical GmbH, Seikagaku Corp, Terumo Corp, W. L. Gore & Associates Inc, Xlynk Surgical LLC |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Type

Form

Indication

End-User

Countries Analyzed

Adhesion Barriers Companies Profiled in the Study

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the Industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies Opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

4. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

5. Market Size Outlook to 2032

Global Adhesion Barriers Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

6. Historical Adhesion Barriers Market Size by Segments, 2018- 2023

Key Statistics, 2024

Adhesion Barriers Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Adhesion Barriers Types, 2018-2023

Adhesion Barriers Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Adhesion Barriers Applications, 2018-2023

7. Adhesion Barriers Market Size Outlook by Segments, 2024- 2032

Adhesion Barriers Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Adhesion Barriers Types, 2024-2032

Adhesion Barriers Market Size Outlook by Form, USD Million, 2024-2032

Growth Comparison (y-o-y) across Adhesion Barriers Forms, 2024-2032

Adhesion Barriers Market Size Outlook by Indication, USD Million, 2024-2032

Growth Comparison (y-o-y) across Adhesion Barriers Indications, 2024-2032

Adhesion Barriers Market Size Outlook by End-User, USD Million, 2024-2032

Growth Comparison (y-o-y) across Adhesion Barriers End-Users, 2024-2032

8. Adhesion Barriers Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

9. United States Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Adhesion Barriers Market Size Outlook by Type, 2021- 2032

United States Adhesion Barriers Market Size Outlook by Application, 2021- 2032

United States Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

10. Canada Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Canada Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Canada Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

11. Mexico Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Mexico Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Mexico Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

12. Germany Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Germany Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Germany Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

13. France Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

France Adhesion Barriers Market Size Outlook by Type, 2021- 2032

France Adhesion Barriers Market Size Outlook by Application, 2021- 2032

France Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

14. United Kingdom Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Adhesion Barriers Market Size Outlook by Type, 2021- 2032

United Kingdom Adhesion Barriers Market Size Outlook by Application, 2021- 2032

United Kingdom Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

15. Spain Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Spain Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Spain Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

16. Italy Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Italy Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Italy Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

17. Benelux Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Benelux Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Benelux Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

18. Nordic Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Nordic Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Nordic Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Rest of Europe Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Rest of Europe Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

20. China Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

China Adhesion Barriers Market Size Outlook by Type, 2021- 2032

China Adhesion Barriers Market Size Outlook by Application, 2021- 2032

China Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

21. India Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

India Adhesion Barriers Market Size Outlook by Type, 2021- 2032

India Adhesion Barriers Market Size Outlook by Application, 2021- 2032

India Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

22. Japan Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Japan Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Japan Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

23. South Korea Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Adhesion Barriers Market Size Outlook by Type, 2021- 2032

South Korea Adhesion Barriers Market Size Outlook by Application, 2021- 2032

South Korea Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

24. Australia Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Australia Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Australia Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

25. South East Asia Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Adhesion Barriers Market Size Outlook by Type, 2021- 2032

South East Asia Adhesion Barriers Market Size Outlook by Application, 2021- 2032

South East Asia Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

27. Brazil Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Brazil Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Brazil Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

28. Argentina Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Argentina Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Argentina Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Rest of South America Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Rest of South America Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Adhesion Barriers Market Size Outlook by Type, 2021- 2032

United Arab Emirates Adhesion Barriers Market Size Outlook by Application, 2021- 2032

United Arab Emirates Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Saudi Arabia Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Saudi Arabia Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Rest of Middle East Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Rest of Middle East Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

33. South Africa Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Adhesion Barriers Market Size Outlook by Type, 2021- 2032

South Africa Adhesion Barriers Market Size Outlook by Application, 2021- 2032

South Africa Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Adhesion Barriers Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Adhesion Barriers Market Size Outlook by Type, 2021- 2032

Rest of Africa Adhesion Barriers Market Size Outlook by Application, 2021- 2032

Rest of Africa Adhesion Barriers Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

SWOT Analysis

36. Recent Market Developments

Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Form

Indication

End-User

Countries Analyzed

USD Analytics forecasts the global Adhesion Barriers market size to increase from $952.9 Million in 2024 to $1.7 Billion in 2032, registering a CAGR of 7.36% during the forecast period

Synthetic adhesion barriers (71.2% Market Share), Adhesion Barrier Films (67.2% Revenue Share), Orthopedic Surgeries ($262 Million)

Actamax Surgical Materials LLC, AlloSource Inc, Anika Therapeutics Inc, Arc Medical Devices Inc, Atrium Medical Corp, Baxter International Inc, Becton, Dickinson and Company, Betatech Medical GmbH, BiosCompass LLC, CG Bio Inc, CorMatrix Cardiovascular Inc, FzioMed Inc, GUNZE Ltd, Hangzhou Singclean Medical Products Co. Ltd, Innocoll Pharmaceuticals Ltd, Integra LifeSciences Holdings Corp, Johnson & Johnson, Leader Biomedical Group B.V., Luna Innovations Inc, MAST Biosurgery AG, PlantTec Medical GmbH, Seikagaku Corp, Terumo Corp, W. L. Gore & Associates Inc, Xlynk Surgical LLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume

Asia Pacific (7.8% CAGR)