The global 3D Printing Metals Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Form (Powder, Filament), By Technology (Powder Bed Fusion, Directed Energy Deposition, Binder Jetting, Metal Extrusion, Others), By Metal (Titanium, Nickel, Stainless Steel, Aluminum, Others), By End-User (Aerospace & Defense, Automotive, Medical & Dental, Others).

3D Printing Metals revolutionizes traditional metal manufacturing processes by employing additive manufacturing techniques to produce complex metal components with precision and efficiency. Metals such as titanium, aluminum, stainless steel, and cobalt-chrome are utilized in additive manufacturing processes like selective laser melting (SLM) and electron beam melting (EBM) to fabricate high-performance parts for aerospace, automotive, and medical applications. The market for 3D Printing Metals is witnessing rapid growth fueled by the demand for lightweight, durable, and intricately designed metal components. Additive manufacturing of metals offers advantages such as reduced material waste, shorter lead times, and the ability to create geometrically complex parts that are difficult or impossible to manufacture using traditional methods. Further, advancements in metallurgy and process optimization are driving the development of new metal alloys tailored for specific applications, further expanding the capabilities of 3D Printing Metals in various industries.

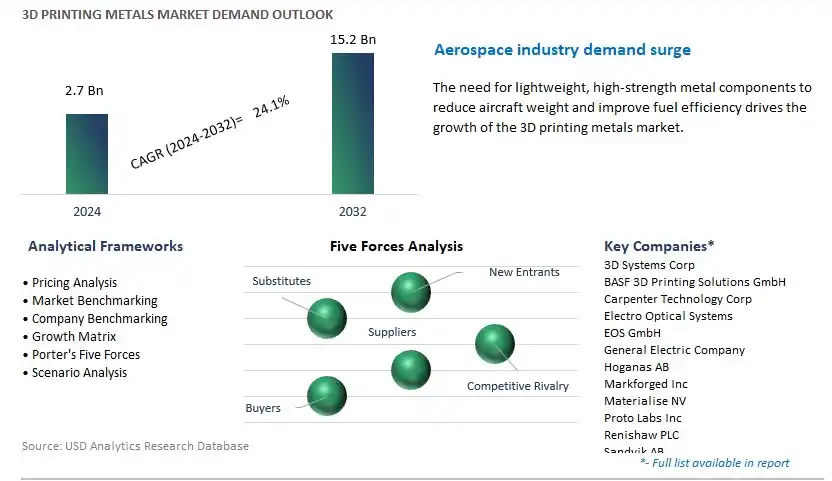

The market report analyses the leading companies in the industry including 3D Systems Corp, BASF 3D Printing Solutions GmbH, Carpenter Technology Corp, Electro Optical Systems, EOS GmbH, General Electric Company, Hoganas AB, Markforged Inc, Materialise NV, Proto Labs Inc, Renishaw PLC, Sandvik AB, SLM Solutions Group AG, Stratasys Ltd, The ExOne Company, Titomic Ltd, Voxeljet AG, Wipro 3D, and others.

A significant market trend for 3D Printing Metals is the continuous advancements in metal 3D printing technologies, driven by innovations in materials, processes, and equipment. As additive manufacturing matures, metal 3D printing is becoming increasingly accessible and affordable, leading to a surge in adoption across industries such as aerospace, automotive, healthcare, and manufacturing. The trend encompasses improvements in printing speed, accuracy, and resolution, as well as the development of new metal alloys tailored for specific applications. This trend signifies a shift towards more sophisticated metal additive manufacturing techniques, enabling the production of complex geometries, functional prototypes, and end-use parts with enhanced mechanical properties and performance characteristics.

A significant market driver for 3D Printing Metals is the growing demand for lightweight and high-performance components in industries such as aerospace, automotive, and medical devices. As manufacturers seek to improve fuel efficiency, reduce emissions, and enhance product performance, there is an increasing need for materials that offer superior strength-to-weight ratios, corrosion resistance, and thermal stability. Metal 3D printing technologies, such as selective laser melting (SLM) and electron beam melting (EBM), enable the production of intricate geometries and complex structures with minimal material waste, making them ideal for producing lightweight yet durable components. This demand for high-performance metal parts is driving the adoption of 3D Printing Metals and fueling market growth in various industrial sectors.

An attractive opportunity in the 3D Printing Metals market lies in providing customized solutions for medical implants and prosthetics, leveraging the capabilities of metal additive manufacturing to produce patient-specific devices with optimal fit and functionality. With the growing demand for personalized healthcare solutions and the increasing prevalence of complex medical conditions, there is a rising need for customized implants that match the unique anatomical characteristics of individual patients. Metal 3D printing technologies offer the ability to create patient-specific implants with precise dimensions, surface textures, and mechanical properties, improving patient outcomes and reducing the risk of complications. By partnering with healthcare providers and regulatory agencies, manufacturers can capitalize on this opportunity to develop tailored solutions for orthopedic implants, dental prosthetics, and craniofacial reconstructions, driving innovation and growth in the 3D Printing Metals market while addressing unmet needs in the healthcare sector.

In the 3D Printing Metals market segmented by form, the Powder Form segment is the largest category. The large revenue share is primarily due to the widespread adoption of powder-based metals in additive manufacturing processes. Powder-based metal 3D printing offers potential advantages, including high precision, intricate design capabilities, and the ability to produce complex geometries with superior mechanical properties. Powder-based metals such as stainless steel, titanium, aluminum, and nickel alloys are preferred for their excellent strength, corrosion resistance, and heat resistance, making them suitable for a wide range of industrial applications. Additionally, powder-based metal 3D printing technologies like selective laser melting (SLM) and electron beam melting (EBM) enable the production of fully dense, near-net-shape parts with minimal material waste. Moreover, the availability of a diverse range of metal powders, coupled with advancements in powder production and handling technologies, further enhances the versatility and application potential of powder-based metals in additive manufacturing. As industries continue to explore innovative solutions and materials for metal additive manufacturing applications, the powder form segment is expected to maintain its leading position in the 3D Printing Metals market.

Within the 3D Printing Metals market segmented by technology, the Powder Bed Fusion segment is the fastest-growing category. This rapid growth is driven by increasing adoption of powder bed fusion technology in metal additive manufacturing. Powder bed fusion encompasses techniques such as selective laser melting (SLM) and electron beam melting (EBM), which involve selectively melting layers of metal powder to build up the desired 3D object. These technologies offer exceptional precision, high surface quality, and the ability to produce complex geometries with superior mechanical properties. Moreover, powder bed fusion enables the production of fully dense, near-net-shape parts with minimal material waste, making it a preferred choice for industries such as aerospace, automotive, healthcare, and energy. Additionally, advancements in powder bed fusion technologies, including improved laser and electron beam systems, enhanced process controls, and a wider range of metal powder materials, contribute to the accelerated growth of this segment. As industries continue to recognize the benefits of powder bed fusion technology for metal additive manufacturing applications, driven by the need for lightweight, high-performance components and efficient production processes, the Powder Bed Fusion segment is poised for sustained rapid expansion in the 3D Printing Metals market.

In the 3D Printing Metals market segmented by metal type, the Stainless-Steel segment is the largest category. The large revenue share is primarily due to the widespread use and versatility of stainless steel in various industries. Stainless steel offers excellent corrosion resistance, high strength-to-weight ratio, and durability, making it suitable for a wide range of applications across industries such as aerospace, automotive, healthcare, consumer goods, and construction. Moreover, the availability of different grades of stainless steel, each with unique properties, further expands its application potential in additive manufacturing. Stainless steel is preferred for producing functional prototypes, tooling, fixtures, and end-use parts due to its ability to withstand harsh environments and diverse operating conditions. Additionally, advancements in metal additive manufacturing technologies, including selective laser melting (SLM) and electron beam melting (EBM), enable the production of complex geometries and near-net-shape components with superior mechanical properties. As industries continue to recognize the benefits of stainless steel in additive manufacturing for its versatility, reliability, and cost-effectiveness, the Stainless-Steel segment is expected to maintain its leading position in the 3D Printing Metals market.

Within the segmentation of the 3D Printing Metals market by end-user, the Medical & Dental segment is the fastest-growing category. The market growth is driven by increasing adoption of 3D printing metals in the medical and dental industries. Metal additive manufacturing technologies offer unique advantages such as high precision, customization capabilities, and biocompatibility, making them ideal for producing patient-specific implants, prosthetics, surgical instruments, and dental appliances. The demand for personalized healthcare solutions and advancements in medical imaging technologies have fuelled the adoption of 3D printing metals for orthopedic implants, dental crowns, and cranial implants, among other applications. Moreover, the ability to produce complex geometries and lattice structures with superior mechanical properties enhances the performance and longevity of medical and dental devices. Additionally, regulatory approvals for 3D-printed medical implants and the growing acceptance of additive manufacturing in healthcare further drive the growth of this segment. As the medical and dental industries continue to prioritize patient-specific treatments and advancements in technology, the Medical & Dental segment of the 3D Printing Metals market is poised for sustained rapid expansion.

By Form

Powder

Filament

By Technology

Powder Bed Fusion

Directed Energy Deposition

Binder Jetting

Metal Extrusion

Others

By Metal

Titanium

Nickel

Stainless Steel

Aluminum

Others

By End-User

Aerospace & Defense

Automotive

Medical & Dental

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3D Systems Corp

BASF 3D Printing Solutions GmbH

Carpenter Technology Corp

Electro Optical Systems

EOS GmbH

General Electric Company

Hoganas AB

Markforged Inc

Materialise NV

Proto Labs Inc

Renishaw PLC

Sandvik AB

SLM Solutions Group AG

Stratasys Ltd

The ExOne Company

Titomic Ltd

Voxeljet AG

Wipro 3D

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 3D Printing Metals Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global 3D Printing Metals Market Size Outlook, $ Million, 2021 to 2032

3.2 3D Printing Metals Market Outlook by Type, $ Million, 2021 to 2032

3.3 3D Printing Metals Market Outlook by Product, $ Million, 2021 to 2032

3.4 3D Printing Metals Market Outlook by Application, $ Million, 2021 to 2032

3.5 3D Printing Metals Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of 3D Printing Metals Industry

4.2 Key Market Trends in 3D Printing Metals Industry

4.3 Potential Opportunities in 3D Printing Metals Industry

4.4 Key Challenges in 3D Printing Metals Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global 3D Printing Metals Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global 3D Printing Metals Market Outlook by Segments

7.1 3D Printing Metals Market Outlook by Segments, $ Million, 2021- 2032

By Form

Powder

Filament

By Technology

Powder Bed Fusion

Directed Energy Deposition

Binder Jetting

Metal Extrusion

Others

By Metal

Titanium

Nickel

Stainless Steel

Aluminum

Others

By End-User

Aerospace & Defense

Automotive

Medical & Dental

Others

8 North America 3D Printing Metals Market Analysis and Outlook To 2032

8.1 Introduction to North America 3D Printing Metals Markets in 2024

8.2 North America 3D Printing Metals Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America 3D Printing Metals Market size Outlook by Segments, 2021-2032

By Form

Powder

Filament

By Technology

Powder Bed Fusion

Directed Energy Deposition

Binder Jetting

Metal Extrusion

Others

By Metal

Titanium

Nickel

Stainless Steel

Aluminum

Others

By End-User

Aerospace & Defense

Automotive

Medical & Dental

Others

9 Europe 3D Printing Metals Market Analysis and Outlook To 2032

9.1 Introduction to Europe 3D Printing Metals Markets in 2024

9.2 Europe 3D Printing Metals Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe 3D Printing Metals Market Size Outlook by Segments, 2021-2032

By Form

Powder

Filament

By Technology

Powder Bed Fusion

Directed Energy Deposition

Binder Jetting

Metal Extrusion

Others

By Metal

Titanium

Nickel

Stainless Steel

Aluminum

Others

By End-User

Aerospace & Defense

Automotive

Medical & Dental

Others

10 Asia Pacific 3D Printing Metals Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific 3D Printing Metals Markets in 2024

10.2 Asia Pacific 3D Printing Metals Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific 3D Printing Metals Market size Outlook by Segments, 2021-2032

By Form

Powder

Filament

By Technology

Powder Bed Fusion

Directed Energy Deposition

Binder Jetting

Metal Extrusion

Others

By Metal

Titanium

Nickel

Stainless Steel

Aluminum

Others

By End-User

Aerospace & Defense

Automotive

Medical & Dental

Others

11 South America 3D Printing Metals Market Analysis and Outlook To 2032

11.1 Introduction to South America 3D Printing Metals Markets in 2024

11.2 South America 3D Printing Metals Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America 3D Printing Metals Market size Outlook by Segments, 2021-2032

By Form

Powder

Filament

By Technology

Powder Bed Fusion

Directed Energy Deposition

Binder Jetting

Metal Extrusion

Others

By Metal

Titanium

Nickel

Stainless Steel

Aluminum

Others

By End-User

Aerospace & Defense

Automotive

Medical & Dental

Others

12 Middle East and Africa 3D Printing Metals Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa 3D Printing Metals Markets in 2024

12.2 Middle East and Africa 3D Printing Metals Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa 3D Printing Metals Market size Outlook by Segments, 2021-2032

By Form

Powder

Filament

By Technology

Powder Bed Fusion

Directed Energy Deposition

Binder Jetting

Metal Extrusion

Others

By Metal

Titanium

Nickel

Stainless Steel

Aluminum

Others

By End-User

Aerospace & Defense

Automotive

Medical & Dental

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3D Systems Corp

BASF 3D Printing Solutions GmbH

Carpenter Technology Corp

Electro Optical Systems

EOS GmbH

General Electric Company

Hoganas AB

Markforged Inc

Materialise NV

Proto Labs Inc

Renishaw PLC

Sandvik AB

SLM Solutions Group AG

Stratasys Ltd

The ExOne Company

Titomic Ltd

Voxeljet AG

Wipro 3D

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Form

Powder

Filament

By Technology

Powder Bed Fusion

Directed Energy Deposition

Binder Jetting

Metal Extrusion

Others

By Metal

Titanium

Nickel

Stainless Steel

Aluminum

Others

By End-User

Aerospace & Defense

Automotive

Medical & Dental

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global 3D Printing Metals Market Size is valued at $2.7 Billion in 2024 and is forecast to register a growth rate (CAGR) of 24.1% to reach $15.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3D Systems Corp, BASF 3D Printing Solutions GmbH, Carpenter Technology Corp, Electro Optical Systems, EOS GmbH, General Electric Company, Hoganas AB, Markforged Inc, Materialise NV, Proto Labs Inc, Renishaw PLC, Sandvik AB, SLM Solutions Group AG, Stratasys Ltd, The ExOne Company, Titomic Ltd, Voxeljet AG, Wipro 3D

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume