The global Acrylic Emulsions Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Polymer & co-polymer, Pure Acrylic), By Application (Paints & coatings, Adhesives & sealants, Construction additives, Paper coating, Others).

Acrylic emulsions are versatile water-based dispersions of acrylic polymers used in a wide range of applications, including paints, coatings, adhesives, textiles, and paper coatings in 2024. These emulsions offer several advantages over solvent-based formulations, including low VOC content, easy cleanup, and improved environmental compatibility. Acrylic emulsions provide excellent adhesion, durability, and weather resistance in architectural paints and coatings, making them ideal for exterior and interior applications. In adhesives and sealants, acrylic emulsions offer strong bonding strength, flexibility, and moisture resistance, making them suitable for bonding various substrates in construction, automotive, and industrial applications. Additionally, acrylic emulsions are used in textile coatings and paper coatings to impart water repellency, abrasion resistance, and printability to fabrics and paper products. With their versatility, performance, and environmental benefits, acrylic emulsions to be preferred materials in numerous industries seeking sustainable and high-performance solutions for their products and applications.

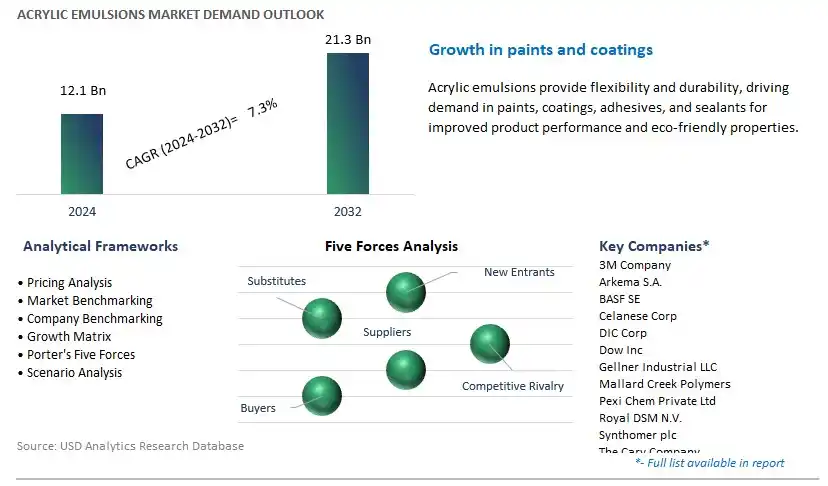

The market report analyses the leading companies in the industry including 3M Company, Arkema S.A., BASF SE, Celanese Corp, DIC Corp, Dow Inc, Gellner Industrial LLC, Mallard Creek Polymers, Pexi Chem Private Ltd, Royal DSM N.V., Synthomer plc, The Cary Company, The Lubrizol Corp, and others.

A significant market trend in the acrylic emulsions industry is the growing demand for eco-friendly coating solutions. With increasing awareness of environmental sustainability and regulatory restrictions on volatile organic compound (VOC) emissions, there is a rising adoption of water-based acrylic emulsion coatings as alternatives to solvent-based coatings. This trend is driven by factors such as tightening environmental regulations, consumer preferences for greener products, and the need for coatings that offer low odor, minimal toxicity, and reduced environmental impact. Acrylic emulsions provide advantages such as low VOC content, easy cleanup, and excellent adhesion and durability, making them suitable for a wide range of applications in architectural coatings, adhesives, and industrial finishes. As manufacturers and consumers prioritize sustainability and health-conscious choices, the demand for acrylic emulsions as environmentally friendly coating solutions is experiencing growth and innovation to meet evolving market needs and regulatory compliance.

The driver behind the growth of the acrylic emulsions market is the expansion of construction and infrastructure development activities. With rapid urbanization, population growth, and increasing investments in infrastructure projects worldwide, there is a growing demand for coatings and adhesives used in construction, renovation, and maintenance activities. This driver is fueled by factors such as urbanization, industrialization, government initiatives promoting infrastructure development, and the need for sustainable building materials and solutions. Acrylic emulsions offer advantages such as versatility, weather resistance, and ease of application, making them preferred choices for architectural coatings, sealants, and waterproofing membranes in construction projects. As construction companies and contractors seek durable and cost-effective coating solutions to protect and enhance building structures, the demand for acrylic emulsions in the construction sector is expected to rise, driving market growth and opportunities for acrylic emulsion manufacturers and suppliers.

An opportunity for growth and differentiation in the acrylic emulsions market lies in innovation in high-performance coating applications. While acrylic emulsions are widely used in architectural coatings and decorative paints, there is potential to explore new market segments and specialty applications that require advanced coating solutions with enhanced properties and functionalities. By leveraging advancements in polymer chemistry, formulation technology, and application techniques, manufacturers can develop high-performance acrylic emulsion coatings tailored to specific end-use applications such as automotive coatings, industrial finishes, and protective coatings for infrastructure and marine environments. Additionally, there is an opportunity to collaborate with industry partners and research institutions to develop novel coatings with improved properties such as scratch resistance, chemical resistance, and anti-graffiti properties. By investing in research and development and offering customized solutions to meet customer requirements, acrylic emulsion producers can unlock new market opportunities, expand their product portfolio, and maintain competitiveness in the dynamic coatings industry landscape.

