Increasing demand for A2 milk from Sports Nutrition, Health, and Performance industries drives the long-term market prospects. In addition, the use of A2 milk in infant formulas further supports the sales volume. Continuous launches of new products coupled with increasing awareness of nutritional benefits are set to shape the sales volume. The abundance of calcium, protein richness, presence of omega-3 fatty acids, and other health benefits support the consumption of blood pressure, osteoporosis, immune system, mood disorders, and others.

According to the European Plant-based Foods Association, around 70% of the world’s population has lactose intolerance and the prevalence is very low in young children and low in early adulthood. The Journal of Dairy Science regarding lactose intolerance and A1/A2 protein differences identifies that around 30% of lactose-intolerant individuals report fewer digestive issues when consuming A2 milk compared to regular milk. Ease of digestion, suitable for lactose intolerance, potential nutrition benefits, demand for minimally processed foods, and others drive sales across emerging and developed markets.

In addition to building capacity and strengthening supply chains, leading manufacturers are focusing on sustainability initiatives to boost market shares. Investments in strengthening distribution channels are widely observed. For instance, A2 Milk’s Marketing investment increased 7.6% to $280.1 million (16.7% of net sales revenue) in FY 2024. The availability of A2 milk in supermarkets, grocery stores, and online stores drives the industry. Reliable labeling with information about certification, quality, safety and health attributes, origin, and others strengthens consumer confidence.

The average price of A2 milk (Ultra-Pasteurized Whole Milk) varied between 4 ¢/fl oz to 20 ¢/fl oz. The price of A2 is higher than regular A1 milk owing to higher production costs, supply chain dynamics, and increasing consumer demand for health-oriented dairy products. Companies like The a2 Milk Company are expanding in North American markets, with partnerships in retail chains such as Walmart and Whole Foods. Similarly, European dairy farms are increasingly focusing on selective breeding programs to promote A2-producing cow herds. On the other hand, the prevalence of indigenous cow breeds, such as Gir and Sahiwal in India, which naturally produce A2 milk leads to a significant supply advantage. Indian brands like Provilac and Amul capitalize on this demand by offering A2 milk products domestically and abroad.

Rising consumer demand for digestive health solutions and clean-label products is encouraging the manufacture of A2 milk-based dairy products. In particular, the demand for A2-based yogurt is witnessing a rapid surge, encouraging companies like The a2 Milk Company and Provilac to launch A2 yogurt and kefir products. The growing awareness of probiotics' role in gut health further boosts the appeal of these products. Similarly, A2 cheese is a rapidly growing category with Taw River Dairy (UK), Urban Farms Milk (U.S.), and others launching A2-based cheese varieties.

Asian producers including Erden Creamery (India), Vinamilk (Vietnam), and others are expanding their product lines to include A2-based butter, aiming to meet the demands of consumers in Asia. On the other hand, Nestlé and The a2 Milk Company are continuously launching A2 infant formula products in China, Australia, and others. Further, Small-scale producers in the U.S. and Australia also market A2 milk-based ice creams, marketing them as both luxurious and digestively friendly.

A2 milk vendors are increasingly targeting online subscription services as a key strategy to reach health-conscious consumers and those with lactose sensitivities. Consumers looking for A2 milk tend to prioritize health and wellness and often prefer the convenience of having products delivered directly to their homes. A2 milk subscription services often offer customizable plans based on delivery frequency, quantity, and product choice. Similarly, The direct-to-consumer (DTC) model is booming across the food and beverage industry, including A2 milk vendors. Companies like The a2 Milk Company, Provilac Dairy Farms, and Urban Farms Milk integrated subscription-based sales into their e-commerce platforms. Further, freshness and sustainability, loyalty, and retention advantages are widely achieved in the subscription models.

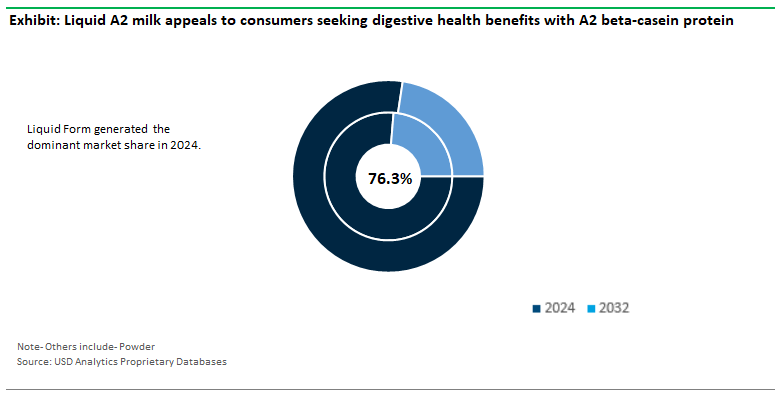

In 2024, liquid A2 milk is estimated to account for 76.3% of the revenue share within the A2 milk industry. Liquid A2 milk appeals to consumers seeking digestive health benefits, as it contains the A2 beta-casein protein. In particular, demand for liquid A2 milk in China is surging rapidly due to the consumer perception as a healthier alternative to traditional cow’s milk. In China, liquid milk consumption grew by over 15% between 2022 and 2023, with a significant share being A2 milk, driven by urban consumers with higher disposable incomes and a focus on health. Further, Liquid milk's widespread availability across various retail and e-commerce channels, particularly in urban areas, reinforces its dominant market share. Unlike milk powder or other forms, liquid A2 milk is marketed for its freshness and immediate consumption.

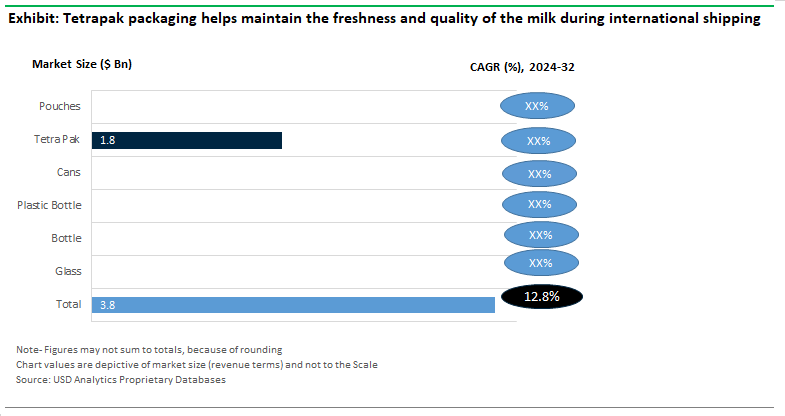

Among A2 Milk Packaging, Tetrapak is projected to be the largest revenue generator with a 47.2% revenue share.

Tetra Pak cartons are lightweight, easy to store, and come in a variety of sizes, catering to different needs. Tetra Pak’s aseptic packaging technology allows A2 milk to be stored at room temperature for extended periods without spoiling. The a2 Milk Company is utilizing Tetra Pak for its products in markets like China and the U.S. The packaging helps maintain the freshness and quality of the milk during international shipping, enabling the brand to expand its global presence.

Similarly, Vinamilk launched its A2 milk in Tetra Pak packaging, highlighting the brand’s commitment to sustainability and the environment, which resonated with its eco-conscious consumers in Southeast Asia. China Mengniu Dairy also launched A2 milk in Tetra Pak, leveraging the cost-effectiveness of the packaging format to penetrate new markets.

The Asia-Pacific region’s rapid economic growth, combined with increasing health awareness and urbanization drives the long-term growth prospects for vendors. The region is poised to register a 13.5% CAGR between 2024 and 2032. China remains the largest market in Asia-Pacific for A2 milk, primarily due to the country's increasing demand for premium dairy products. Major A2 milk players like The a2 Milk Company and Mengniu Dairy are launching extensive marketing campaigns. Further, the rise of e-commerce platforms in Asia-Pacific is a significant growth driver for A2 milk.

The global A2 Milk market is consolidated with the presence of both local and global players. Leading companies included in the study are Amul Cooperative Society Limited, Dairy Farmers Incorporated, Freedom Foods Group Limited, Nestle S.A., Provilac Holdings Inc., PURA Holdings Inc., The A2 Milk Company Limited, Vedaaz Organics Inc., Vietnam Dairy Products Joint Stock Company, Vinamilk Joint Stock Company, Westland Cooperative Dairy Company Limited, and others.

|

Parameter |

Details |

|

Market Size (2024) |

$3.8 Billion |

|

Market Size (2032) |

$9.9 Billion |

|

Market Growth Rate |

12.8% |

|

Largest Segment- Form |

Liquid (76.3% market share) |

|

Fastest Growing Market- Region |

Asia Pacific (13.5% CAGR) |

|

Largest Segment- Packaging |

Tetrapak (47.2% revnue share) |

|

Largest Segment- Application |

Milk-Based Beverages |

|

Largest Segment- Sales Channel |

Supermarkets and Hypermarkets |

|

Segments |

Types, Packaging, Applications, Sales Channels |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Amul Cooperative Society Limited, Dairy Farmers Incorporated, Freedom Foods Group Limited, Nestle S.A., Provilac Holdings Inc., PURA Holdings Inc., The A2 Milk Company Limited, Vedaaz Organics Inc., Vietnam Dairy Products Joint Stock Company, Vinamilk Joint Stock Company, Westland Cooperative Dairy Company Limited |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Type

Packaging

Application

Sales Channel

Countries Analyzed

A2 Milk Companies Profiled in the Study

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the Industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies Opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global A2 Milk Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical A2 Milk Market Size by Segments, 2018- 2023

Key Statistics, 2024

A2 Milk Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across A2 Milk Types, 2018-2023

A2 Milk Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across A2 Milk Applications, 2018-2023

8. A2 Milk Market Size Outlook by Segments, 2024- 2032

A2 Milk Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across A2 Milk Types, 2024-2032

A2 Milk Market Size Outlook by Packaging, USD Million, 2024-2032

Growth Comparison (y-o-y) across A2 Milk Packaging, 2024-2032

A2 Milk Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across A2 Milk Applications, 2024-2032

A2 Milk Market Size Outlook by Sales Channel, USD Million, 2024-2032

Growth Comparison (y-o-y) across A2 Milk Sales Channels, 2024-2032

9. A2 Milk Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

United States A2 Milk Market Size Outlook by Type, 2021- 2032

United States A2 Milk Market Size Outlook by Application, 2021- 2032

United States A2 Milk Market Size Outlook by End-User, 2021- 2032

11. Canada A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada A2 Milk Market Size Outlook by Type, 2021- 2032

Canada A2 Milk Market Size Outlook by Application, 2021- 2032

Canada A2 Milk Market Size Outlook by End-User, 2021- 2032

12. Mexico A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico A2 Milk Market Size Outlook by Type, 2021- 2032

Mexico A2 Milk Market Size Outlook by Application, 2021- 2032

Mexico A2 Milk Market Size Outlook by End-User, 2021- 2032

13. Germany A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany A2 Milk Market Size Outlook by Type, 2021- 2032

Germany A2 Milk Market Size Outlook by Application, 2021- 2032

Germany A2 Milk Market Size Outlook by End-User, 2021- 2032

14. France A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

France A2 Milk Market Size Outlook by Type, 2021- 2032

France A2 Milk Market Size Outlook by Application, 2021- 2032

France A2 Milk Market Size Outlook by End-User, 2021- 2032

15. United Kingdom A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom A2 Milk Market Size Outlook by Type, 2021- 2032

United Kingdom A2 Milk Market Size Outlook by Application, 2021- 2032

United Kingdom A2 Milk Market Size Outlook by End-User, 2021- 2032

10. Spain A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain A2 Milk Market Size Outlook by Type, 2021- 2032

Spain A2 Milk Market Size Outlook by Application, 2021- 2032

Spain A2 Milk Market Size Outlook by End-User, 2021- 2032

16. Italy A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy A2 Milk Market Size Outlook by Type, 2021- 2032

Italy A2 Milk Market Size Outlook by Application, 2021- 2032

Italy A2 Milk Market Size Outlook by End-User, 2021- 2032

17. Benelux A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux A2 Milk Market Size Outlook by Type, 2021- 2032

Benelux A2 Milk Market Size Outlook by Application, 2021- 2032

Benelux A2 Milk Market Size Outlook by End-User, 2021- 2032

18. Nordic A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic A2 Milk Market Size Outlook by Type, 2021- 2032

Nordic A2 Milk Market Size Outlook by Application, 2021- 2032

Nordic A2 Milk Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe A2 Milk Market Size Outlook by Type, 2021- 2032

Rest of Europe A2 Milk Market Size Outlook by Application, 2021- 2032

Rest of Europe A2 Milk Market Size Outlook by End-User, 2021- 2032

20. China A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

China A2 Milk Market Size Outlook by Type, 2021- 2032

China A2 Milk Market Size Outlook by Application, 2021- 2032

China A2 Milk Market Size Outlook by End-User, 2021- 2032

21. India A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

India A2 Milk Market Size Outlook by Type, 2021- 2032

India A2 Milk Market Size Outlook by Application, 2021- 2032

India A2 Milk Market Size Outlook by End-User, 2021- 2032

22. Japan A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan A2 Milk Market Size Outlook by Type, 2021- 2032

Japan A2 Milk Market Size Outlook by Application, 2021- 2032

Japan A2 Milk Market Size Outlook by End-User, 2021- 2032

23. South Korea A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea A2 Milk Market Size Outlook by Type, 2021- 2032

South Korea A2 Milk Market Size Outlook by Application, 2021- 2032

South Korea A2 Milk Market Size Outlook by End-User, 2021- 2032

24. Australia A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia A2 Milk Market Size Outlook by Type, 2021- 2032

Australia A2 Milk Market Size Outlook by Application, 2021- 2032

Australia A2 Milk Market Size Outlook by End-User, 2021- 2032

25. South East Asia A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia A2 Milk Market Size Outlook by Type, 2021- 2032

South East Asia A2 Milk Market Size Outlook by Application, 2021- 2032

South East Asia A2 Milk Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific A2 Milk Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific A2 Milk Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific A2 Milk Market Size Outlook by End-User, 2021- 2032

27. Brazil A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil A2 Milk Market Size Outlook by Type, 2021- 2032

Brazil A2 Milk Market Size Outlook by Application, 2021- 2032

Brazil A2 Milk Market Size Outlook by End-User, 2021- 2032

28. Argentina A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina A2 Milk Market Size Outlook by Type, 2021- 2032

Argentina A2 Milk Market Size Outlook by Application, 2021- 2032

Argentina A2 Milk Market Size Outlook by End-User, 2021- 2032

29. Rest of South America A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America A2 Milk Market Size Outlook by Type, 2021- 2032

Rest of South America A2 Milk Market Size Outlook by Application, 2021- 2032

Rest of South America A2 Milk Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates A2 Milk Market Size Outlook by Type, 2021- 2032

United Arab Emirates A2 Milk Market Size Outlook by Application, 2021- 2032

United Arab Emirates A2 Milk Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia A2 Milk Market Size Outlook by Type, 2021- 2032

Saudi Arabia A2 Milk Market Size Outlook by Application, 2021- 2032

Saudi Arabia A2 Milk Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East A2 Milk Market Size Outlook by Type, 2021- 2032

Rest of Middle East A2 Milk Market Size Outlook by Application, 2021- 2032

Rest of Middle East A2 Milk Market Size Outlook by End-User, 2021- 2032

33. South Africa A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa A2 Milk Market Size Outlook by Type, 2021- 2032

South Africa A2 Milk Market Size Outlook by Application, 2021- 2032

South Africa A2 Milk Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa A2 Milk Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa A2 Milk Market Size Outlook by Type, 2021- 2032

Rest of Africa A2 Milk Market Size Outlook by Application, 2021- 2032

Rest of Africa A2 Milk Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Packaging

Application

Sales Channel

Countries Analyzed

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

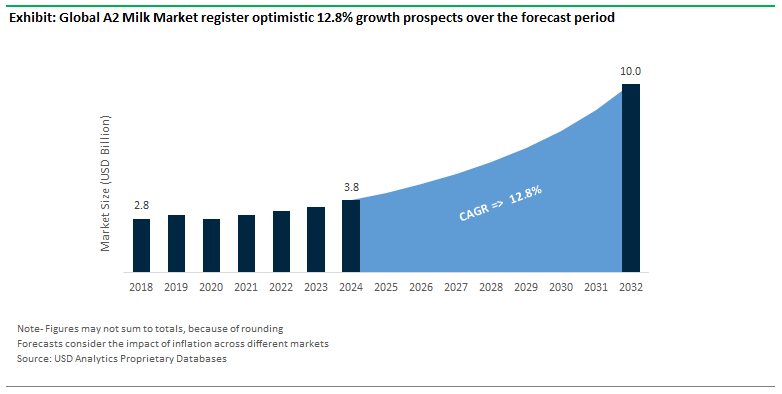

USD Analytics forecasts the global A2 Milk market size to increase from $3.8 Billion in 2024 to $9.9 Billion in 2032, registering a CAGR of 12.8% during the forecast period

Liquid (76.3% market share), Tetrapak (47.2% revnue share), Milk-Based Beverages, Supermarkets and Hypermarkets

Amul Cooperative Society Limited, Dairy Farmers Incorporated, Freedom Foods Group Limited, Nestle S.A., Provilac Holdings Inc., PURA Holdings Inc., The A2 Milk Company Limited, Vedaaz Organics Inc., Vietnam Dairy Products Joint Stock Company, Vinamilk Joint Stock Company, Westland Cooperative Dairy Company Limited

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume

Asia Pacific (13.5% CAGR)