Within the Acrylic Emulsions market, the Polymer & Co-polymer segment stands out as the largest segment. Polymer & Co-polymer acrylic emulsions are widely used across various industries due to their versatility, durability, and superior performance characteristics. These emulsions are composed of acrylic polymers or co-polymers, which impart excellent adhesion, flexibility, and weather resistance to coatings, adhesives, sealants, and other products. The Polymer & Co-polymer acrylic emulsions find extensive applications in paints and coatings, architectural coatings, adhesives, textiles, paper coatings, and leather finishes, among others. Moreover, they offer advantages such as high gloss, color retention, UV resistance, and good mechanical properties, making them suitable for both interior and exterior applications. Additionally, the growing demand for environmentally friendly and low-VOC (volatile organic compound) products has further propelled the adoption of Polymer & Co-polymer acrylic emulsions, as they are water-based and comply with stringent environmental regulations. As a result, the Polymer & Co-polymer segment dominates the Acrylic Emulsions market, reflecting its widespread usage and indispensable role in various industries.

Within the Acrylic Emulsions market, the Construction Additives segment is the fastest-growing segment. Construction additives refer to a diverse range of materials added to concrete, mortar, or other construction materials to enhance their properties and performance. Acrylic emulsions are increasingly being used as additives in construction applications due to their ability to improve the workability, durability, and strength of concrete and mortar mixes. These emulsions act as water reducers, plasticizers, and bonding agents, facilitating better cohesion between particles, reducing water content, and enhancing the overall performance of construction materials. With the global construction industry witnessing rapid urbanization, infrastructure development, and demand for sustainable building solutions, the demand for acrylic emulsions as construction additives is experiencing significant growth. Additionally, the increasing preference for eco-friendly and low-VOC construction materials further drives the adoption of acrylic emulsions in construction applications. As a result, the Construction Additives segment is poised for rapid expansion within the Acrylic Emulsions market, propelled by the growing demand for high-performance and sustainable construction solutions.

By Type

Polymer & co-polymer

Pure Acrylic

By Application

Paints & coatings

Adhesives & sealants

Construction additives

Paper coating

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Arkema S.A.

BASF SE

Celanese Corp

DIC Corp

Dow Inc

Gellner Industrial LLC

Mallard Creek Polymers

Pexi Chem Private Ltd

Royal DSM N.V.

Synthomer plc

The Cary Company

The Lubrizol Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Acrylic Emulsions Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Acrylic Emulsions Market Size Outlook, $ Million, 2021 to 2032

3.2 Acrylic Emulsions Market Outlook by Type, $ Million, 2021 to 2032

3.3 Acrylic Emulsions Market Outlook by Product, $ Million, 2021 to 2032

3.4 Acrylic Emulsions Market Outlook by Application, $ Million, 2021 to 2032

3.5 Acrylic Emulsions Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Acrylic Emulsions Industry

4.2 Key Market Trends in Acrylic Emulsions Industry

4.3 Potential Opportunities in Acrylic Emulsions Industry

4.4 Key Challenges in Acrylic Emulsions Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Acrylic Emulsions Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Acrylic Emulsions Market Outlook by Segments

7.1 Acrylic Emulsions Market Outlook by Segments, $ Million, 2021- 2032

By Type

Polymer & co-polymer

Pure Acrylic

By Application

Paints & coatings

Adhesives & sealants

Construction additives

Paper coating

Others

8 North America Acrylic Emulsions Market Analysis and Outlook To 2032

8.1 Introduction to North America Acrylic Emulsions Markets in 2024

8.2 North America Acrylic Emulsions Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Acrylic Emulsions Market size Outlook by Segments, 2021-2032

By Type

Polymer & co-polymer

Pure Acrylic

By Application

Paints & coatings

Adhesives & sealants

Construction additives

Paper coating

Others

9 Europe Acrylic Emulsions Market Analysis and Outlook To 2032

9.1 Introduction to Europe Acrylic Emulsions Markets in 2024

9.2 Europe Acrylic Emulsions Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Acrylic Emulsions Market Size Outlook by Segments, 2021-2032

By Type

Polymer & co-polymer

Pure Acrylic

By Application

Paints & coatings

Adhesives & sealants

Construction additives

Paper coating

Others

10 Asia Pacific Acrylic Emulsions Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Acrylic Emulsions Markets in 2024

10.2 Asia Pacific Acrylic Emulsions Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Acrylic Emulsions Market size Outlook by Segments, 2021-2032

By Type

Polymer & co-polymer

Pure Acrylic

By Application

Paints & coatings

Adhesives & sealants

Construction additives

Paper coating

Others

11 South America Acrylic Emulsions Market Analysis and Outlook To 2032

11.1 Introduction to South America Acrylic Emulsions Markets in 2024

11.2 South America Acrylic Emulsions Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Acrylic Emulsions Market size Outlook by Segments, 2021-2032

By Type

Polymer & co-polymer

Pure Acrylic

By Application

Paints & coatings

Adhesives & sealants

Construction additives

Paper coating

Others

12 Middle East and Africa Acrylic Emulsions Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Acrylic Emulsions Markets in 2024

12.2 Middle East and Africa Acrylic Emulsions Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Acrylic Emulsions Market size Outlook by Segments, 2021-2032

By Type

Polymer & co-polymer

Pure Acrylic

By Application

Paints & coatings

Adhesives & sealants

Construction additives

Paper coating

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Arkema S.A.

BASF SE

Celanese Corp

DIC Corp

Dow Inc

Gellner Industrial LLC

Mallard Creek Polymers

Pexi Chem Private Ltd

Royal DSM N.V.

Synthomer plc

The Cary Company

The Lubrizol Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Polymer & co-polymer

Pure Acrylic

By Application

Paints & coatings

Adhesives & sealants

Construction additives

Paper coating

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Acrylic Emulsions Market Size is valued at $12.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.3% to reach $21.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Arkema S.A., BASF SE, Celanese Corp, DIC Corp, Dow Inc, Gellner Industrial LLC, Mallard Creek Polymers, Pexi Chem Private Ltd, Royal DSM N.V., Synthomer plc, The Cary Company, The Lubrizol Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume